Hi All,

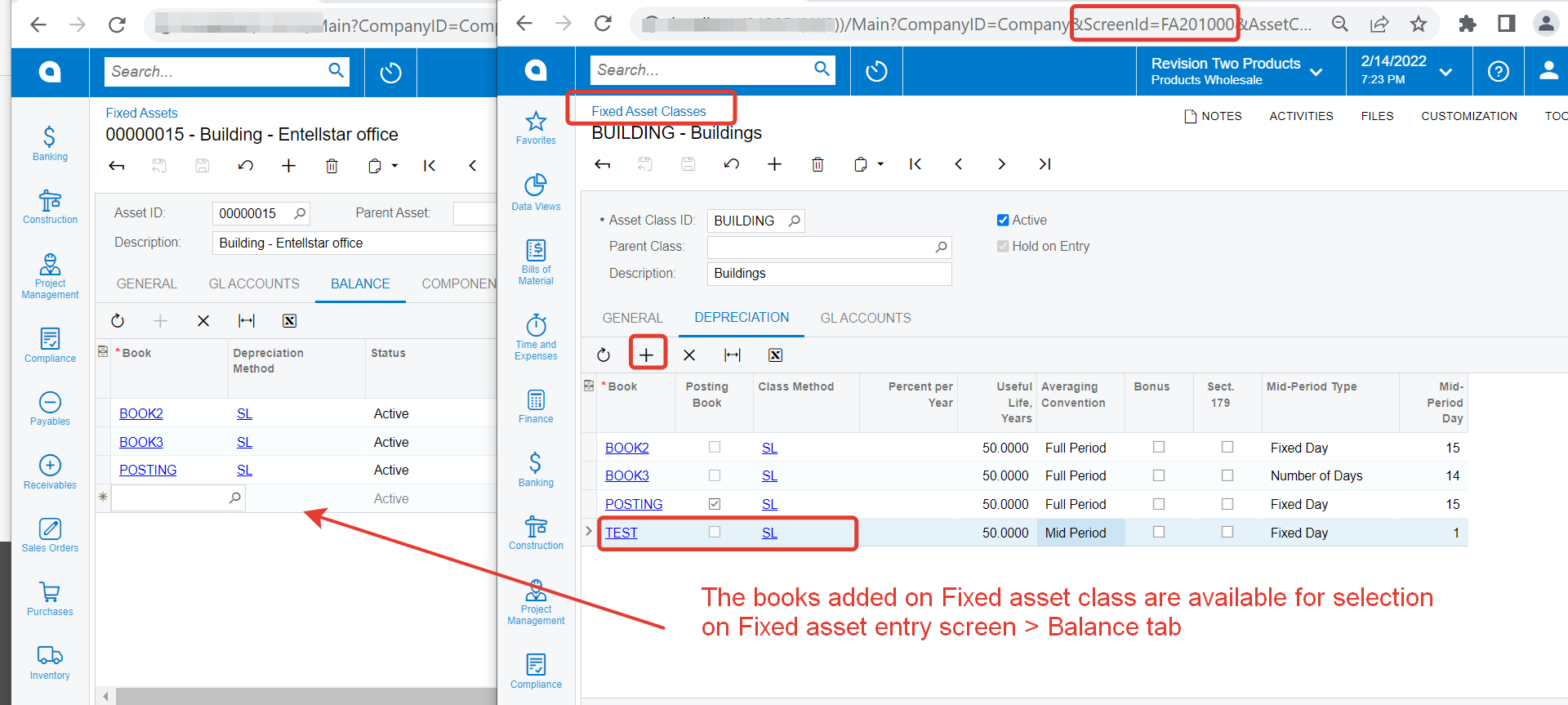

I have uploaded Assets and they have been depreciated using Tax Type “Book”. however now the client would like to calculate “Tax” (i.e. no posting) as well. I don’t seem to be able to add another Book in the Balance section against the Asset.

How do I add this please?

Regards,

Laura

Best answer by vkumar

View original