Background: In Canada, more than one province has the same tax code but with different tax rates. That is in Ontario the tax code used is HST with 13% and in New Brunswick it is HST with 15%. In Acumatica, a same tax ID cannot have two different rates. And in Shopify the Tax Code cannot be changed manually for US and Canada. But for other countries, the tax code could be manually modified.

Commerce Connector:

Connector should get the HST code from Shopify order Api for both provinces and import the order with appropriate tax rates in Acumatica.

How is it done?

Commerce connector works the following way for the Tax ID comparison for Order imports.

Checks the Shipping Address first. If not found, then Billing address and gets the Country Code and Province Code from the address and does the concatenation as TaxCode+CountryCode+ProvinceCode for Tax ID.

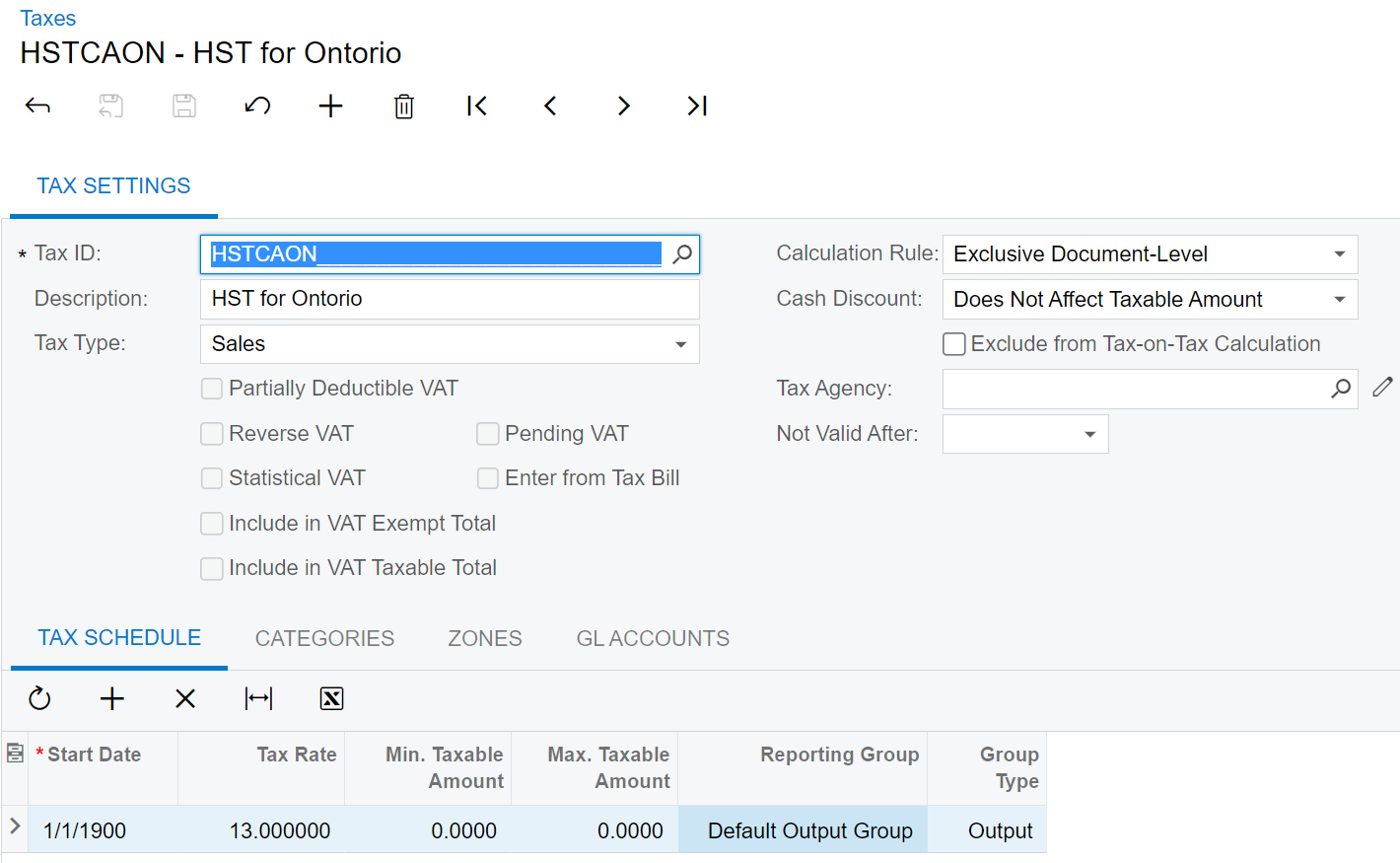

Eg: HSTCAON or HSTCANB

Algorithm:

First the connector check the Substitution List to find if there is any substituted tax id for HSTCAON.

If it finds the Tax ID, then it would be used for the order imports.

else, the connector looks for HSTCAON in the Taxes form.

If it finds the Tax ID, then it would be used for the order imports.

else, then the connector looks for HST in the Substitution List.

If it finds the Tax ID, then it would be used for the order imports.

else, then HST from the Taxes form.

If it finds the Tax ID, then it would be used for the order imports.

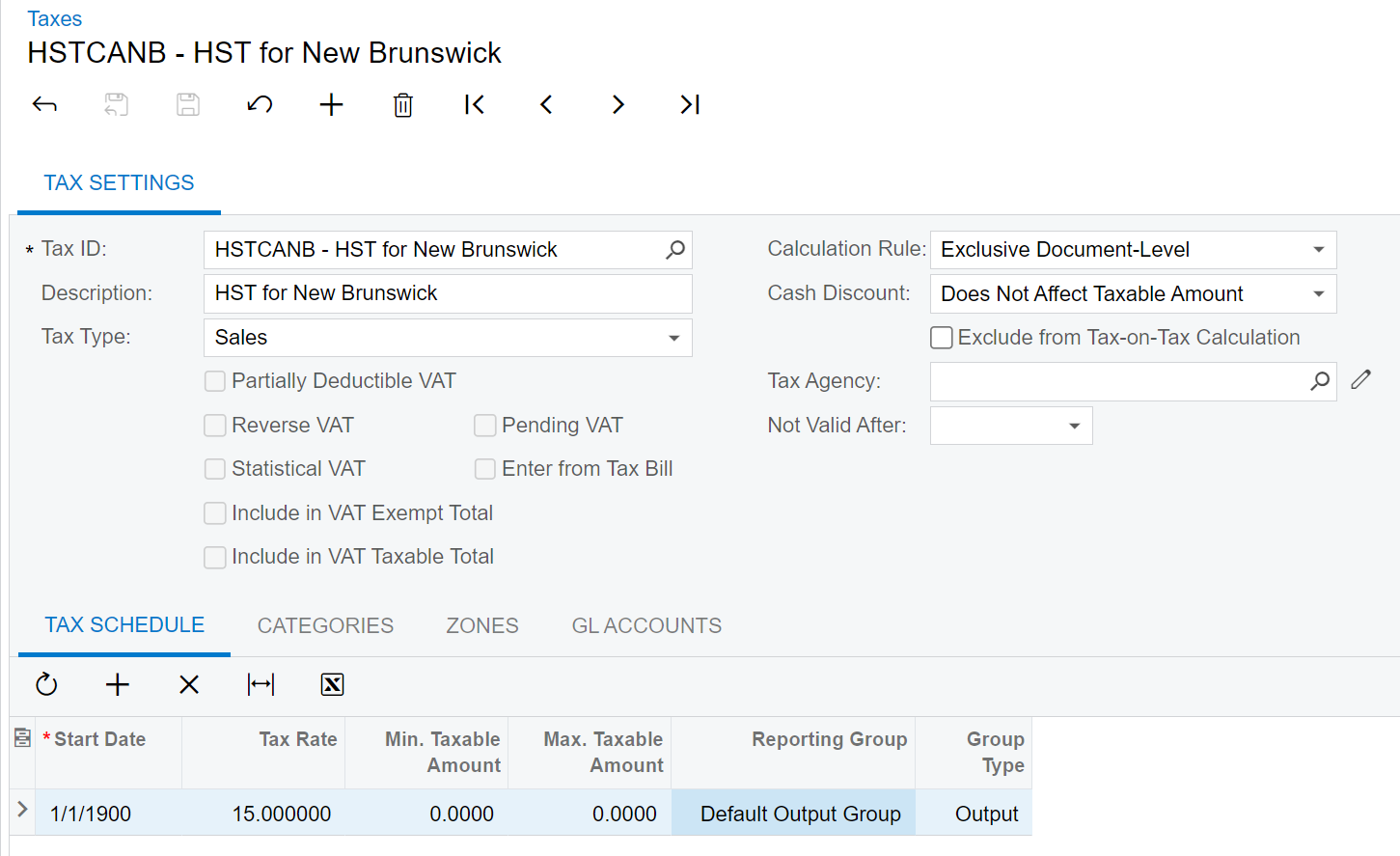

Taxes(TX205000)

So in this case, the user could create the Tax IDs as HSTCAON and HSTCANB with 13% and 15% respectively.

Limitation:

- POS orders do not have either Shipping Address or Billing Address and Shopify Order Api do not show the Ship From Address. So it will not work for POS orders.

- Works only with Sales Tax.