Hello,

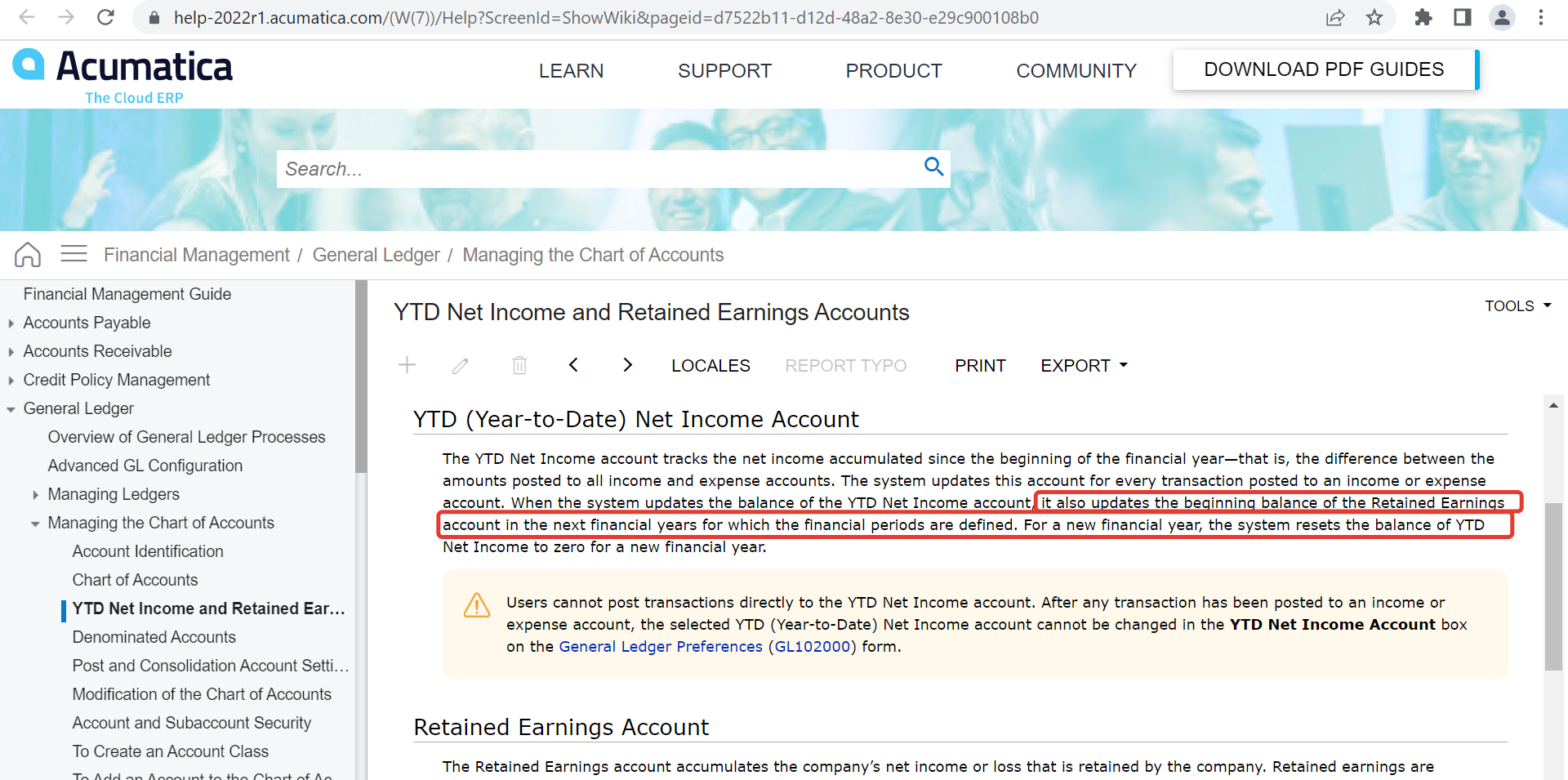

I am aware that Acumatica has a dedicated account for keeping track of the YTD Net Income balance and with every income or expense transaction, this account is updated. Furthermore, as documented in Acumatica’s Help material (see below), Acumatica automatically updates the Retained Earnings account for the next financial years that are defined.

The system updates this account for every transaction posted to an income or expense account. When the system updates the balance of the YTD Net Income account, it also updates the beginning balance of the Retained Earnings account in the next financial years for which the financial periods are defined. For a new financial year, the system resets the balance of YTD Net Income to zero for a new financial year.

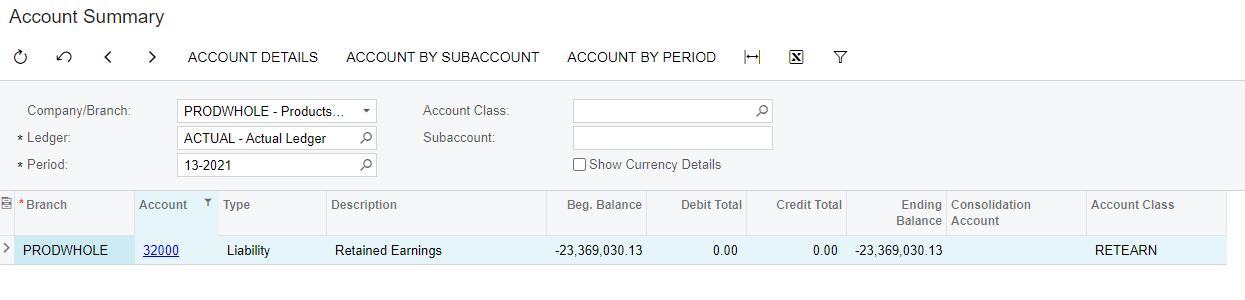

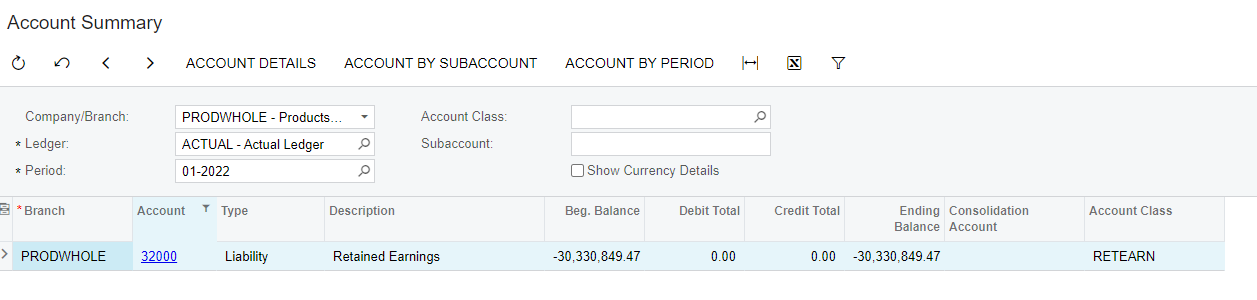

However, for auditing purposes, when a user looks at the Account Summary and Trial Balances for the retained earnings account, the Ending Balance of the last period of one year would not match with the Beginning Balance of the first period of the following year. An example is below.

Period 13-2021. Ending Balance is -23,369,030.13

Period 01-2022. Beginning Balance is -30,330,849.47

This could cause some confusion for the users. Furthermore, no actual GL Journal seems to be present for the transfer of the amount to the Retained Earnings Account (as it appears that the amount is automatically moved). Hence, a user would not be able to track the difference.

For this reason, I would like to ask whether Acumatica has some DB Table (such as GLHistory) where a transaction is kept for this movement to the Retained Earnings account.

Thanks,

Nigel Pace

Best answer by Laura02

View original