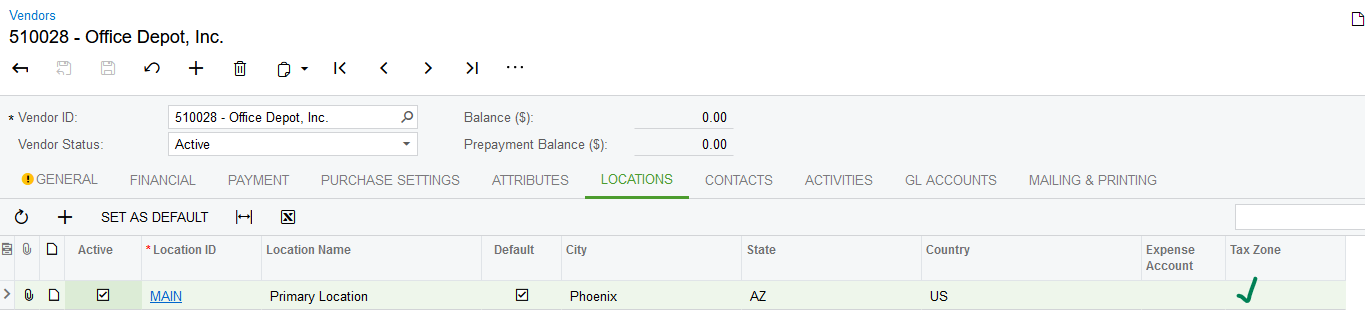

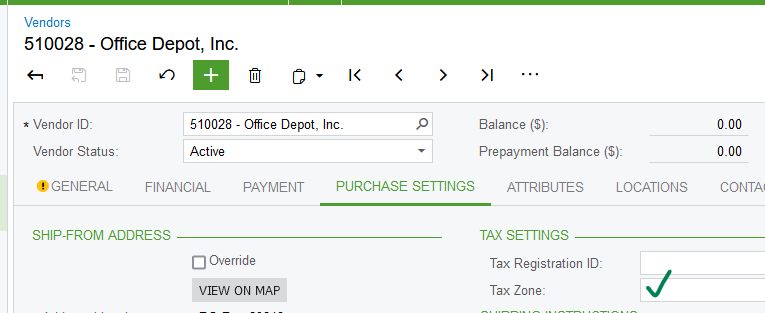

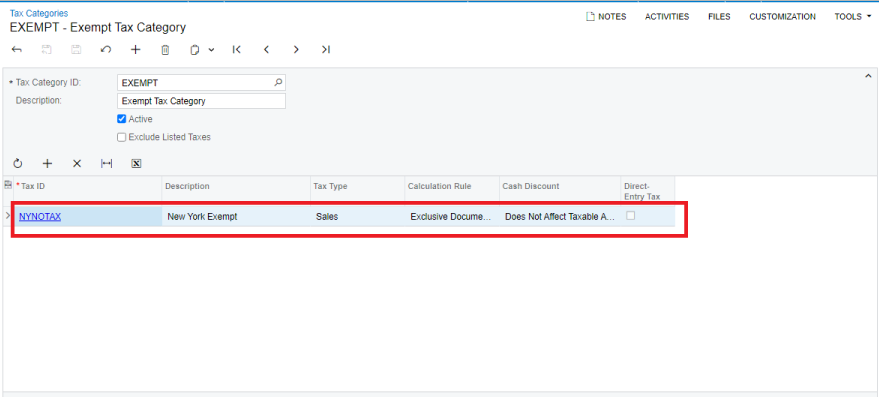

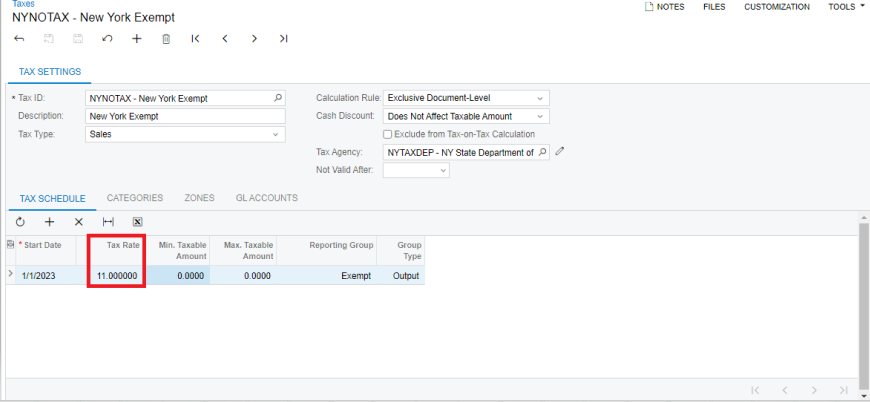

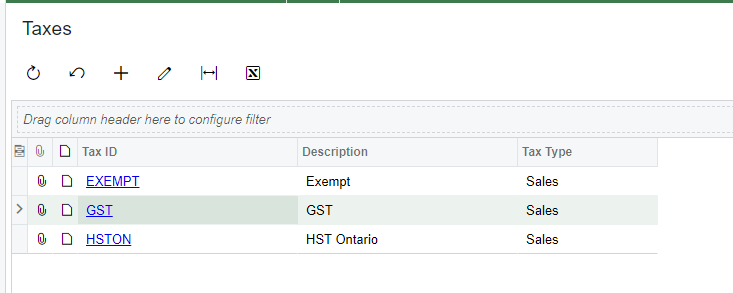

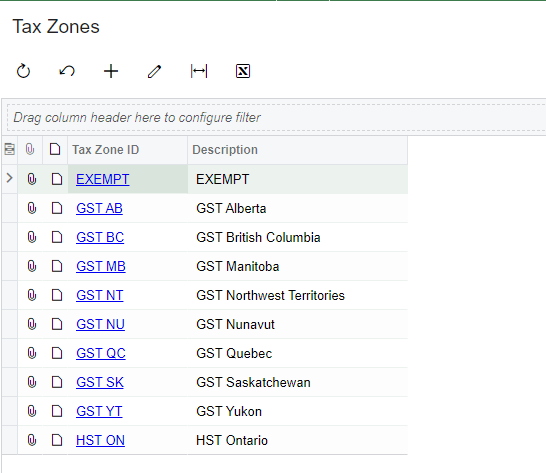

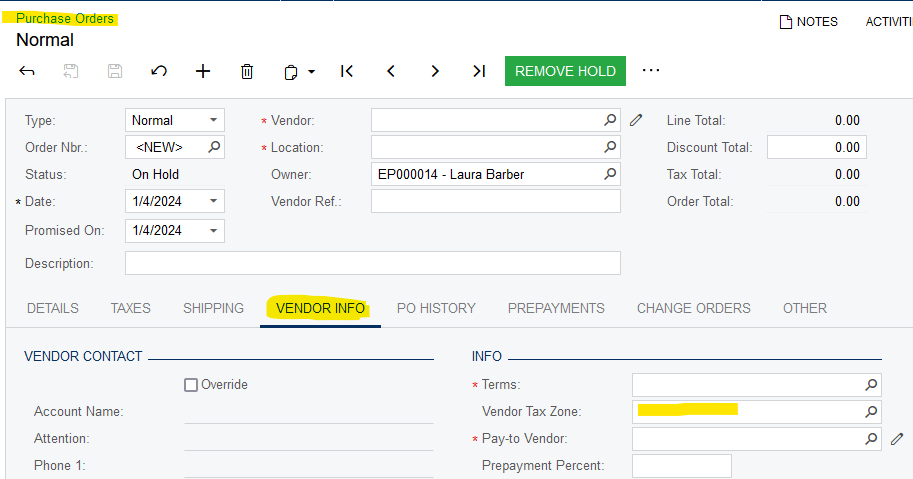

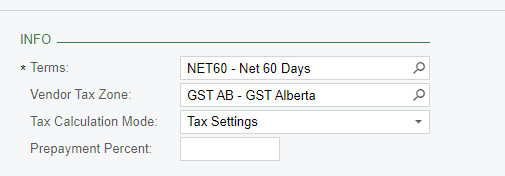

We have an intercompany vendor that we purchase goods from without any tax impact.

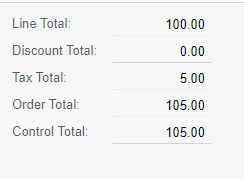

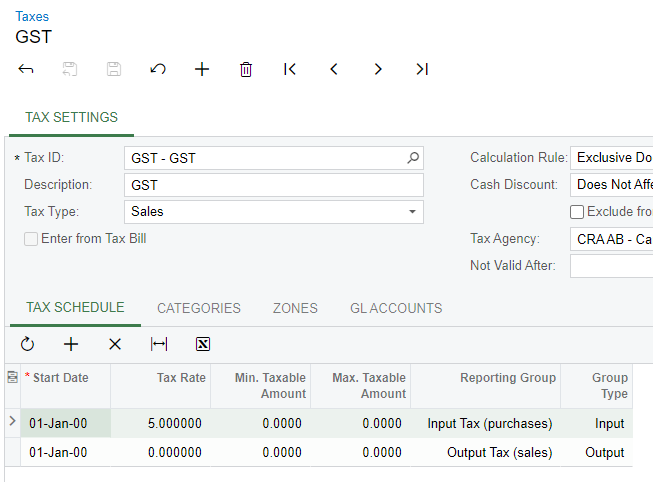

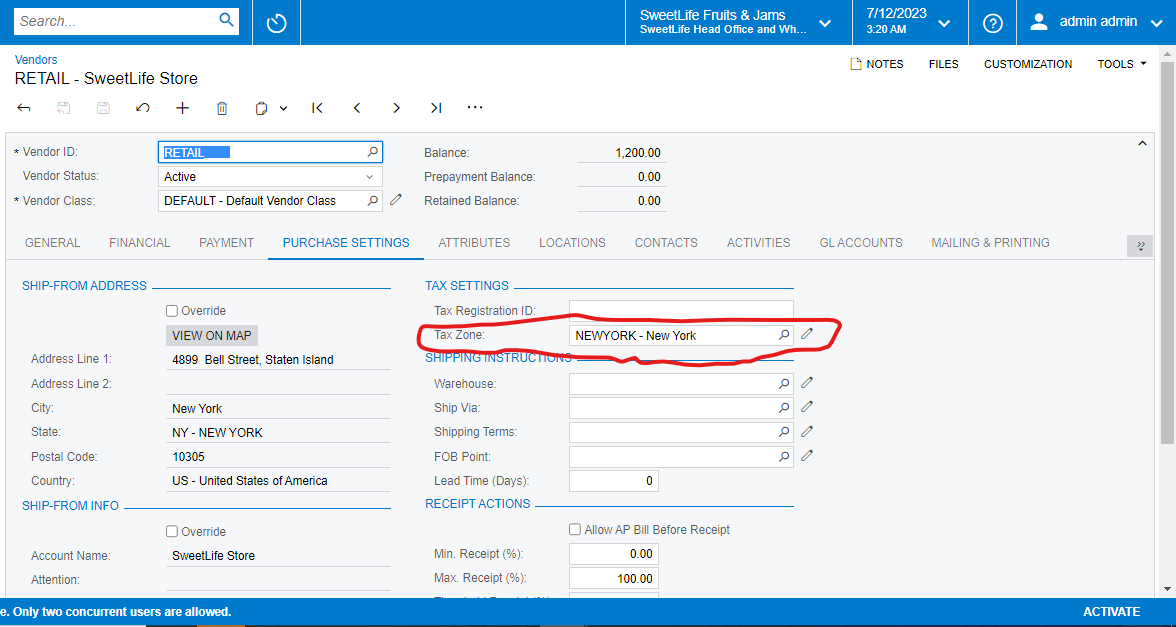

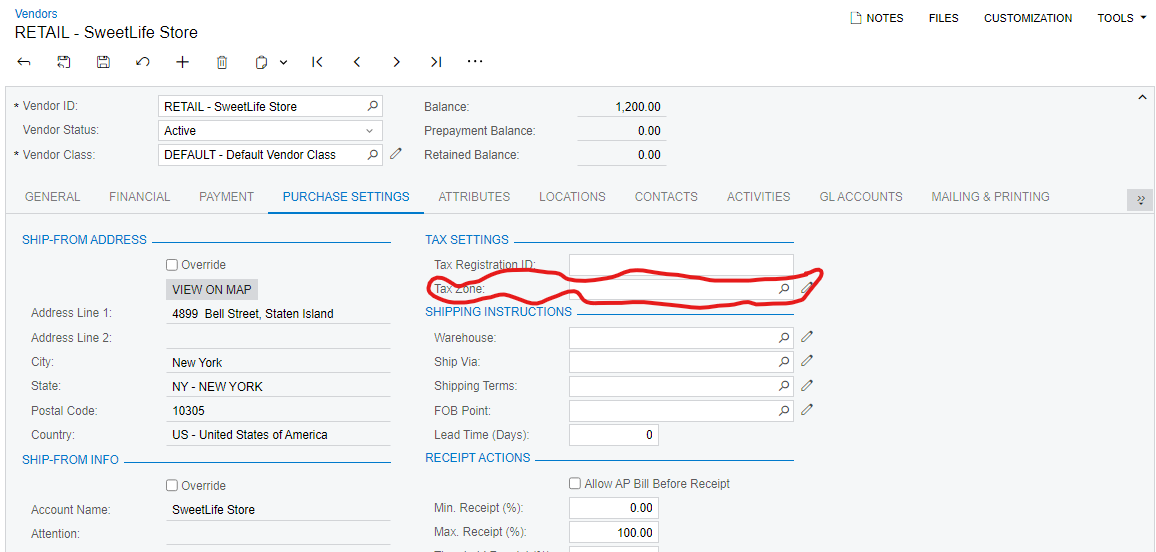

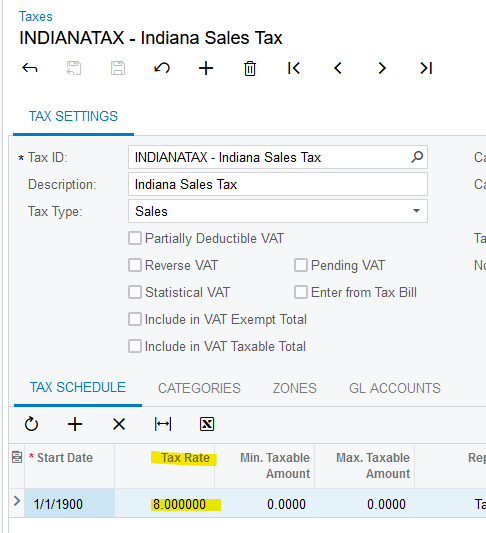

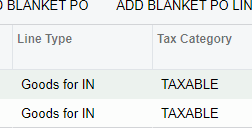

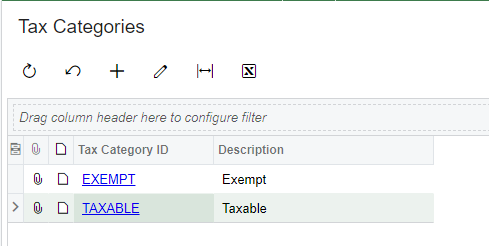

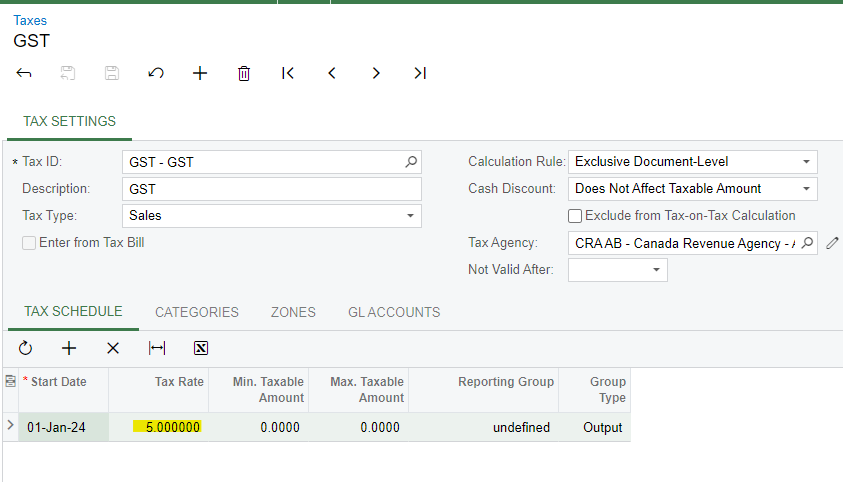

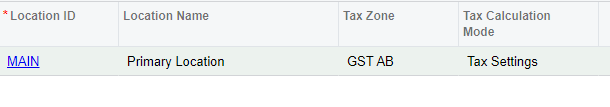

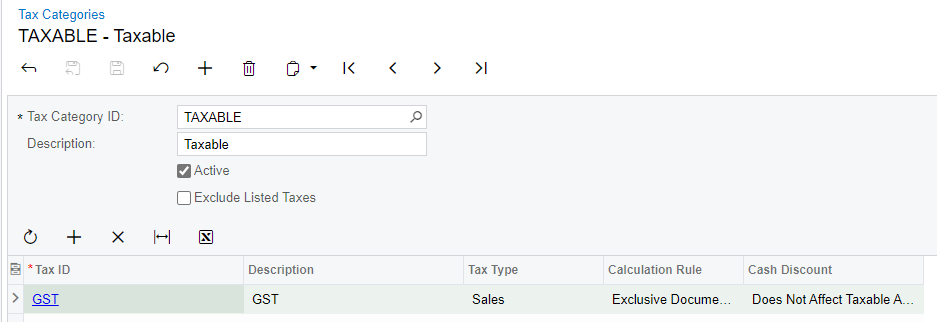

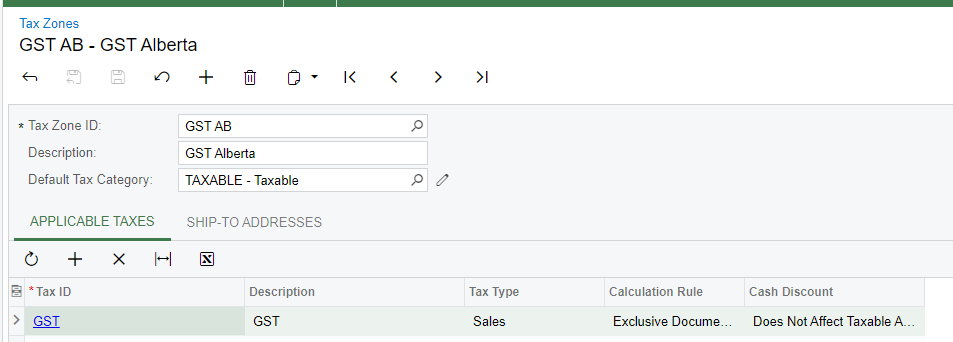

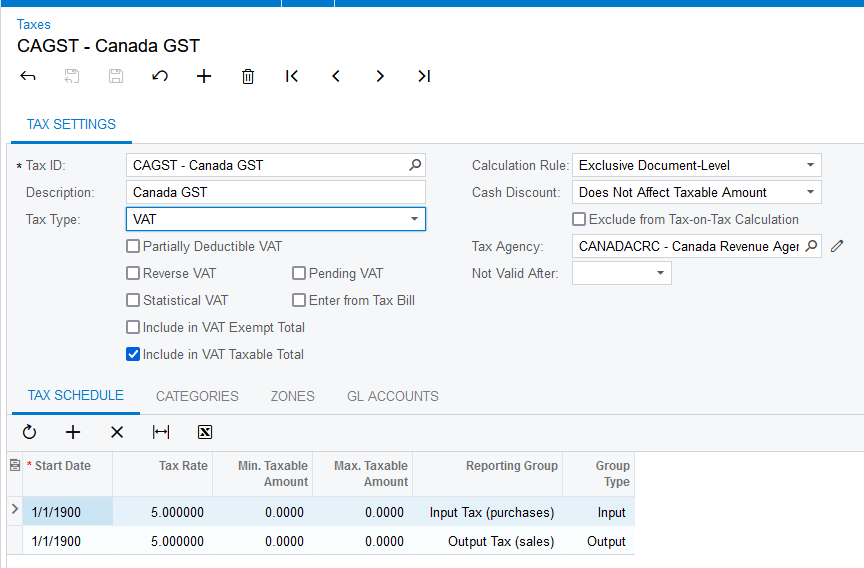

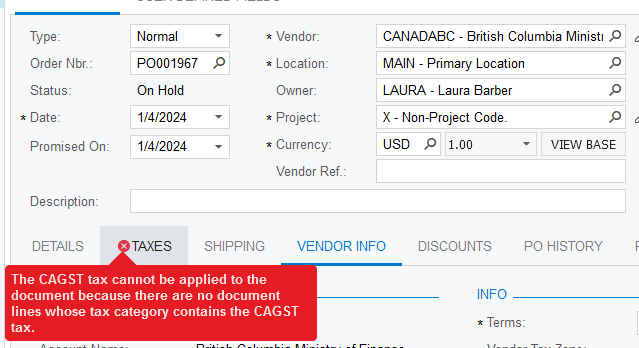

The vendor is tax exempt, but when we issue a PO, it is generated with tax. When we generate interco sales order, it is generated without tax.

Any idea why the PO would be getting created with tax? The item on the PO is a taxable item as it is taxable to the end customer.