Hi,

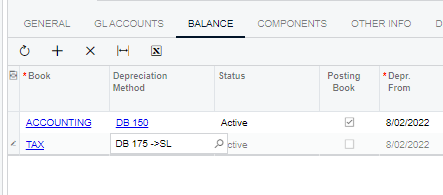

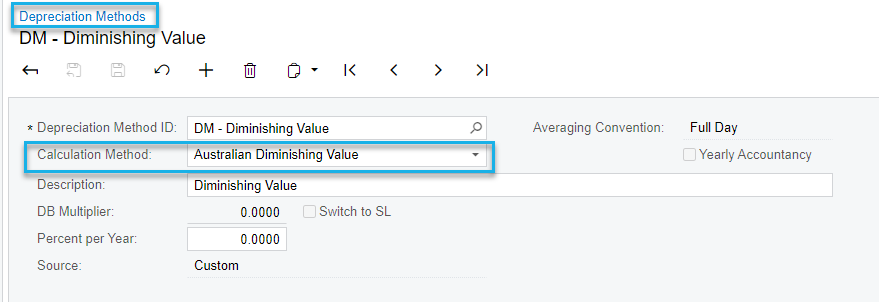

We are trying to use Australian Diminishing Value in Fixed Assets, however system forces us to use ‘useful Life Year’.

This method is only capturing the place-in-service date, the cost and the percentage per year.

So it does not make sense to have years against each asset, as it’ll change the method.

Can someone assist and let me know how you imported your assets using this method?

Thanks,

Foujan