Hi Sir/Mdm

Not sure if anyone know what the root cause to cause this issue happend.

We understand that Vendor AP bill will auto generate once we receipt in the goods and tick the create bill.

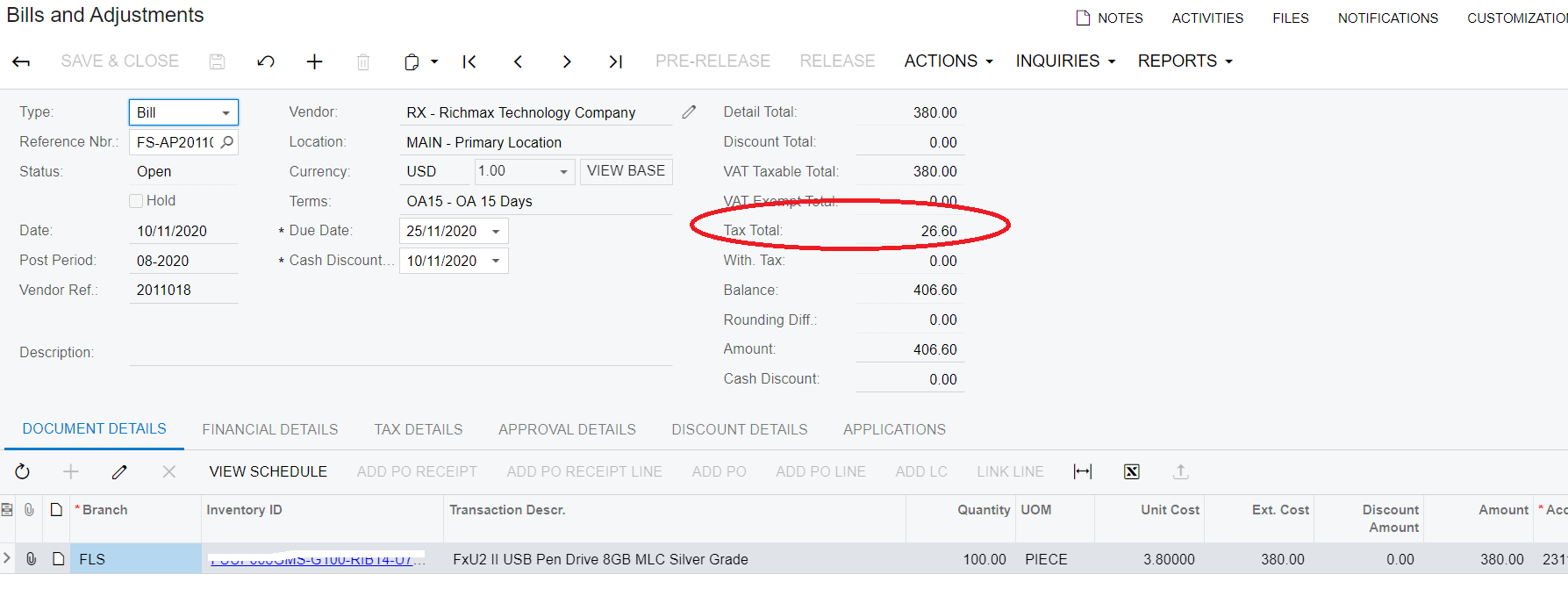

We notice that one of AP Bill generated is come with Tax where

However , the vendor set up Tax Zone is Tax exempt .Not sure why the AP bill will come with tax?

Anyone can advise?

Please find the screenshot as below

Hope to hear from you soon

Thank you