Hi All

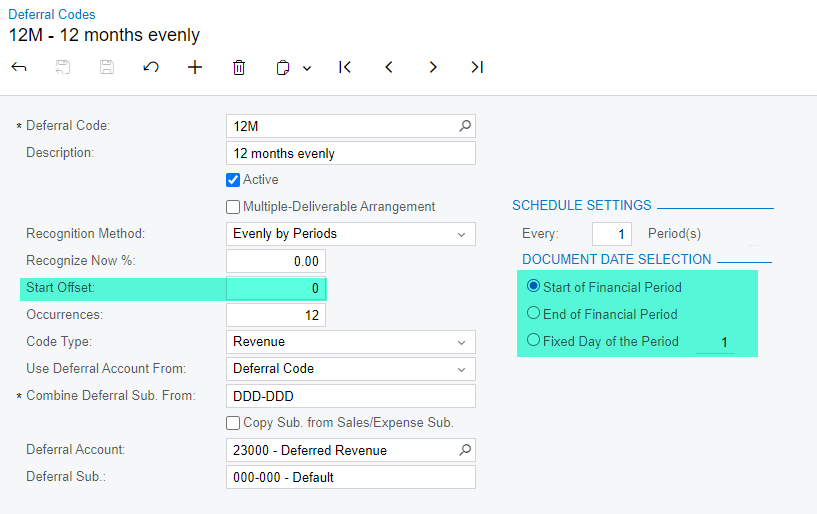

We are currently implementing a new business module - Subscription Fee for customers. This means that we will receive upfront payment from customers. From a financial perspective, we need to split the subscription fee into 12 monthly installments to accurately capture revenue each month.

I'm not sure if anyone knows whether Acumatica can support this type of subscription fee module.

If not, is there an integrator that can support and integrate it into Acumatica?

I hope to hear from you soon."