What if the vendor charged tax is different form the ISV calculated tax? How does Acumatica handle that? Is there a setting or configuration to do a tax adjustment?

Vendor Charged Tax - Accounts Payable

Best answer by Laura02

Hello

Rounding Difference is calculated by Acumatica and cannot be edited, even with the Bill on Hold status as shown.

$9.41 is not a rounding difference; it’s too large.

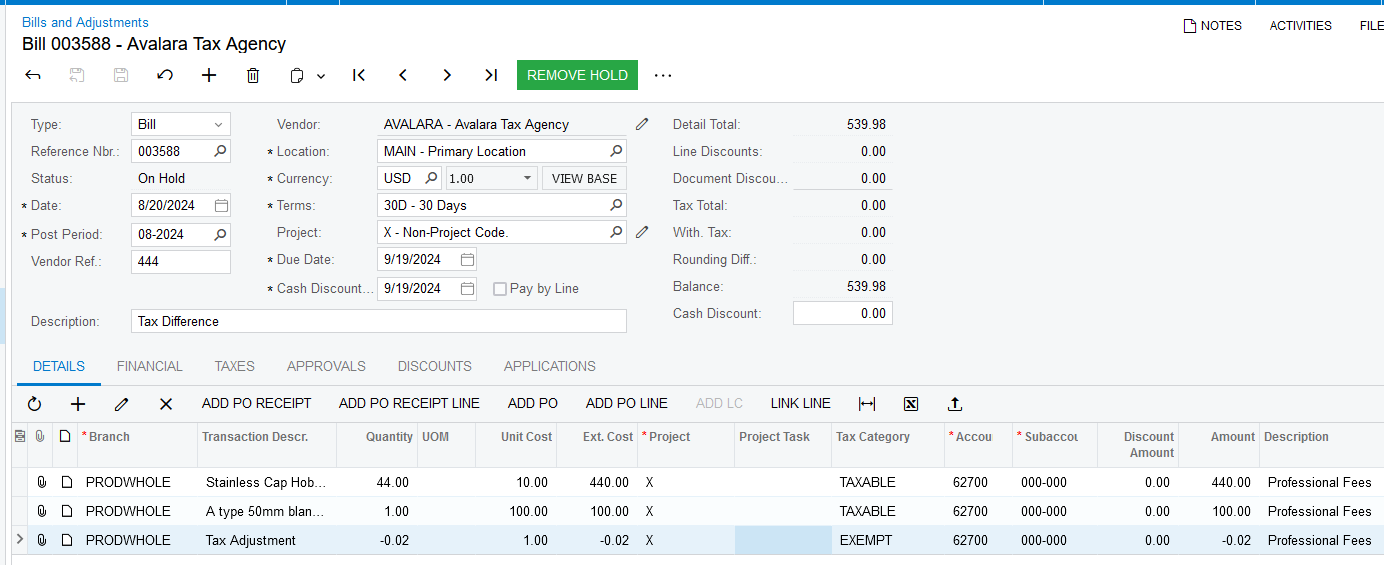

If you think the ISV amount is incorrect, you may contact the ISV. If you think the vendor’s tax amount is incorrect, contact the vendor. (That’s what I meant to say, above.) I don’t have enough information to guess which amount is correct. If Acumatica is calculating $59.41 tax and you only need to pay your vendor $50 tax, the negative bill line example shown above will adjust your AP Bill to match the vendor’s document.

Most of the time, automatic tax calculation in AP is turned off, meaning there is no Tax Zone entered on vendors who are actively charging tax, for the exact reason you are presenting in this post. 🤔 We pay Bills, with or without tax, based on document amounts the vendors send us. Tax can be entered as a separate line or included in the amount of merchandise/services purchased.

As (US) taxpayers, we are more concerned with vendors who should have charged us tax but did not.

- When a vendor should have charged tax but instead charged $0… this is a vendor who needs a Tax Zone in our Acumatica so that we may report Use Tax (“Uce Tax” not “Uze tax” on our Sales Tax returns.

- When a vendor charges us too little tax - the vendor reports their sales and taxes collected on their tax returns. If they charged too little to their customer (us), the vendor makes up the difference to the department of revenue.

Laura

Disclaimer: I am not a tax expert or a CPA.

Reply

Enter your E-mail address. We'll send you an e-mail with instructions to reset your password.