We issued a P.O for $10.000.00 to purchase Raw materials. P.O has lead time of 45 days. 30 days for production and 15 days transit time.

We have to pay advance 50% to the Vender with P.O.

We pay next 25% when the order is ready to ship. (Within 30 days)

We release remaining 25% before accepting shipment in our dock.

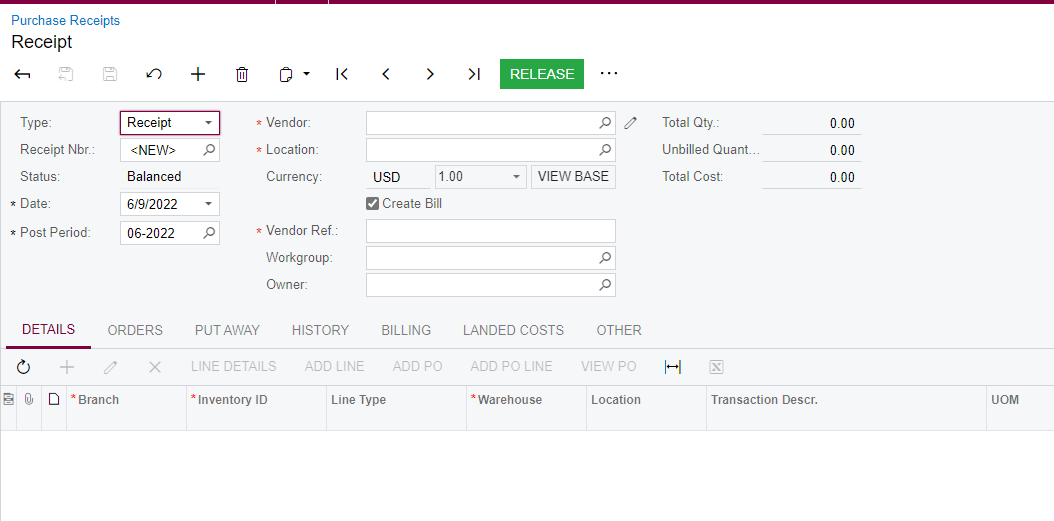

How can I record these transactions inside accumatica liked with a P.O and adjust with accruals when the products are received?

Thank you,

SB