Hello all,

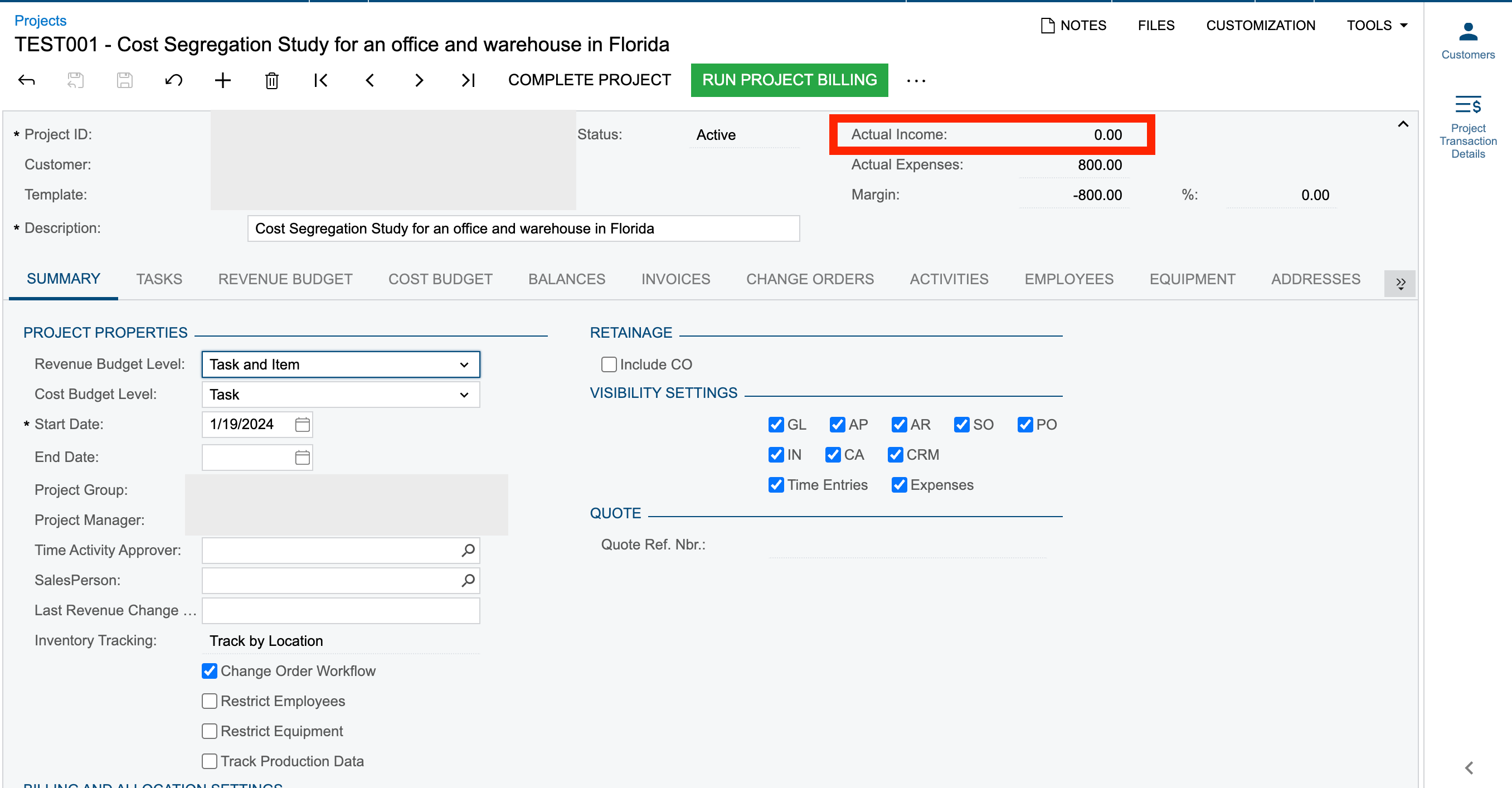

I have been trying out to let the system calculate & display the Actual Income section of the Projects before creating an AR Invoices.

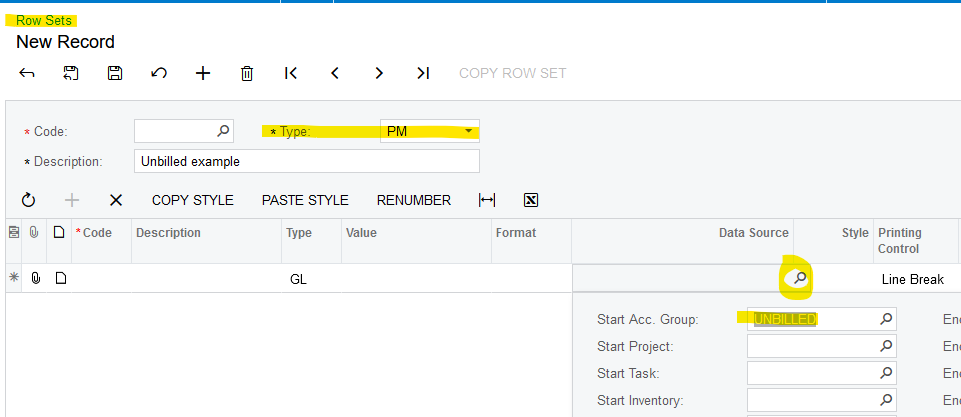

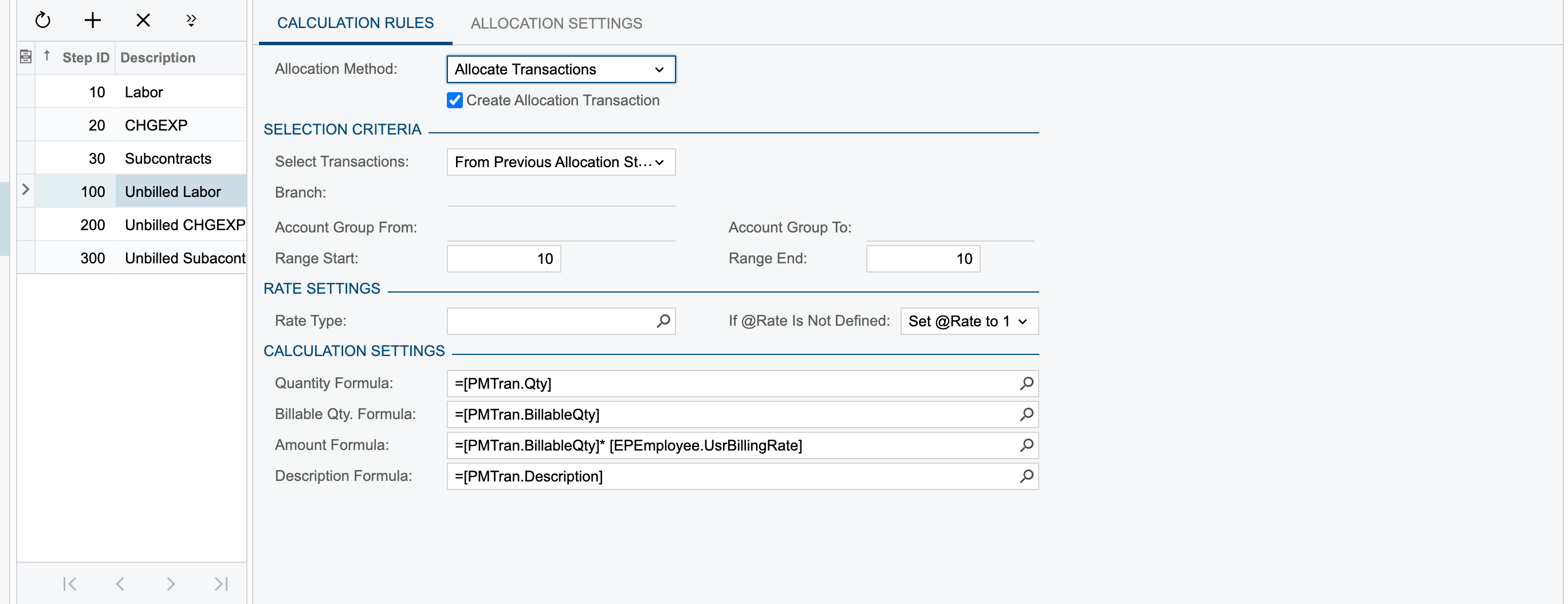

So I would like to record Unbilled AR and display that figure under Actual Income.

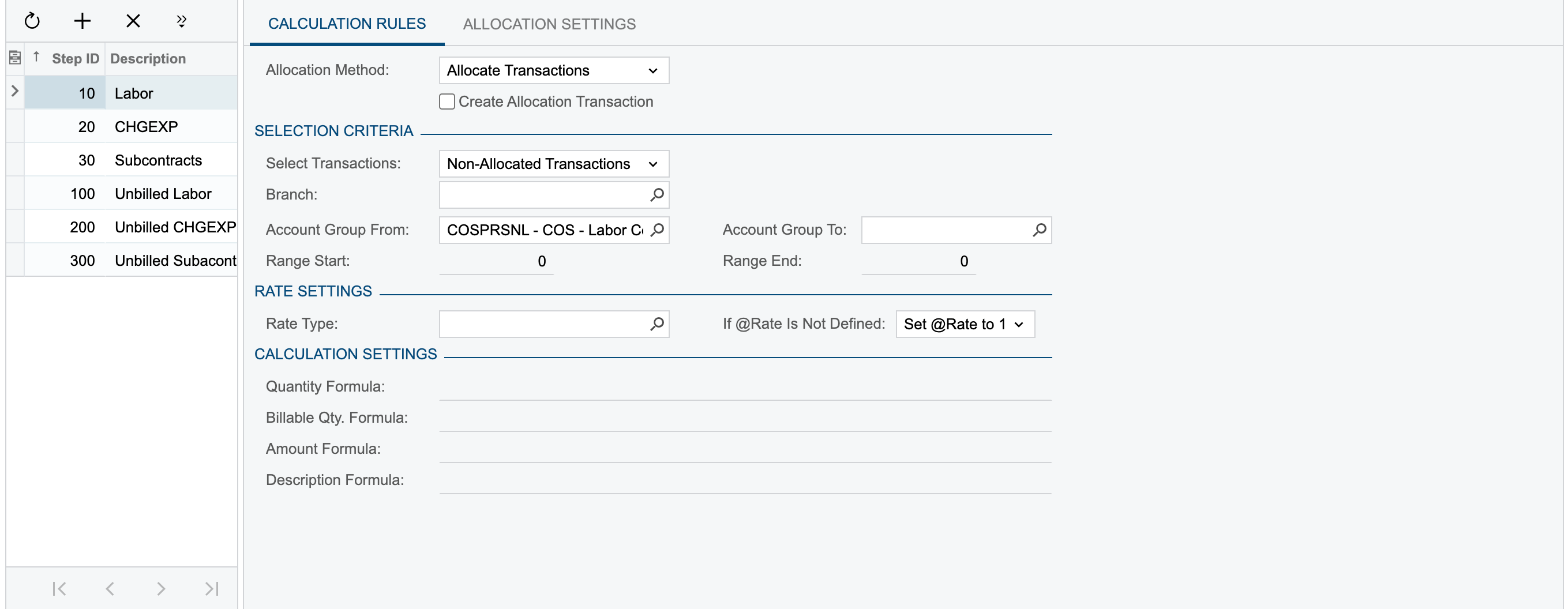

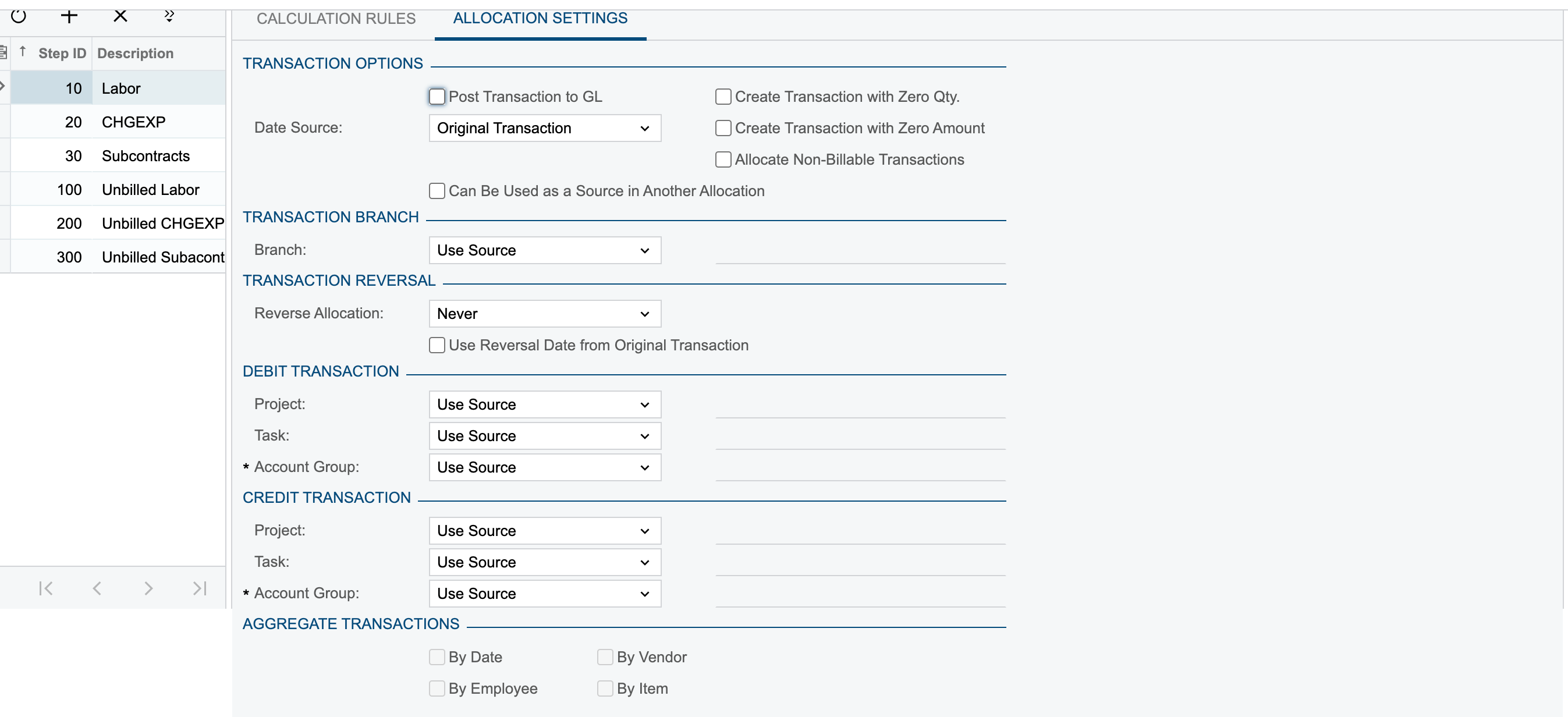

I have a Time & Material project, so I create the project transactions , not posted to GL, using the Employee Time Cards.

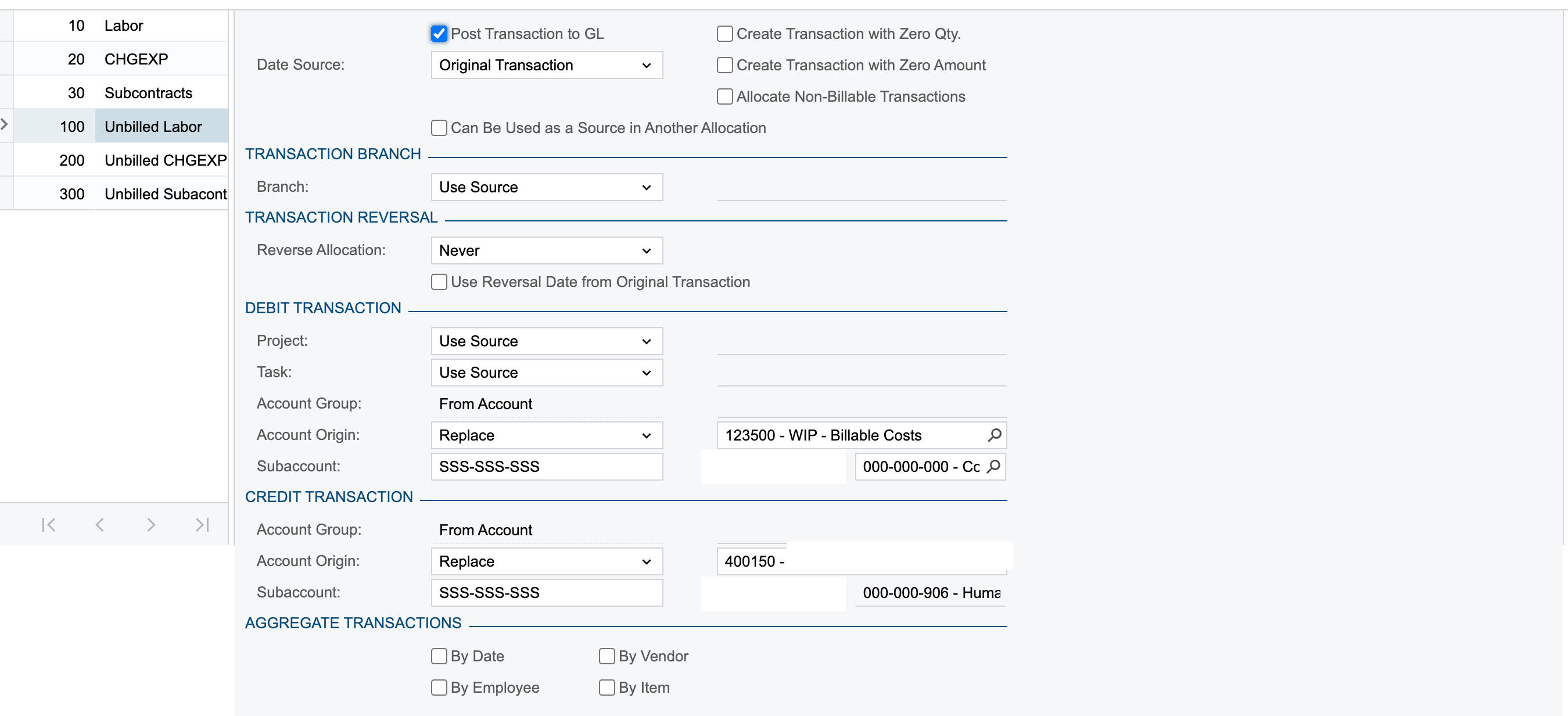

Now I would like an Allocation rule that would post a GL transaction as:

DR CR

Unbilled AR 800

Revenue A/c 800

And then the Actual Income gets updated to 800.

And then when we generate the AR Invoice/Run Project Billing then the Unbilled AR should get nullified.

How can we get this done?

Best answer by Laura02

View original