Hello all,

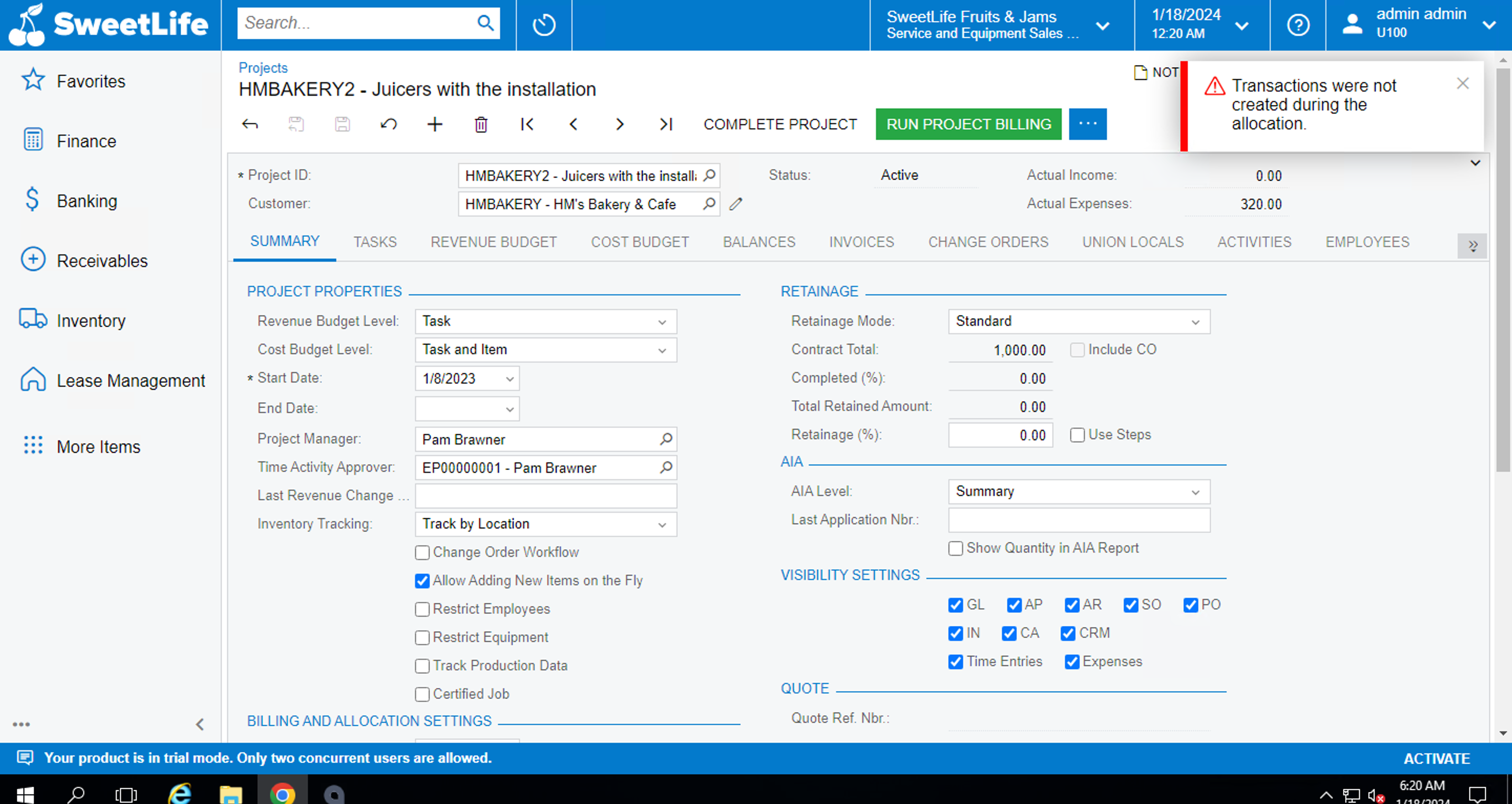

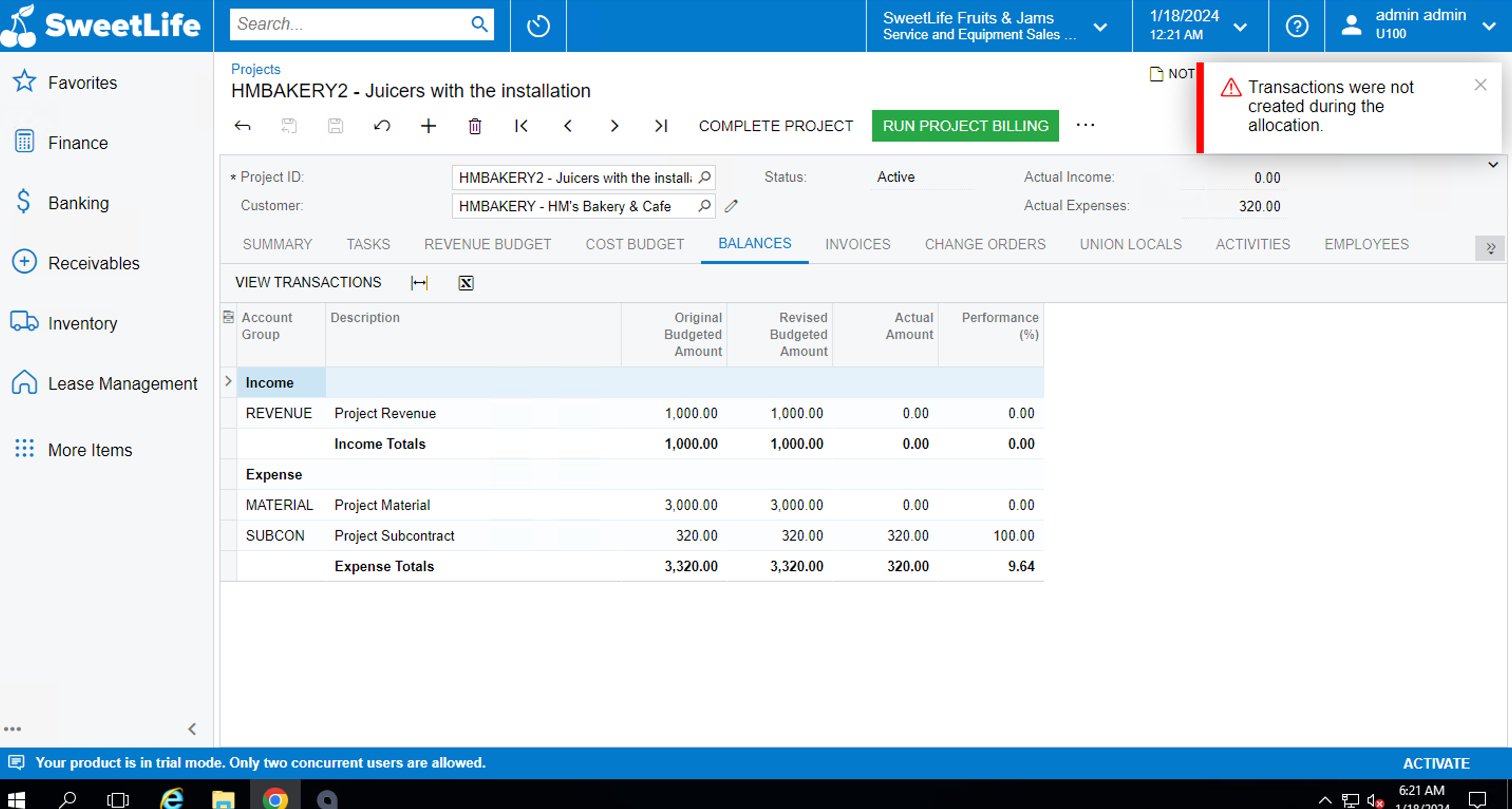

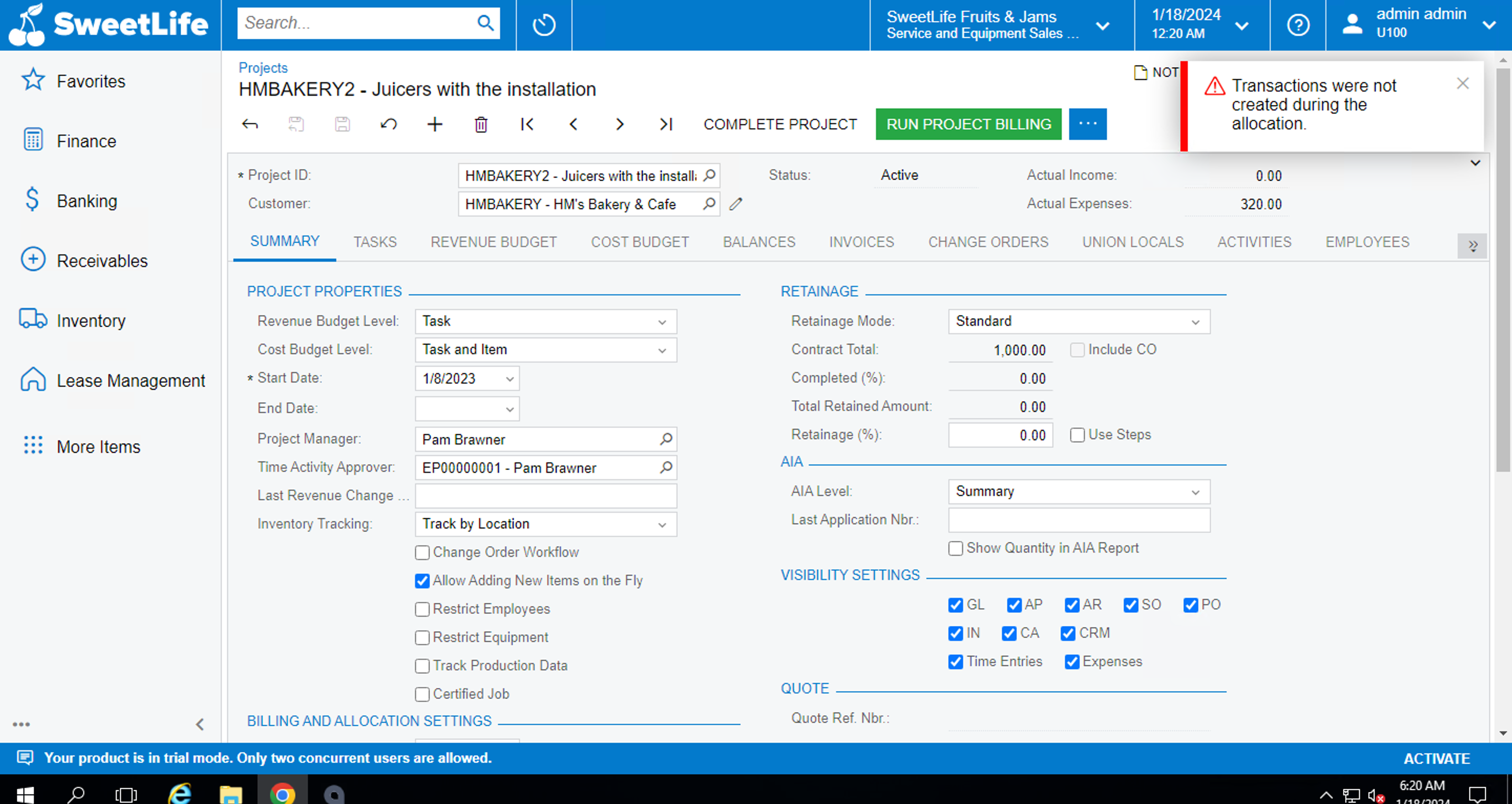

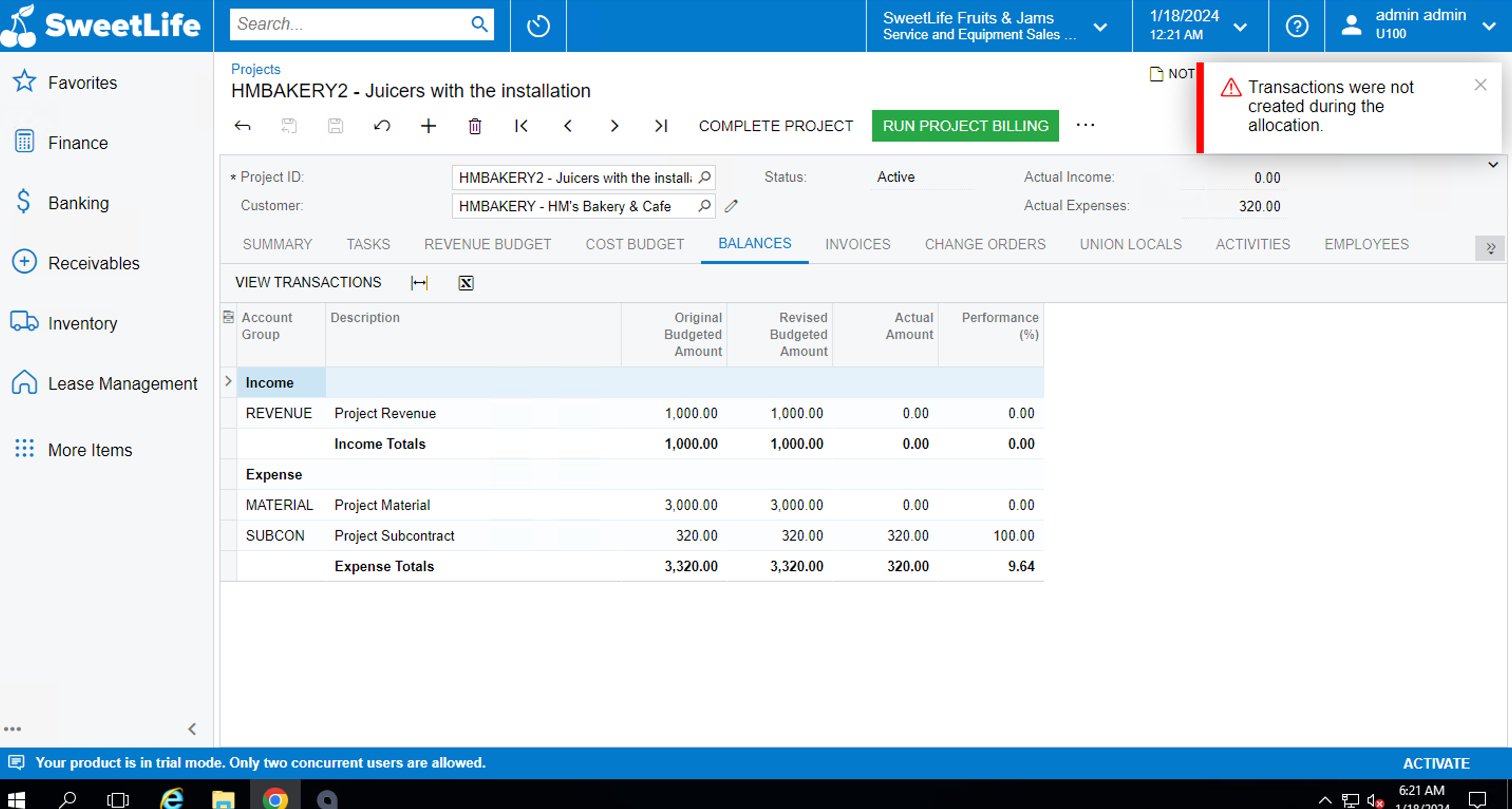

I have been trying to run allocations, but it displays the following error:

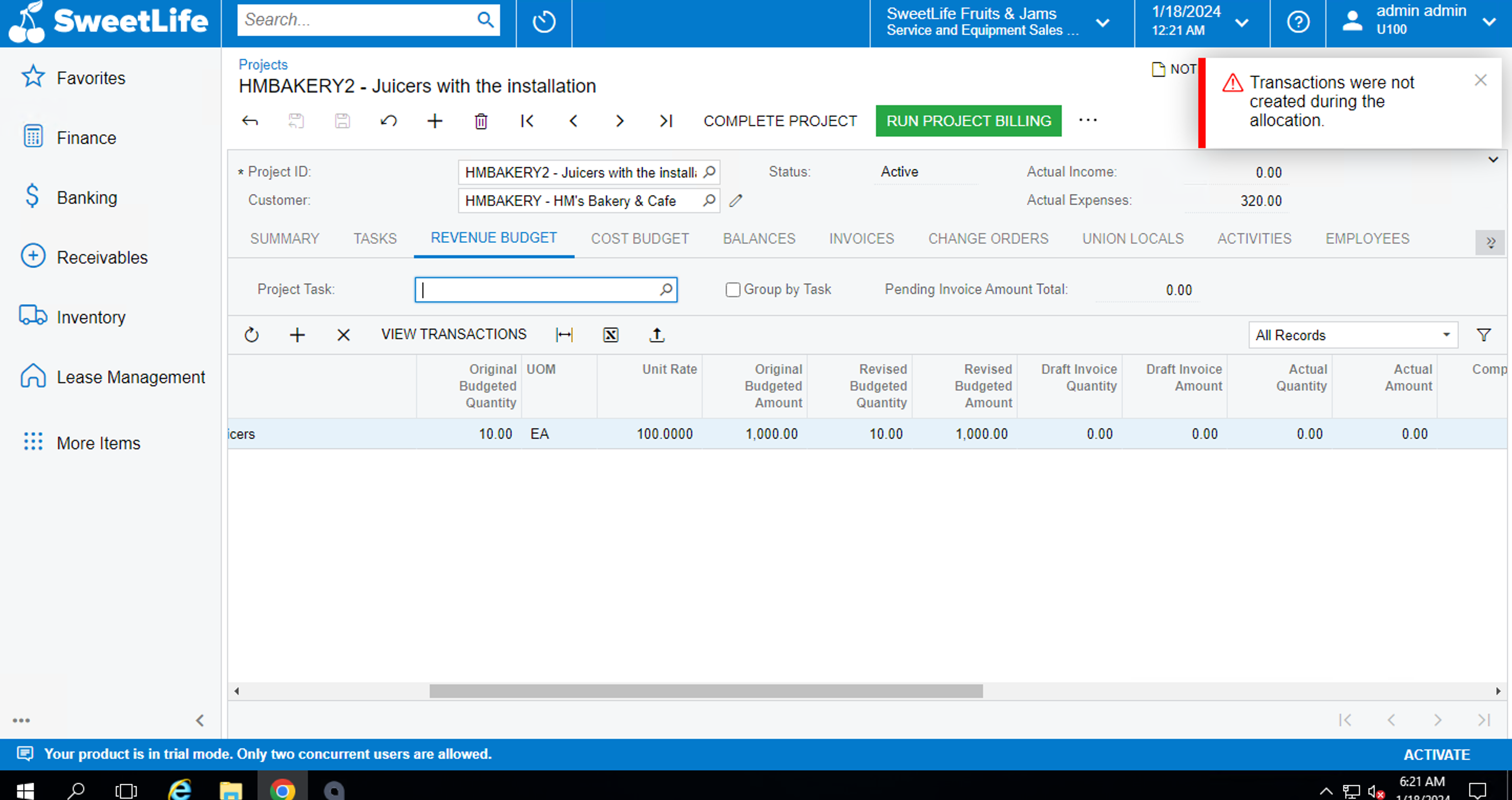

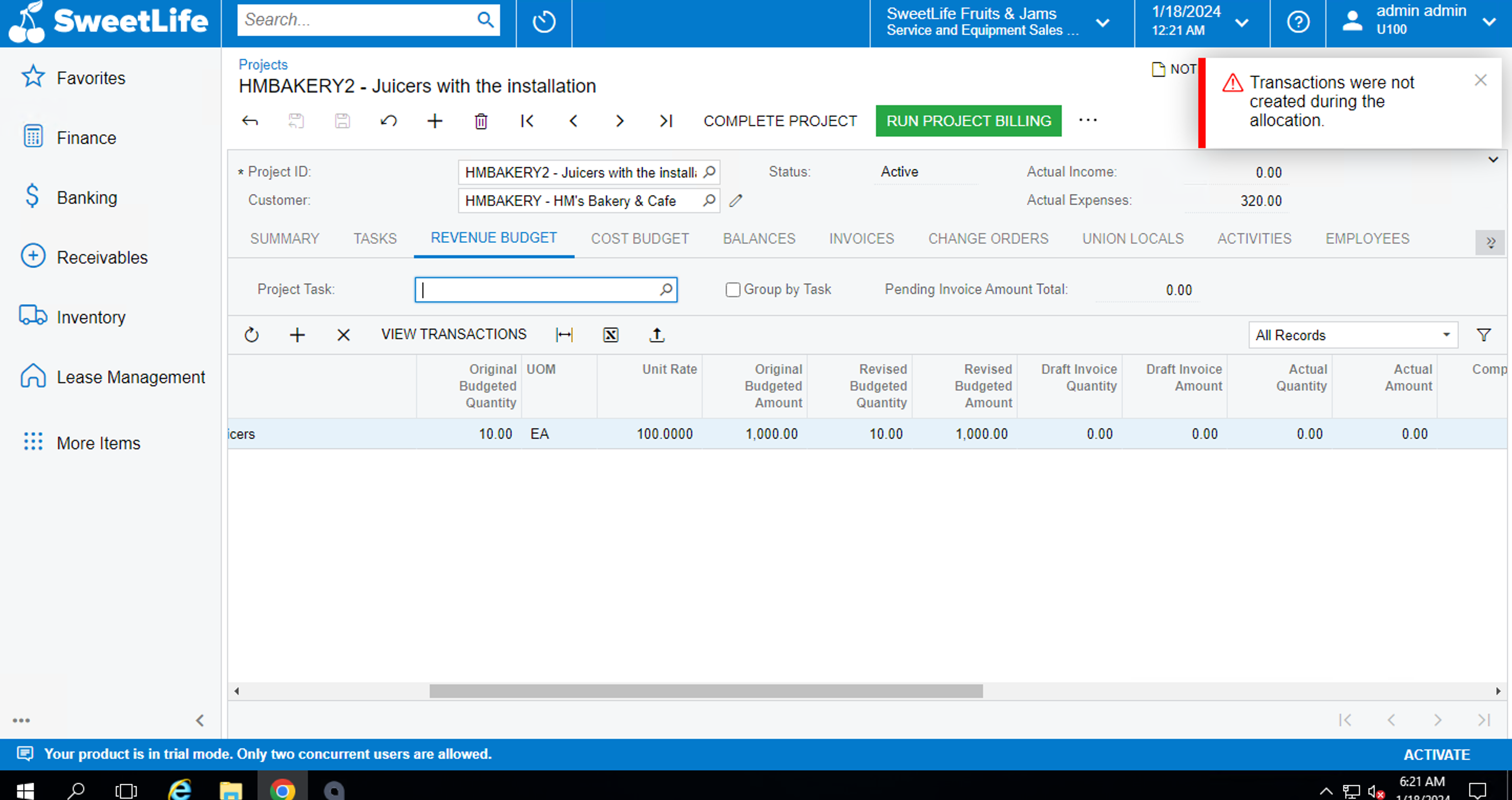

I have my project Transaction of the type AP created, have my revenue budget tab setup as:

What is it that I am missing here?

Thanks in advance.

Hello all,

I have been trying to run allocations, but it displays the following error:

I have my project Transaction of the type AP created, have my revenue budget tab setup as:

What is it that I am missing here?

Thanks in advance.

Best answer by Heidi Dempsey

Enter your E-mail address. We'll send you an e-mail with instructions to reset your password.