Does anybody have any input on a workflow for creating purchase orders with “estimated” costs?

Example - vendor estimates cost for services will be $1,500, PO written for $1,500. Cost may come in higher or lower.

*this is assuming no Subcontracts/Projects.

Here are some of my thoughts…

"PO with estimated costs" - option 1

- create normal PO at $1,500 (no accounting transaction)

- create PO receipt for $2,000 (also created AP bill)

- PO closed

- Accounting on receipt:

- debit COGS $2,000

- credit Inv. Purchase Accrual $2,000

- Accounting on AP Bill:

- debit Inv. Purchase Accrual $2,000

- credit Accts. Payable $2,000

In option 1 - PO can still go through approval, receipt approval = n/a, AP Bill approval if needed (won't be able to create approval where AP cost > PO cost)

"PO with estimated costs" - option 2

- create normal PO at $1,500 (no accounting transaction)

- PO approval if needed

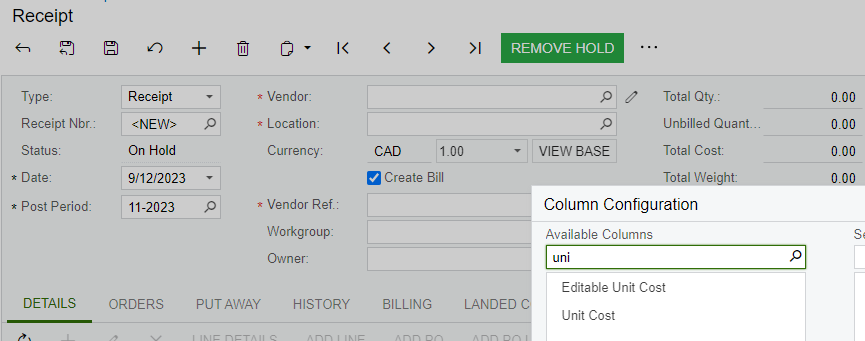

- Place back on Hold - adjust cost

- *will have to run through approval again