I have set up row sets that work on standalone Income Statement, but not sure how to design the row set so it eliminates on consolidated statement. Maybe I need different GL accounts - see below.

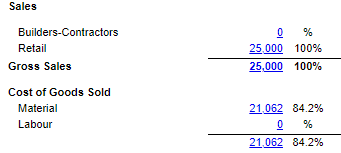

Entity A - Correct

- Sale to end customer - $25K

- COGS for order - $21K

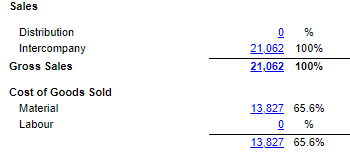

Entity B - Correct

- Interco sale of $21K

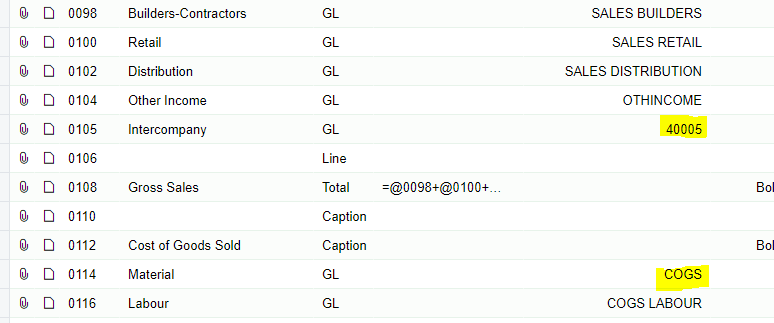

Consolidated - No Elimination

- The intercompany Sales line should be zero and hidden.

- The COGS material line should be $13,827 ($34,889 - 21,062)

The row sets are set up as follows:

- Intercompany sales being driven by GL account 40005

- COGS Material being driven by COGS account class

How do I go about eliminating the interco entries on consolidation. Open to changing row set/GL account/Account classes as necesary but wondering what the best practice is for structuring this.