Is there a process in Acumatica that allows you to do a return, leave the Purchase Order closed/completed, and create a credit?

Solved

Vendor Return For Credit

Best answer by Laura03

Hello

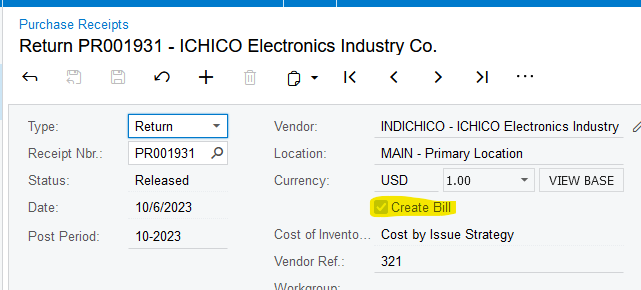

When returning the Receipt, if you check ON the “Create Bill” option in the header of the return, the Debit Adjustment (vendor Credit Memo) will be automatically created in Payables, reducing the balance owed to the vendor.

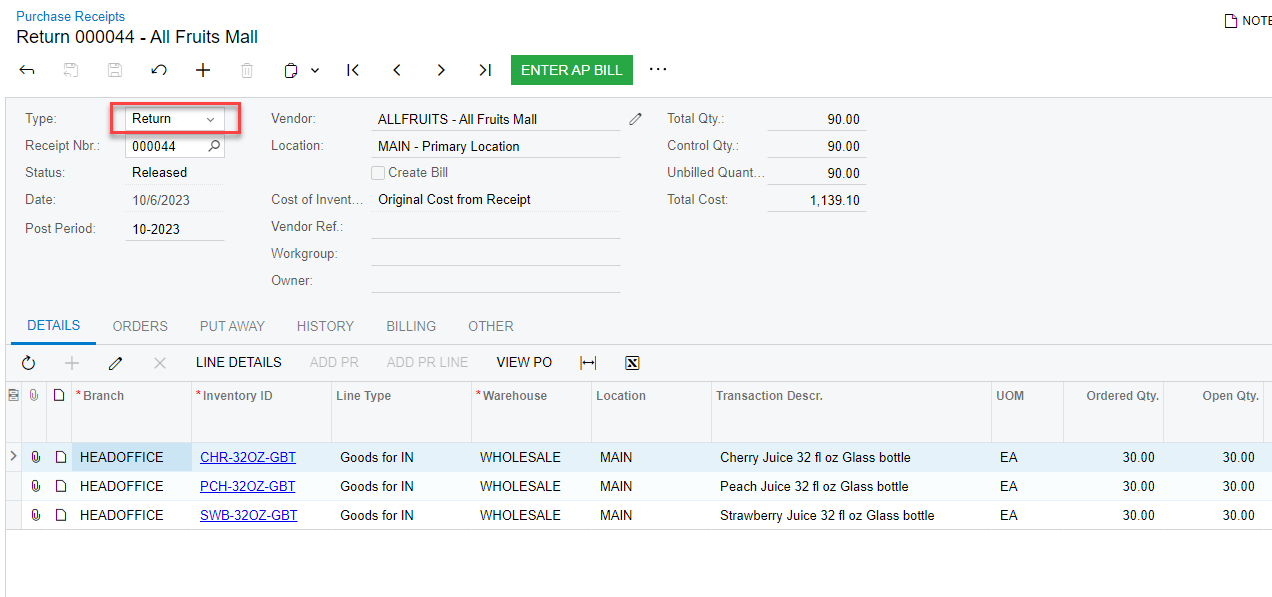

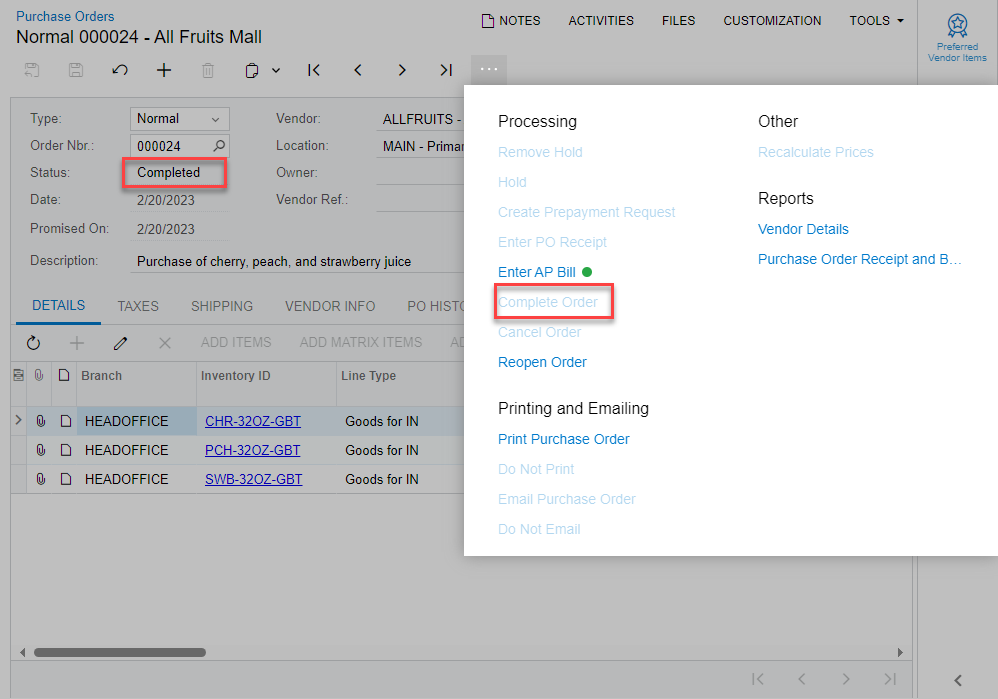

Returns do reopen PO’s and leave them on Open status. Please consider adding an Idea to the Community so we can vote for an option to select whether to re-open a PO upon return.

Further information about how to create the business event to Complete the PO after return can be found here, answered by BThomas.

Laura

Enter your E-mail address. We'll send you an e-mail with instructions to reset your password.