Hello,

Disclaimer: I am not a CPA. Please check with your CPA to verify the accounts and periods to adjust.

- If the vehicle became unusable last Nov. and you have later received a payment from insurance:

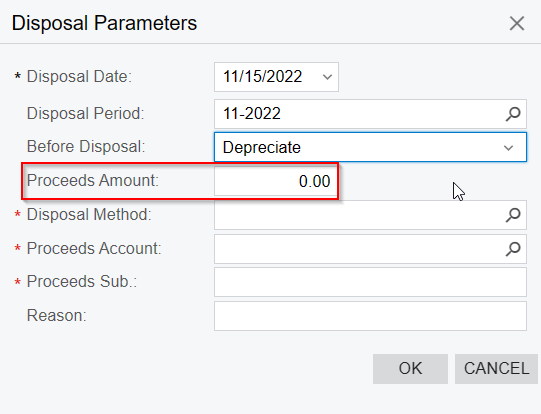

Write off the vehicle with $0 proceeds in November 2022.

In the month when insurance reimbursement was received, enter the cash payment via GL Journal Transactions. Use a debit to increase cash and a credit to an income account such as Other Income. Or, create a new Income account called Insurance Proceeds, and credit the Insurance Proceeds account.

- If the proceeds were received in November, in the same month when the vehicle became unusable, then enter the Insurance proceeds in Proceeds Amount of Disposal Parameters window and enter cash account where insurance money was deposited in the Proceeds account.

I think insurance proceeds received after the vehicle is ‘deceased’ will not impact the Cost of the vehicle.

Laura