Hi,

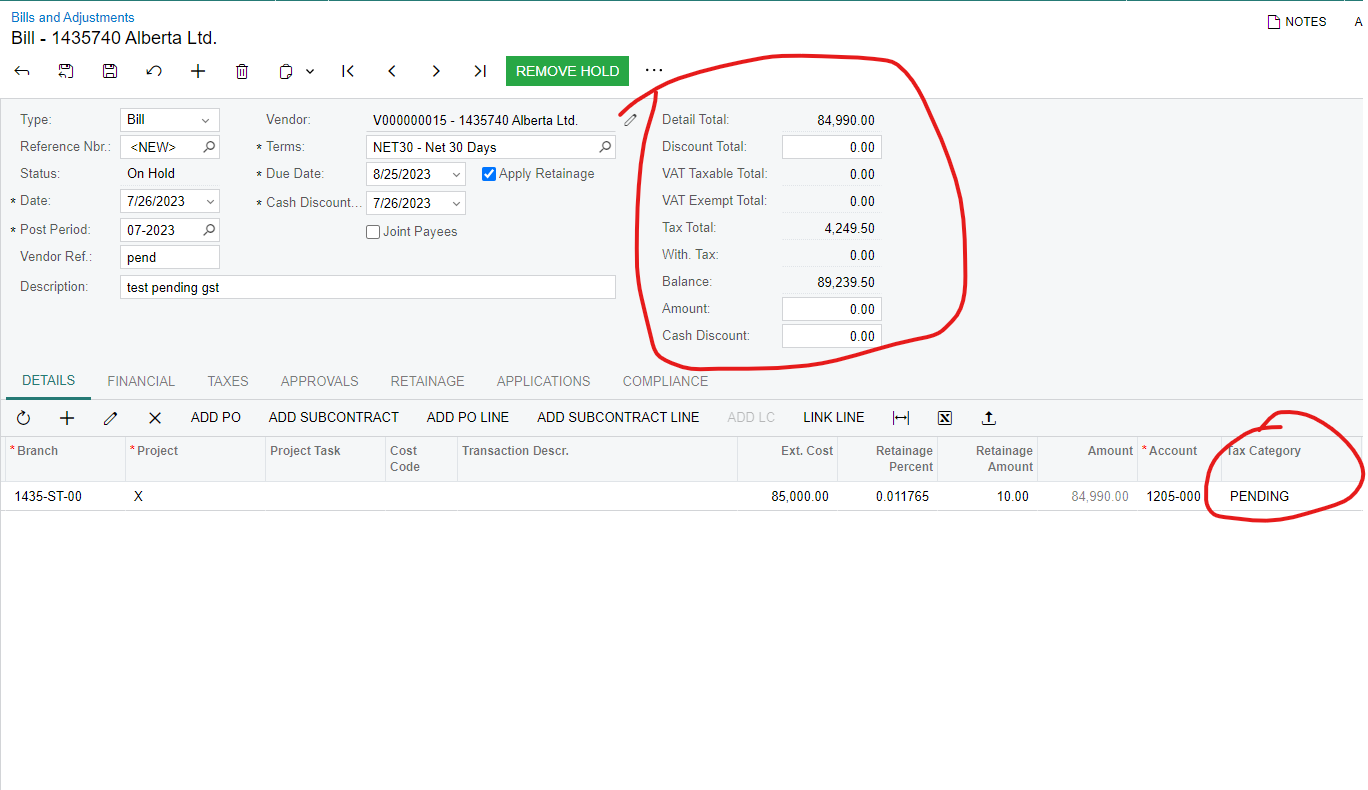

We have a client that is using Retainage for A/P. However, we have a VAT that calculates the tax. I configured a pending VAT. What is the best way to setup pending VAT so the current taxable due is recognized right away but the tax portion on the retainage is part of the pending VAT? Let me know. Right now the total amount is all going to Pending VAT and I do not want that. Here is a screenshot.

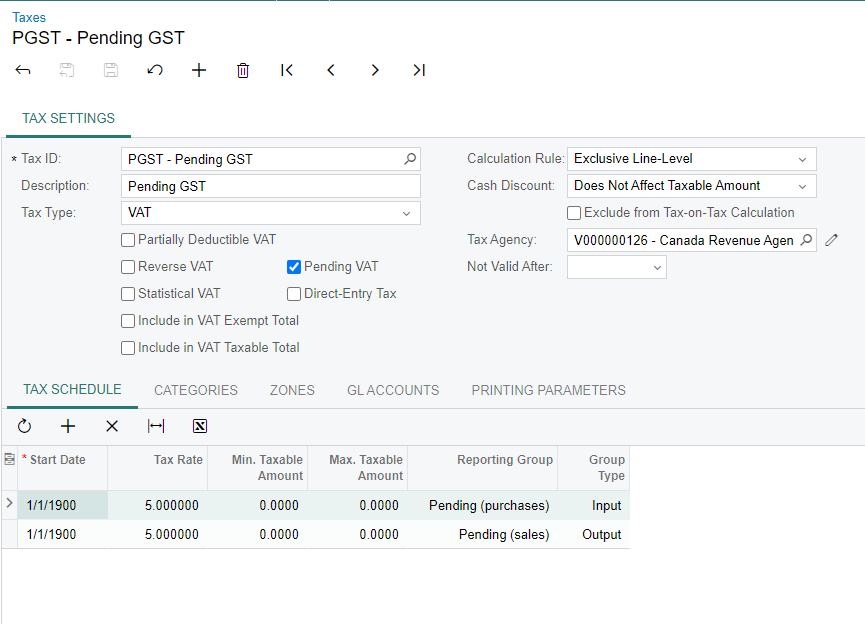

Here is a screenshot of my Taxes Setup:

Thanks,

Frances