Hi,

I am completing the financial training for Acumatica and I am thoroughly confused by the refund process.

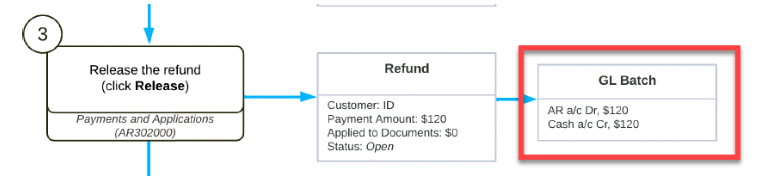

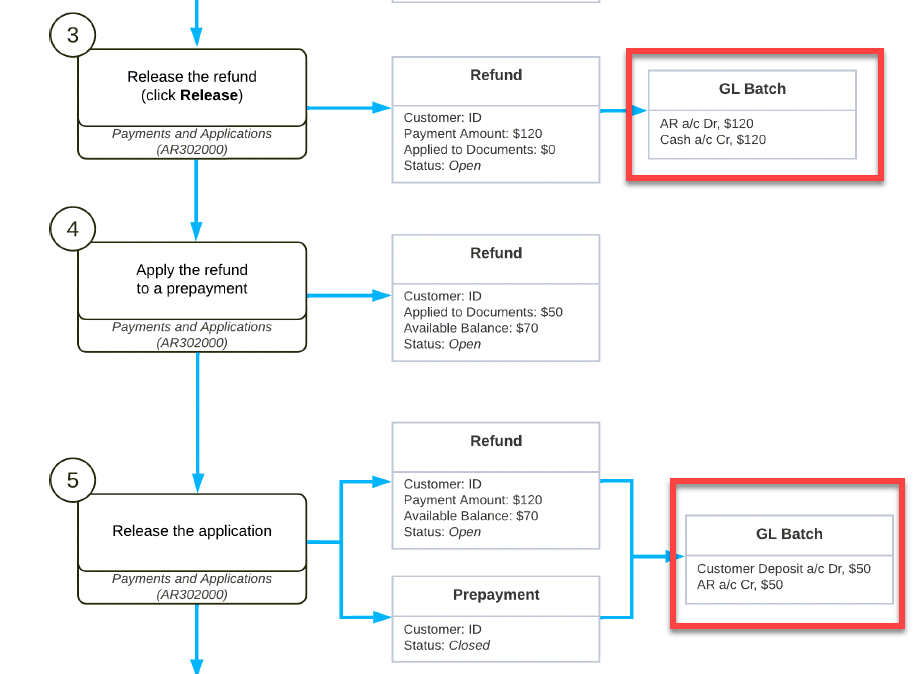

According to the training manual, this is the general flow:

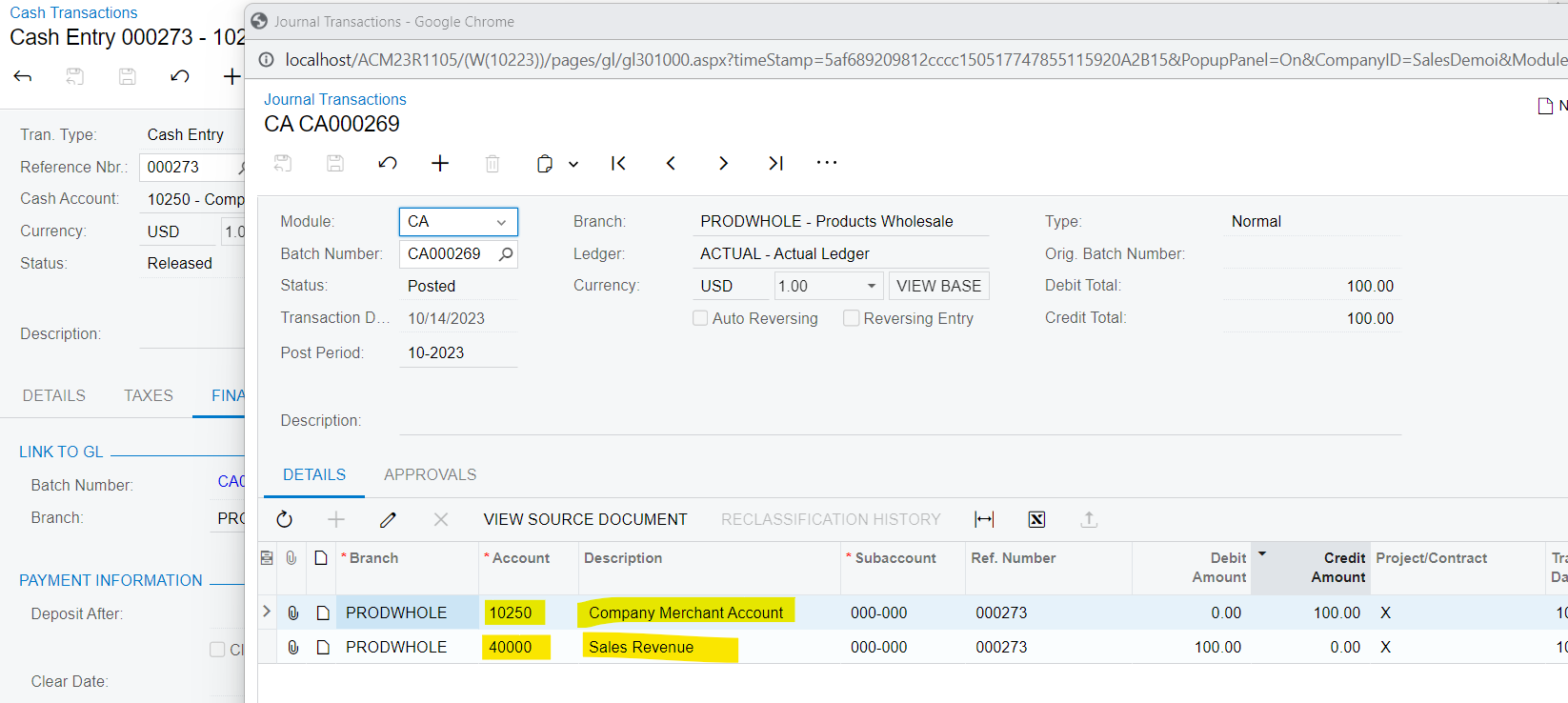

So, according to this, when you release a refund it increases cash and increases AR? I do not understand this at all. Refunds decrease cash. I have no idea why an AR account is involved. You now have:

- an entry increasing cash that will not be reflected in the bank statements and will be impossible to reconcile

- An entry increasing AR when no invoice was issued.

This would impact your cash audit trail, distort AR and cash balances, mess up your reconciliations, and possibly circumvent cash controls. They’d all have to be needlessly restated or reclassified in the ledger to correct them.

In addition, when you apply it to a prepayment (the second red box), it reduces customer deposits, assuming it’s properly classified as a liability, and decreases cash? Why? Normal sales refunds have nothing to do with customer deposits. And to reduce cash directly, without properly capturing the audit trail for issuing the actual payment, creates the same problem from the first step.

Refunds involve cash payments to customers. As such, there should be no entries ever to AR; the AR is closed and paid. Otherwise, if you haven’t received the cash yet, you can just issue a credit memo to an open invoice or balance and you’re done. Making entries to any AR account for a refund is just going to pollute your books.

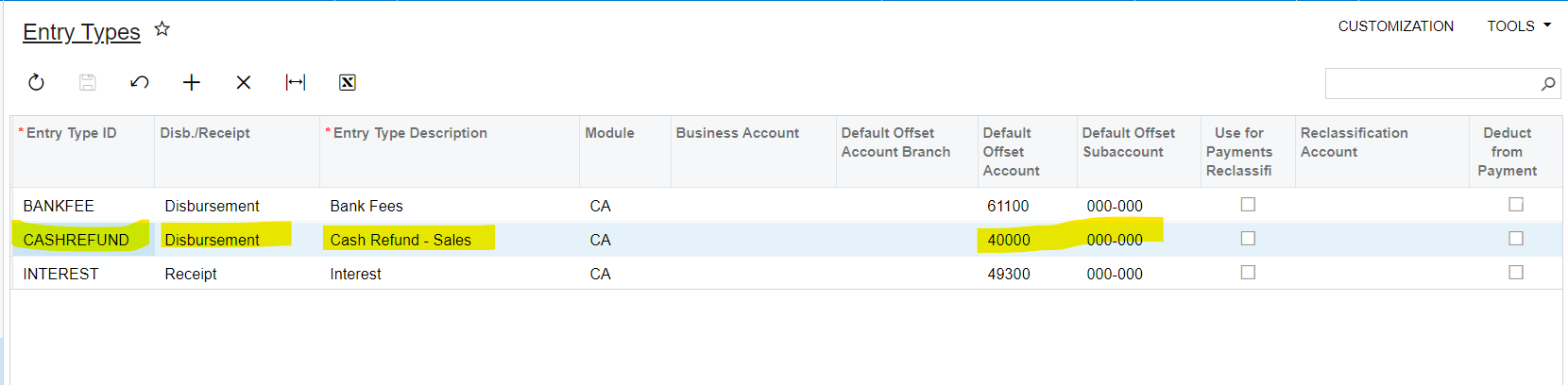

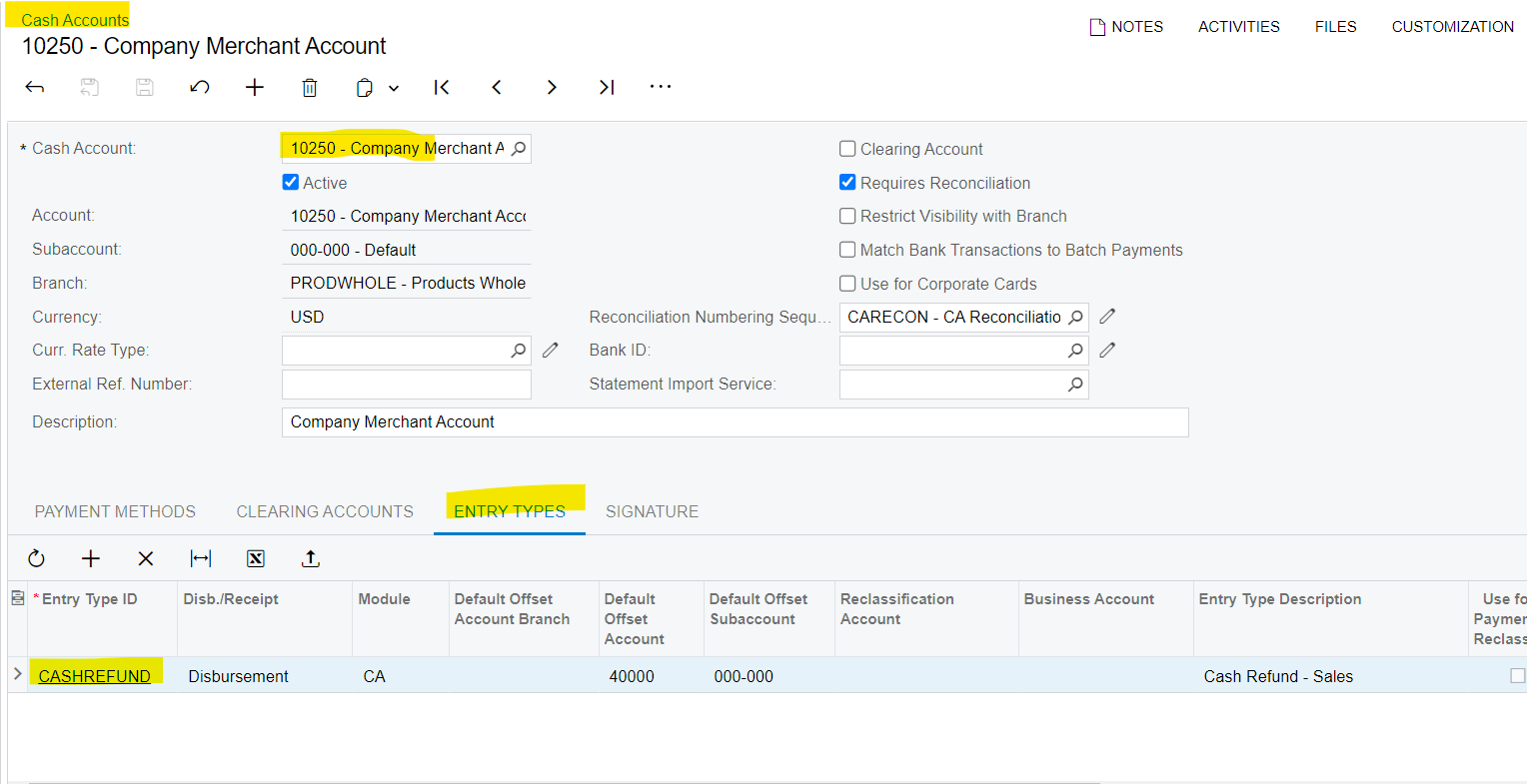

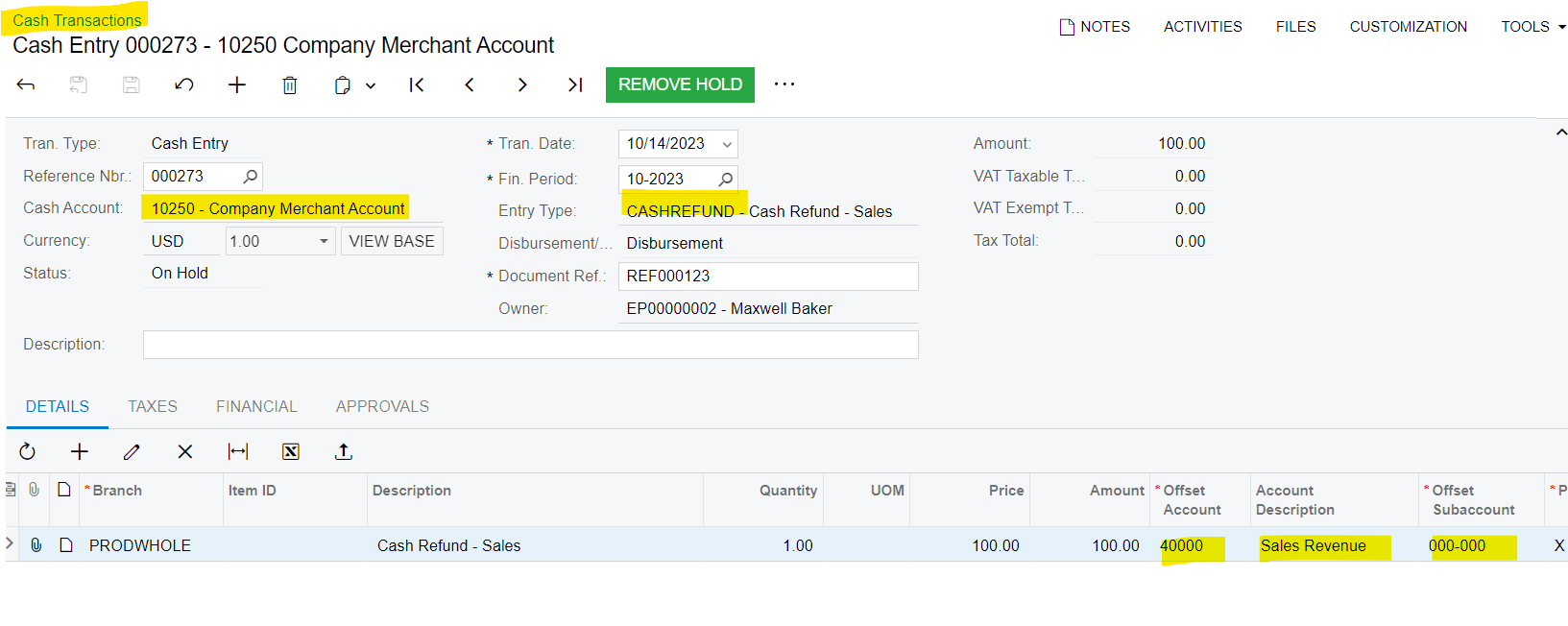

Instead, they are a special type of AP. So, they need to incorporate both the Sales and AP process and should be tracked in each, as well as linked together.

This is the normal process for a refund process:

Step 1 - Refund is requested. It’s fine to start this process in the AR module so long as it’s clear that no AR ledger account will be modified.

Step 2 - Request is reviewed and approved (so it should be tracked in the approval trail).

Step 3 - Once approved, a customer refund is processed. Even though the invoice is closed, it should clearly indicate the initial entry it was related to. So, you should be able to select that...but no AR entries should be posted in the GL. The entry should be:

Dr. Sales account (or a Sales Refund account)

Cr. Customer Refunds Payable

Step 4 - The process should then move to AP processing. It should be a special type - Customer Refunds - and only let you process transactions created in Step 3.

Step 5 - The refund payable can then be processed like any other type of payable. The process should link the AP batch created to the batch created in step 3 as an audit trail. The entry in the leger should be:

Dr. Customer Refunds Payable

Cr. Bank (or Cash)

That’s it. Two simple entries that don’t require complicated reconciliations or correcting entries.

Am I missing something here? Can someone explain the thinking behind this?

Thanks for the help.