Hi all,

I have a question regarding the Project (PM301000) billing.

For the progressive income of a task at the beginning of the project, we enter a Original budget, for example 100K, at 0% completion. For simplification purposes: we do not have a Change order so Revised Budget = Original Budget.

Now, We invoice 80% completion, so 80K invoice :

Someone makes a Sale Order on the side, on the task in question of 30K and invoices it.

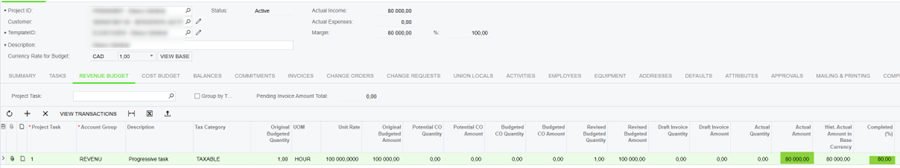

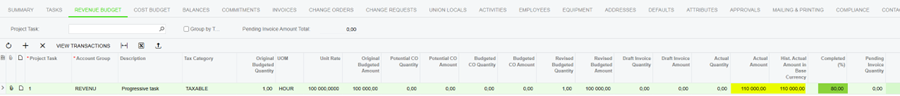

ImageIf the project manager returns to the Project (PM301000), in the Budget Income tab, he will see this:

Actual amount = 110K, it's ok, we understand that there was the sale order of 30K invoiced in addition to the Progressive.

Now the project manager wants to invoice 90%, he sets Completion of the progressive task to 90%, which would logically give an invoice of 10K. On the other hand, the system calculates a credit of 20K, which is not logical.

And it is the same principle if we create revenu on this task with another source than a sales order

Am I missing something and not using it the right way, or is it a system malfunction?

Thanks