How do we apply a payment, using payments and applications, for something that is not invoiced or does not require an invoice. For example, we may get a government tax refund and need to apply the check we receive. How do do so using payments and applications?

Solved

Payment Application with no invoice

Best answer by Kandy Beatty

Hi

For a refund from the government, are they set up as a vendor or customer? From what you have described, they should be a vendor.

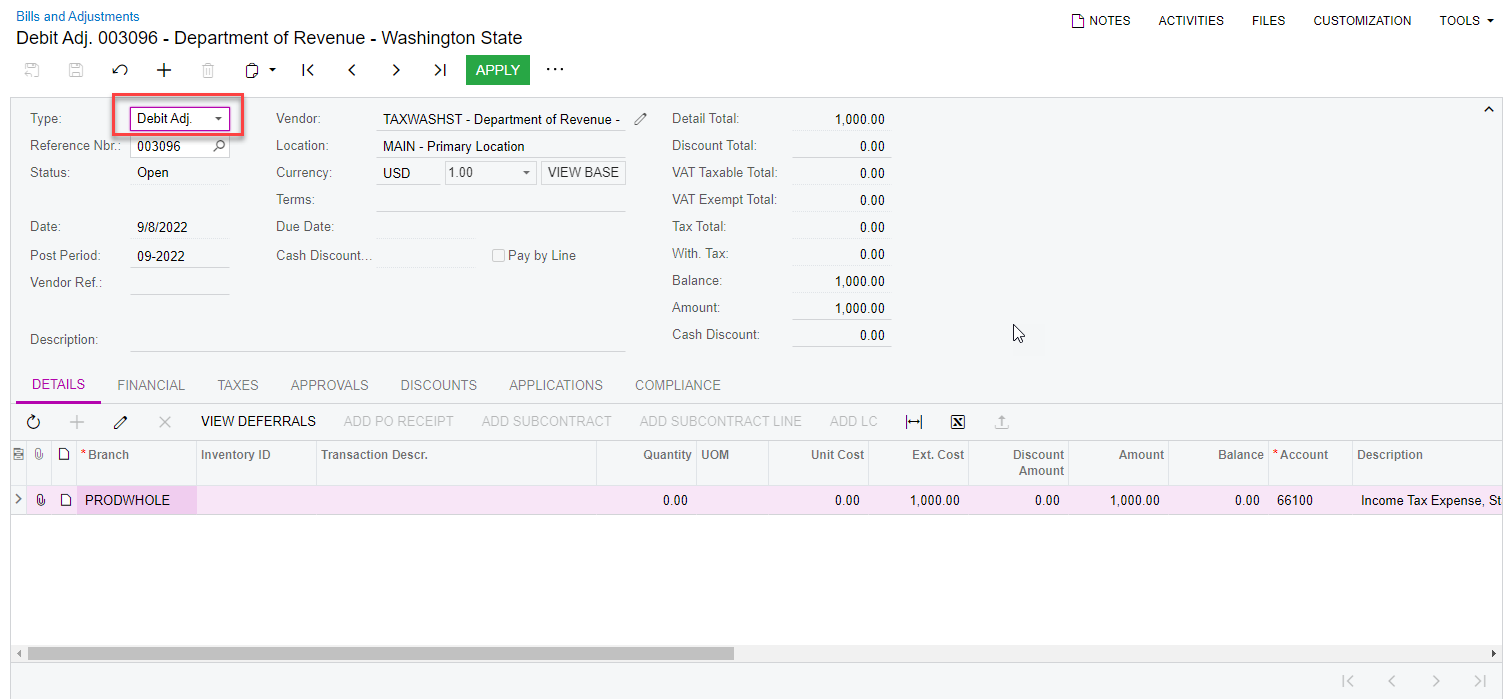

You would need to create a Debit Adjustment for the amount you are receiving:

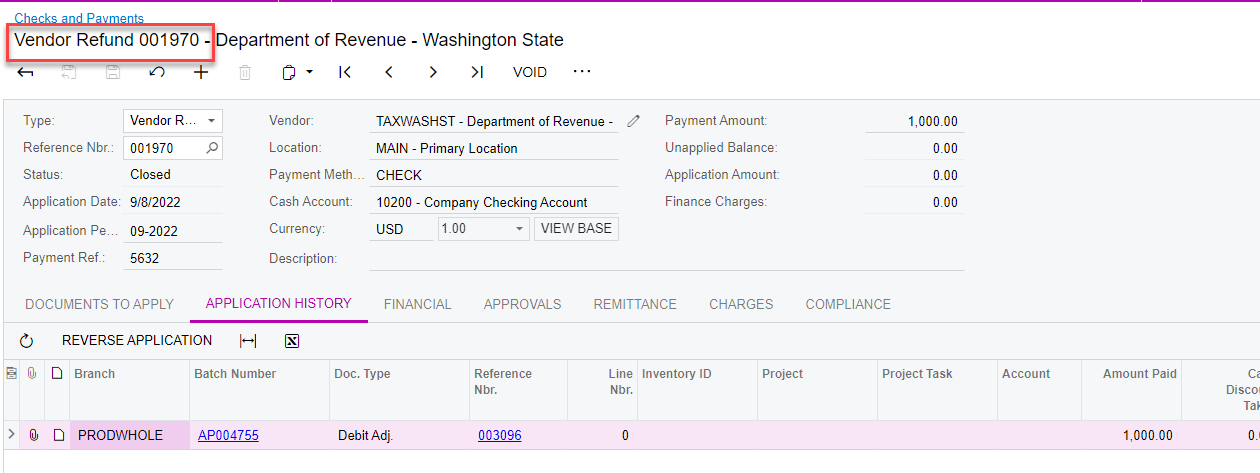

Then you would create a Vendor Refund for that Debit Adj.:

You need to have the Bill Type to have a refund.

Enter your E-mail address. We'll send you an e-mail with instructions to reset your password.