We have many instances where we do work for a customer in Tax Jurisdiction A (Example). The invoice, is generated to a sperate bill TO Customer.

The tax rate due - is based on where the Service customer is - where the work is physically performed. However, the tax rate is pulling from the bill to customer, creating a very cumbersome tax Code review process.

IS there something I am overlooking, or is this a shortcoming / issue that is being addressed?

For Service work, it would always be tax in jurisdiction work is performed.

Would be great if anyone could share some insights (hoping IM making a mistake!).

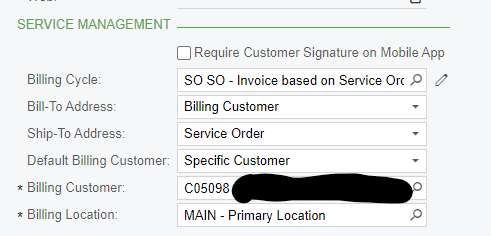

Below is example of our current billing configuration in this scenario.