Hello,

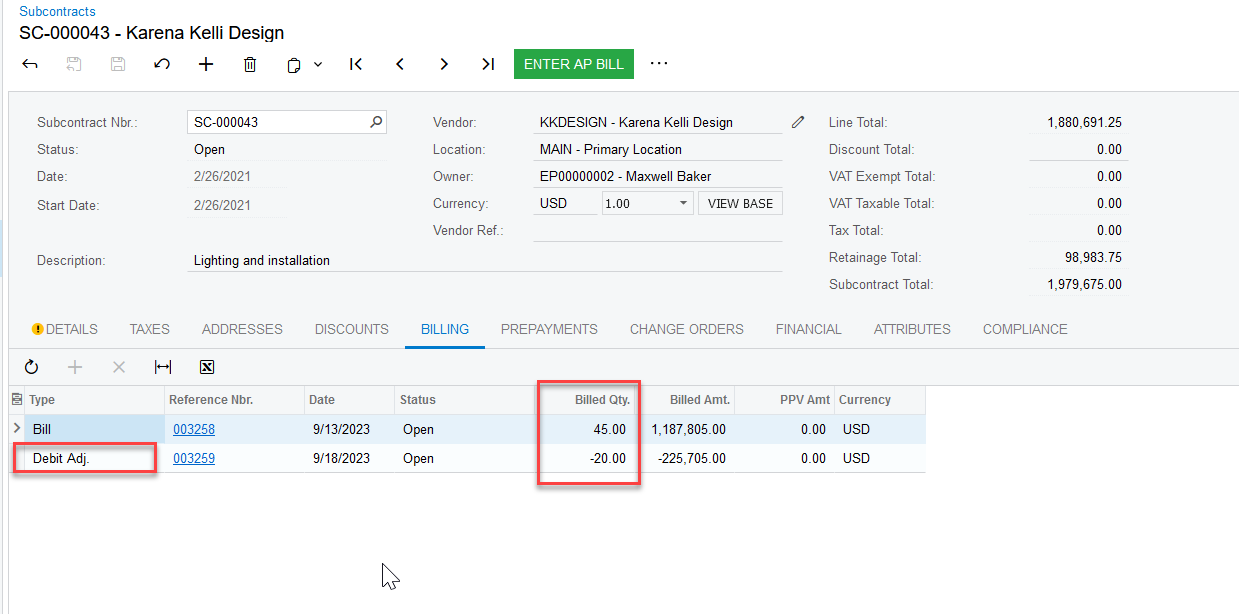

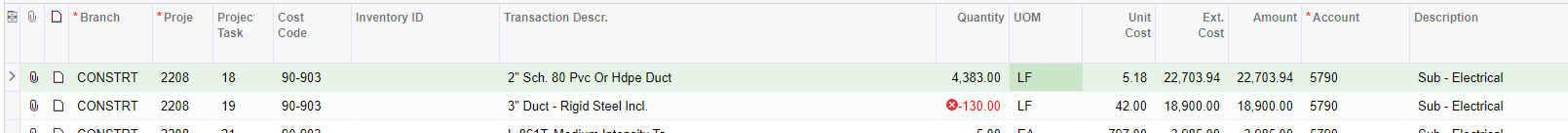

I am trying to put a negative quantity in a subcontract line item, but it errors out.

Anyone have a work around for this that doesn’t require a debit adjustments. I am trying to keep all the details on one invoice. We create the invoice for subcontractors and tie them off to each pay applications. If we create multiple invoices it creates confusion.

I found I can put a negative dollar value which makes the $ side work, but i don’t think it will work on the total qty side.

Thanks,

Jeremy

Best answer by Heidi Dempsey

View original