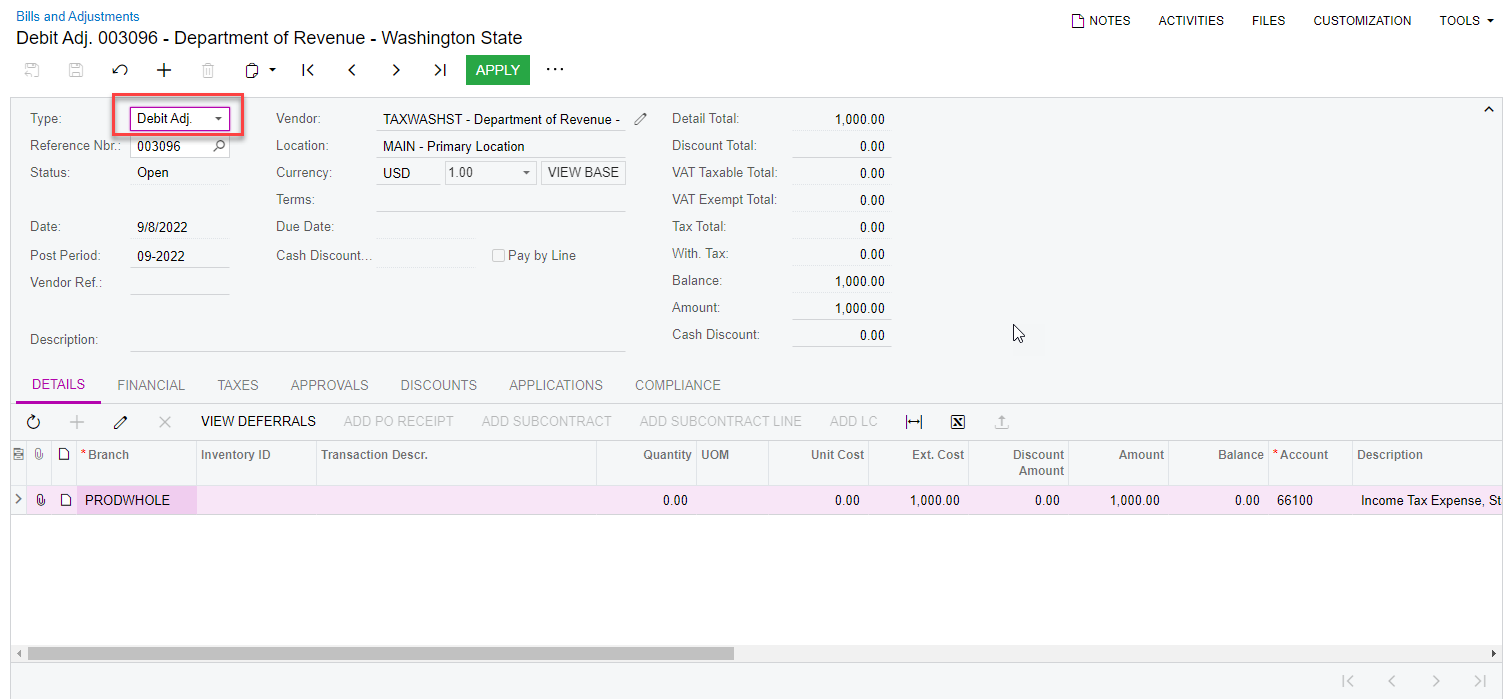

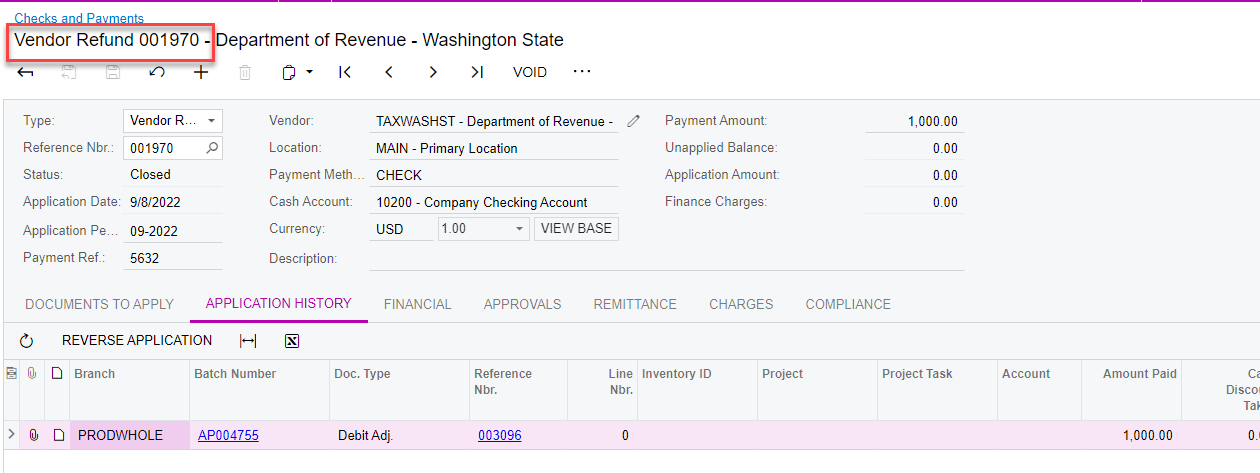

How do we apply a payment, using payments and applications, for something that is not invoiced or does not require an invoice. For example, we may get a government tax refund and need to apply the check we receive. How do do so using payments and applications?

Best answer by Kandy Beatty

View original