We use AP Bills to track and pay employee expenses. We use an approval rule to route the expense to the appropriate approver based on the detail provided in the AP Bill Transaction line. We have found that on occasion Sr. Managers are asked, through our approval process, to approve their own expense reports.

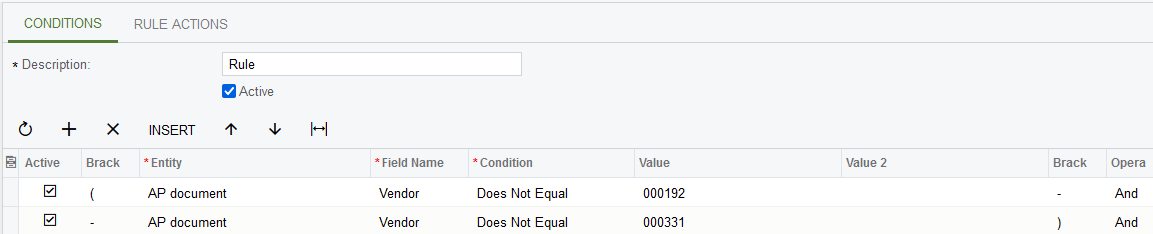

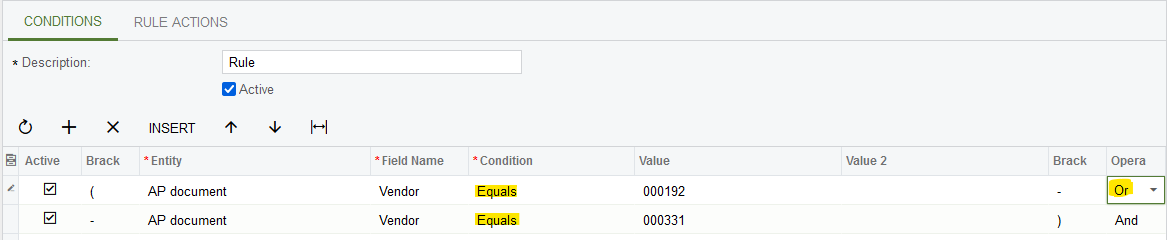

Could someone please provide me with an approval routing rule so that an employee (vendor) cannot approve their own expense report.

Thanks!