Hey, team - I’m a little new to allocation rules so any assistance would be AWESOME!

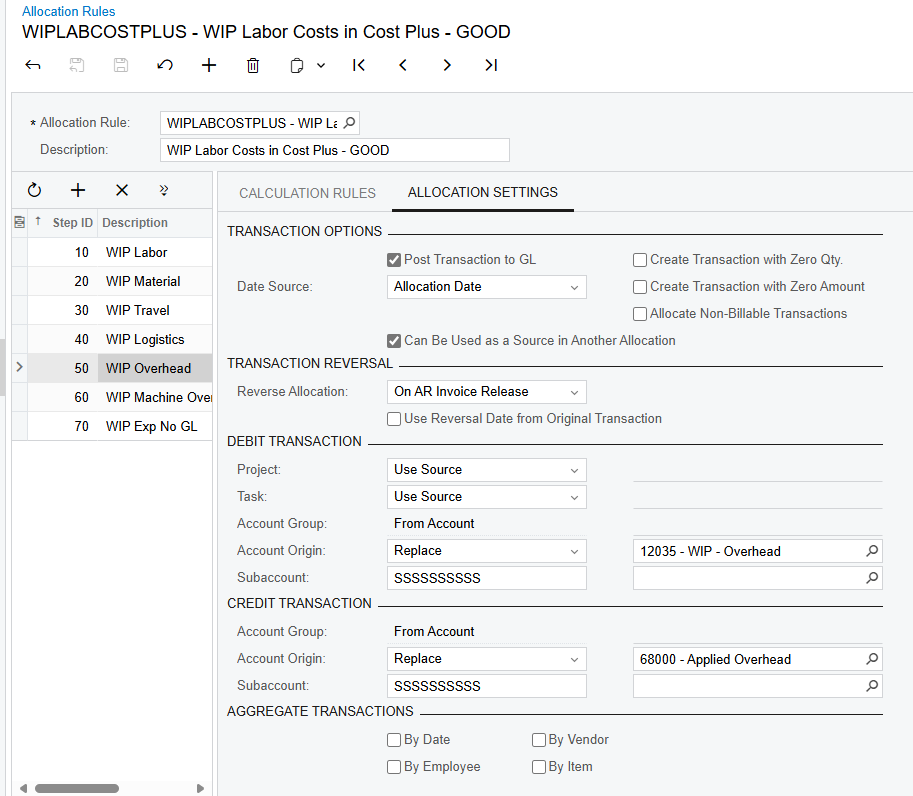

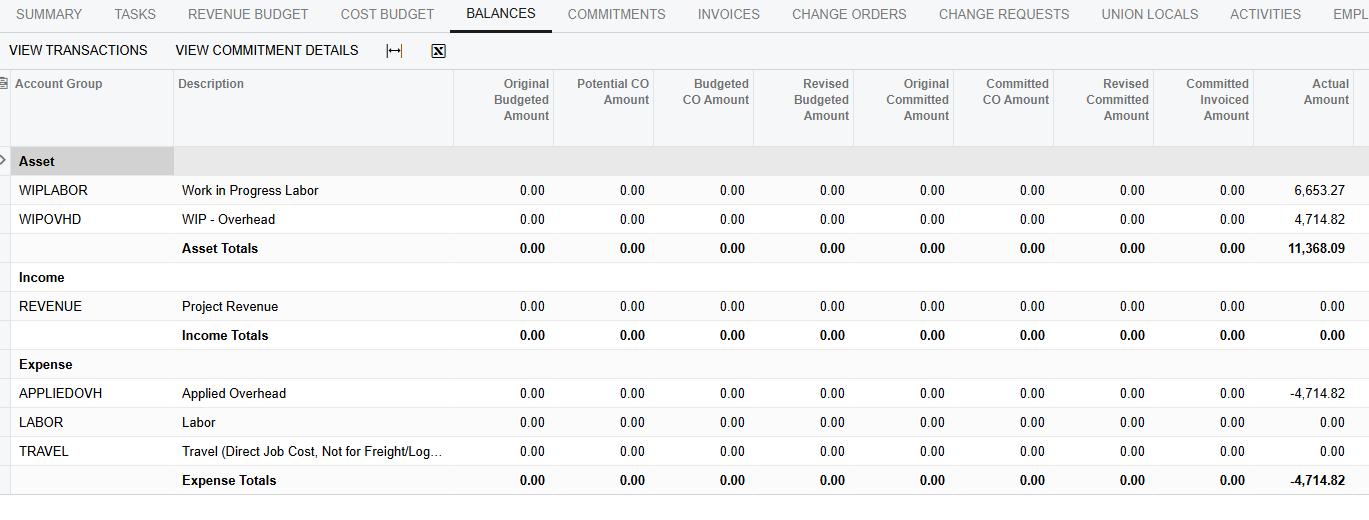

Got a client who is applying Labor at a standard rate and then replacing the standard amounts from payroll. They are getting a negative value in the balances for the APPLIEDOVH Expense and want this to zero out. They have a credit account associated with this step of the allocation rule - is this as simple as removing that account? Thanks!

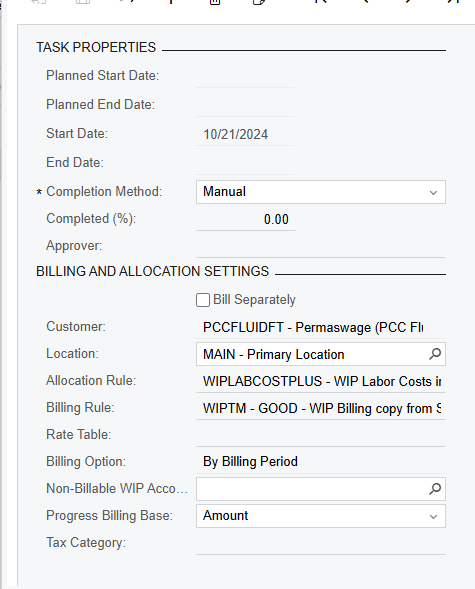

Here’s the task

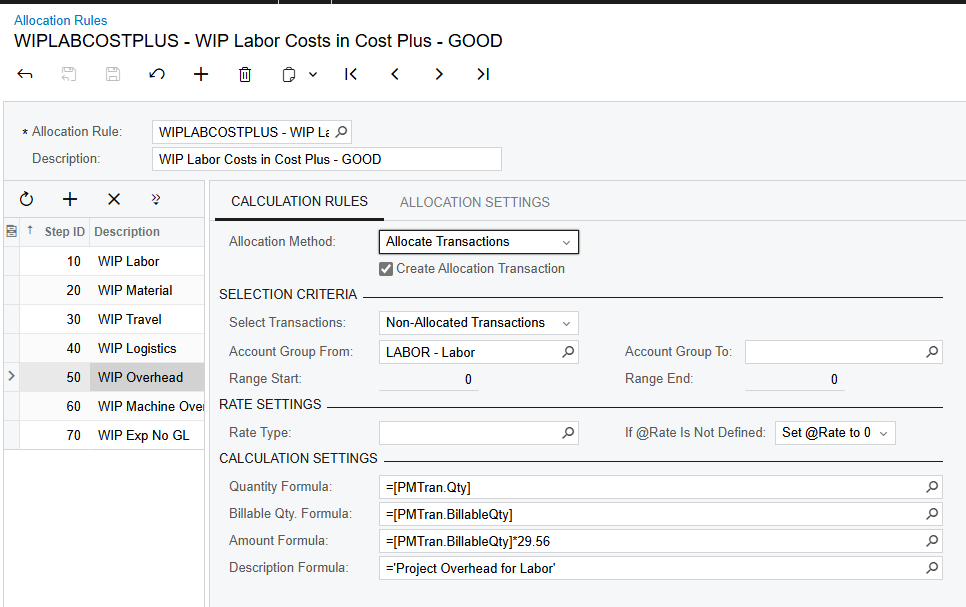

Here is the allocation rule.