Hi All--

I have been searching for various process methods to accrue costs on a project until we’re ready to invoice and so far I’ve found (1) best outcome and another (2) that semi-works but realizing day by day, it’s not going to work.

(1)

This method will have users create a Project with Inventory Tracking = ‘Track by Project Quantity and Cost’

Then create PO using STOCK items, this is a must, where Type = ‘Normal’

Then create PO Receipt, this will DEBIT INV and CREDIT ACCRUE PURCH

Then create AP Bill, this will DEBIT ACCRUE PURCH and CREDIT AP

Then create Issue, where Cost Layer = ‘Project’, this will DEBIT COGS and CREDIT INV (Sweet spot)

Then create AR Invoice, where DEBIT AR and CREDIT SALES

(2)

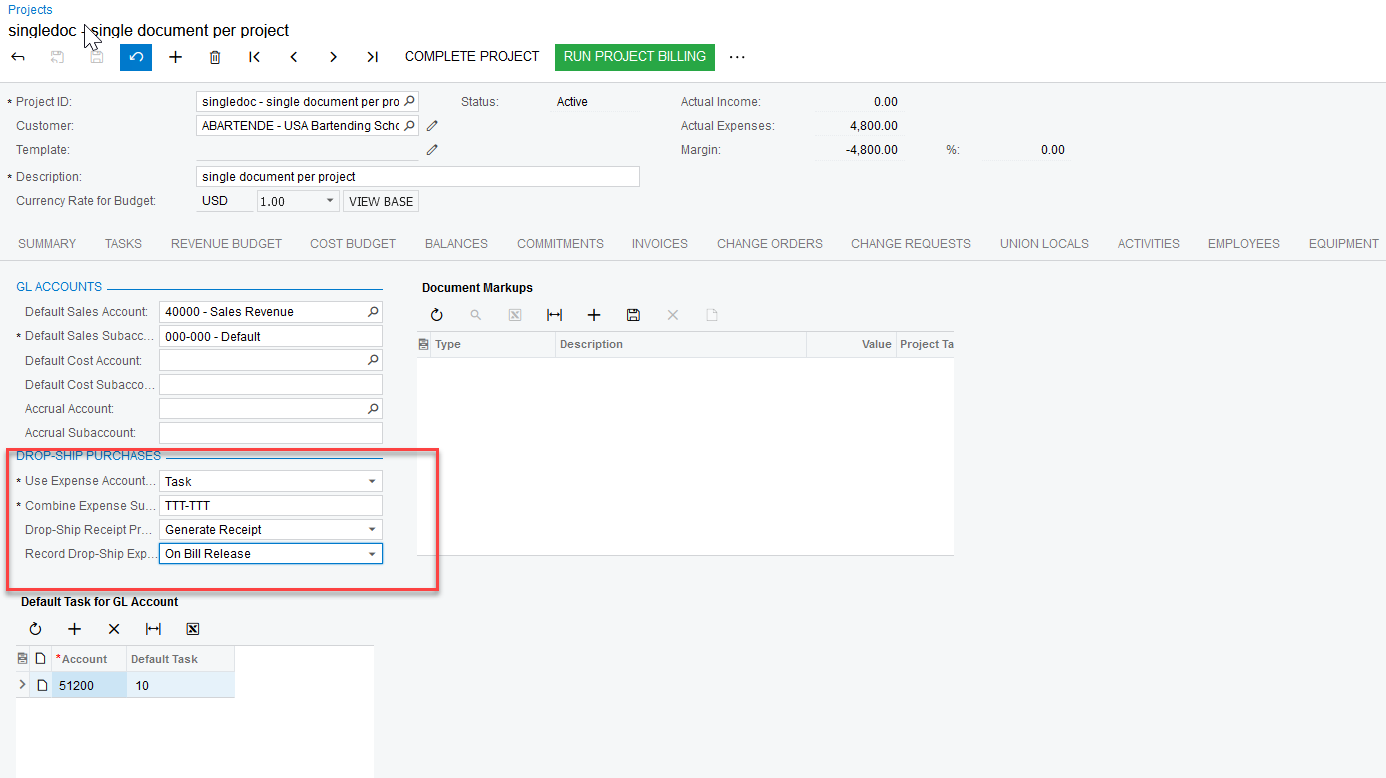

This method will have users create a Project with Inventory Tracking = ‘Tracking by Project Quantity’ or ‘Track by Location’ .. meaning ‘Track by Project Quantity and Cost’ will cause an error

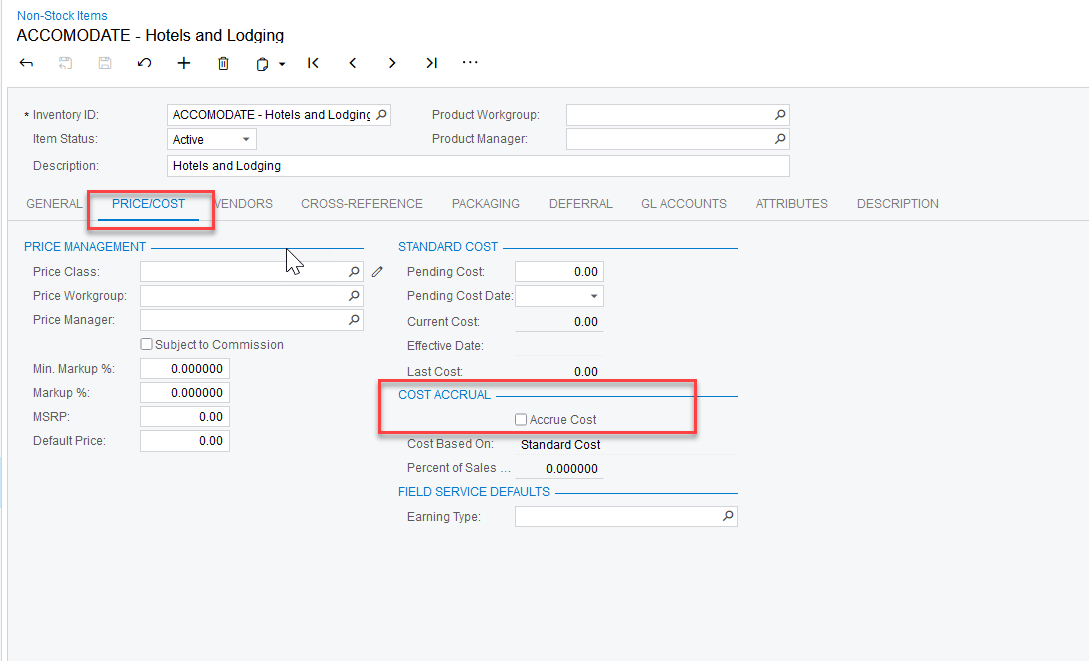

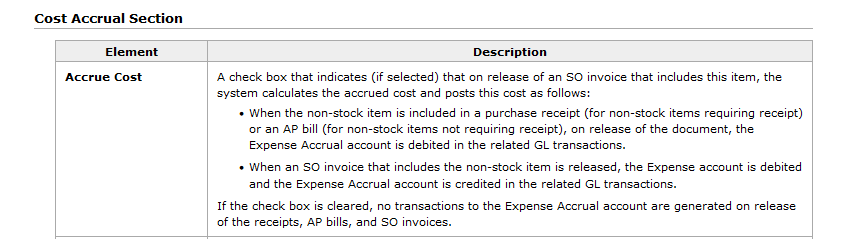

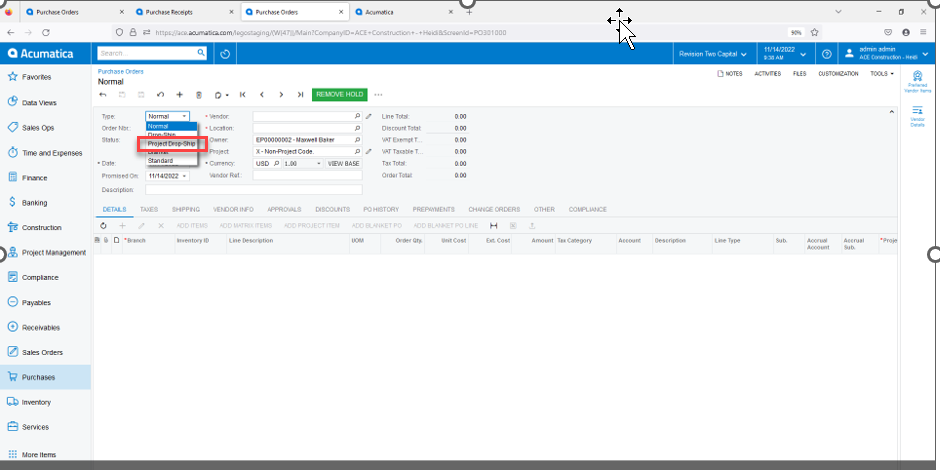

Then create PO using NON-STOCK items where Type = ‘Normal’

Then create PO Receipt, this will DEBIT INV and CREDIT ACCRUE PURCH

Then create AP Bill, this will DEBIT ACCRUE PURCH and CREDIT AP

Then create AR Invoice, where DEBIT AR and CREDIT SALES

Overall-- Method (1) is what was thought up from implementation team and what I’ve seen another community user post about as well however the issue for us is that we really don’t carry any inventory and 95% of our business is drop ship to site until ready to be used so I’m trying very hard to find a solution that will act like this method however use NON-STOCK and or drop ship of stock item… thus the reason I came up with Method (2). HOWEVER…. running the project with this method… leaves that non-stock item stuck where it’s still in ‘inventory’ account and never am able to DEBIT COGS and CREDIT iINV

Does anyone have thoughts or ideas or similar issues? All comments and thoughts welcome!