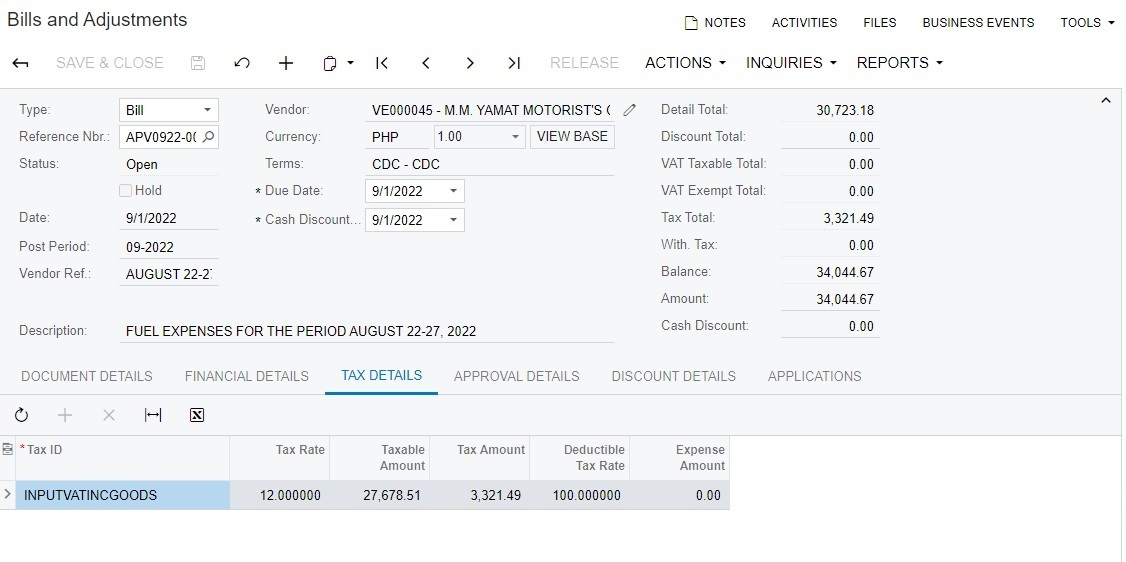

Hi! I would like to ask if it is really possible to override tax amount in Payables Module - Bills and Adjustment. I tried doing it in one of our vendors (Vatinc) but it resulted to wrong value of entries. Can someone enlighten me on how to properly override tax amount.

Gross Amount: P31,200.00

Taxable Amt.: P27,678.51

Tax Amt.: P3,321.49

Withholding Tax: P276.82

I attached the screenshots of the transaction.

Thank you very much.