We noticed that many of our vendors were not designated 1099 vendors in the year 2023. If I desigante them NOW will it still show them on the reports for the 1099 tax year 2023? I added someone so they would populate but they’re not showing up on our efile. Help!

Hello,

After marking vendors to check 1099 Box ON, update all the 1099-appropriate lines of all 2023 paid bills and all open bills for this vendor, to add 1099 box numbers. Then reprint 1099 reports.

Laura

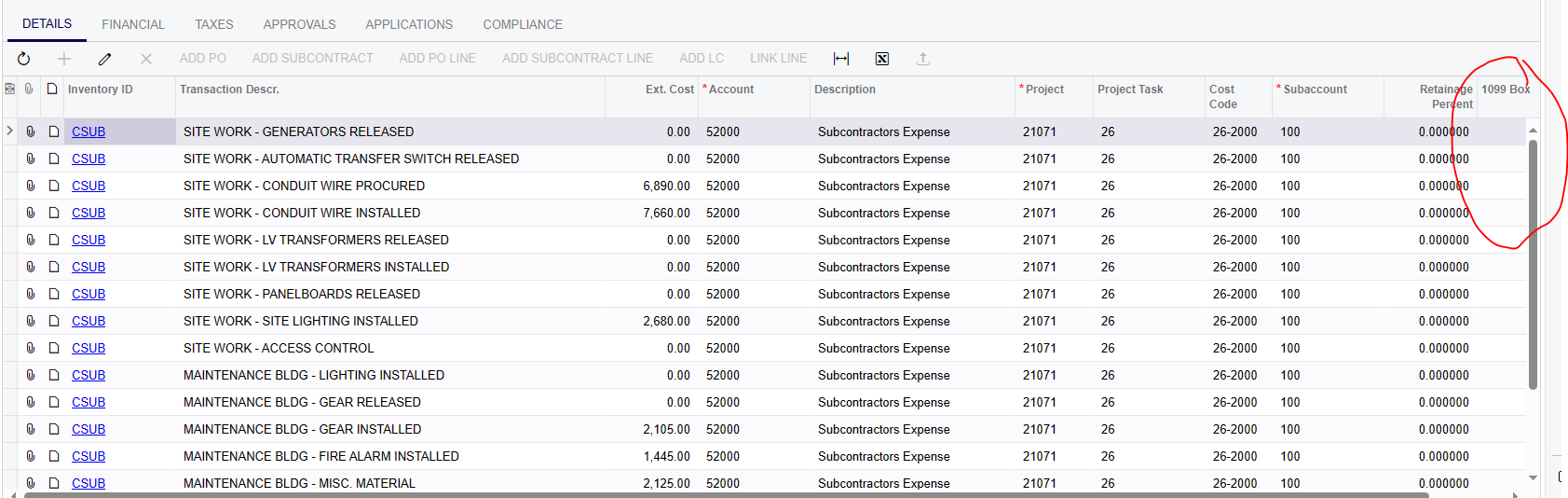

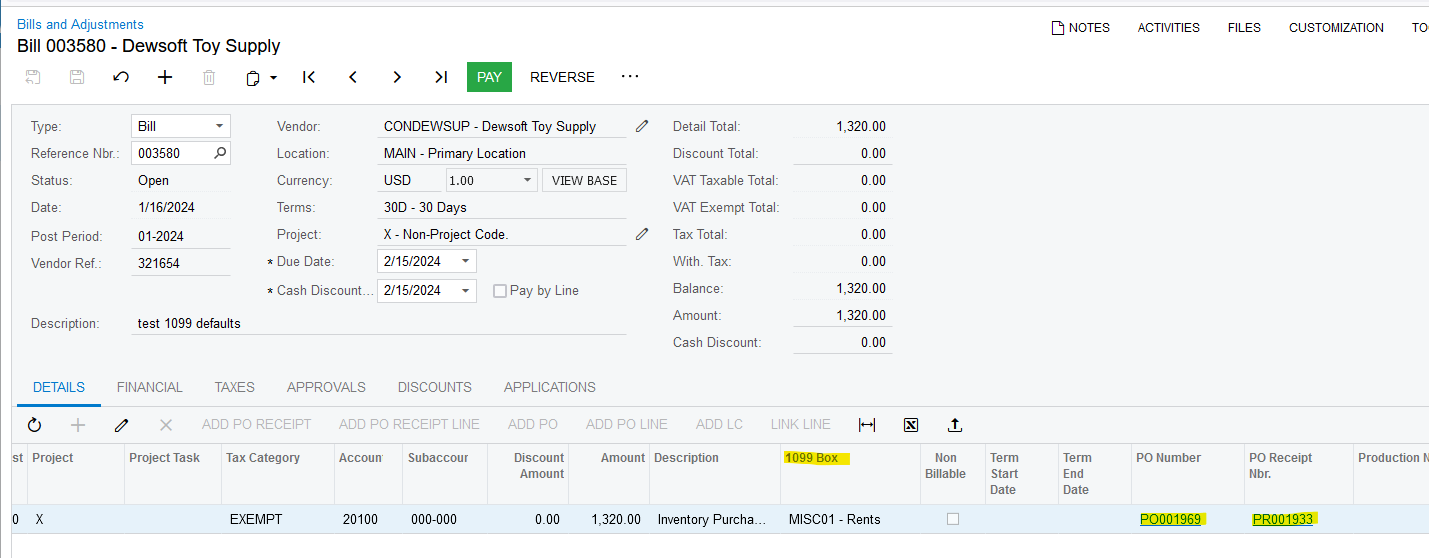

This means to update the 109 box on each detail line of each bill for each 1099 vendor as shown below

Hello,

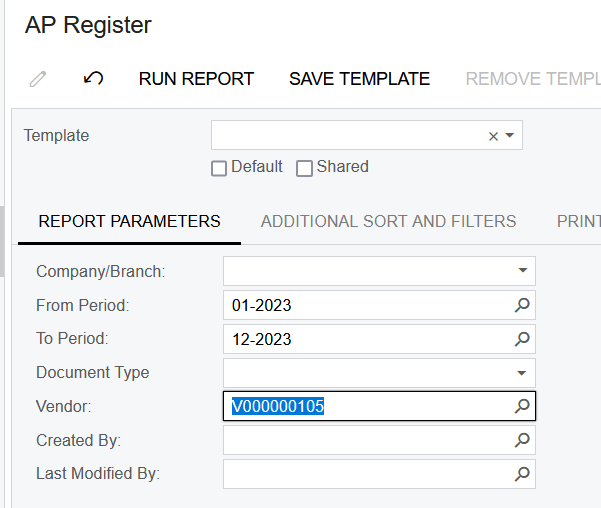

To identify 2023 Bills for a vendor, try AP Register report:

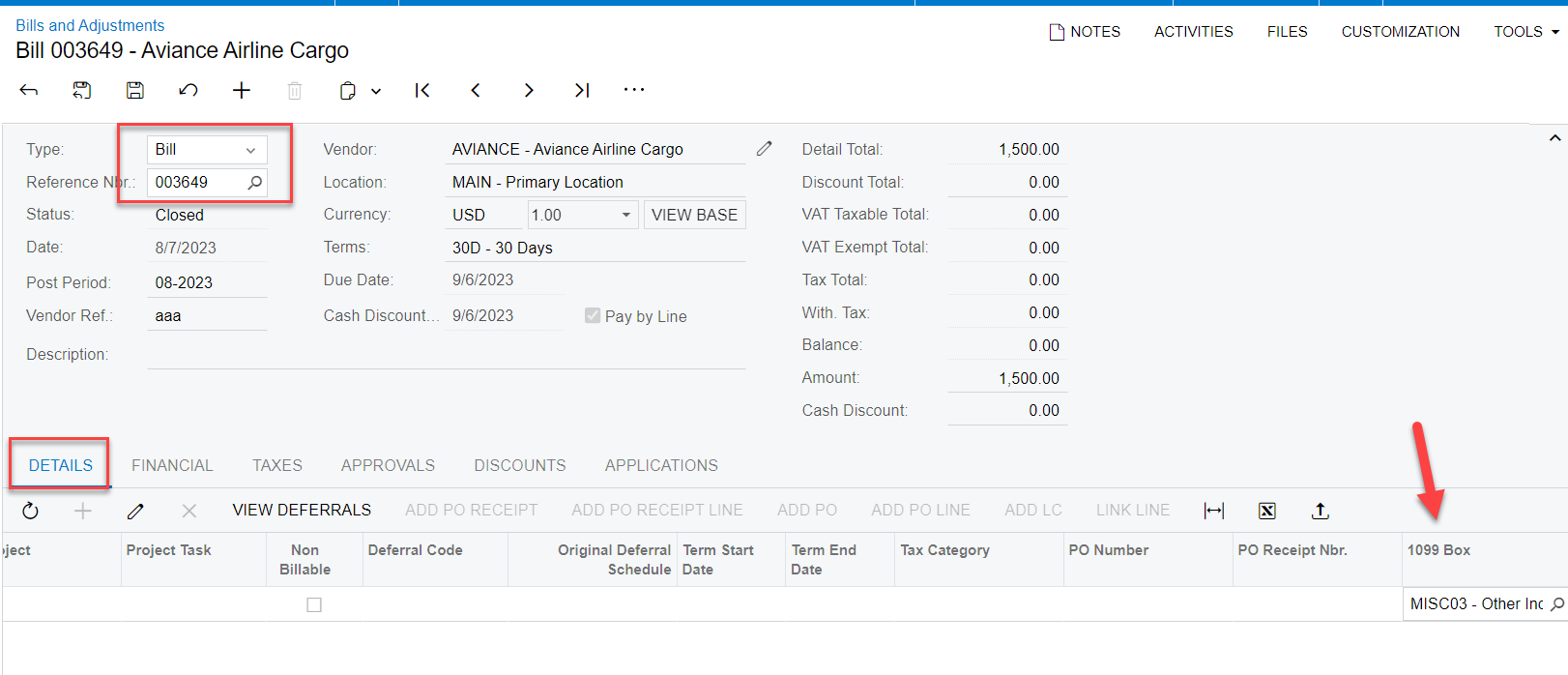

To update the Bills/Debit Adjustments/Credit Adjustments, open each Bill/Debit Adjustment/Credit Adjustment by clicking on the Reference Numbers in the above report and type in the correct box number on the bill lines. Save changes.

Laura

https://help.acumatica.com/(W(4))/Help?ScreenId=ShowWiki&pageid=6815d69c-8e42-46fc-8776-cce10dccad04

Hello,

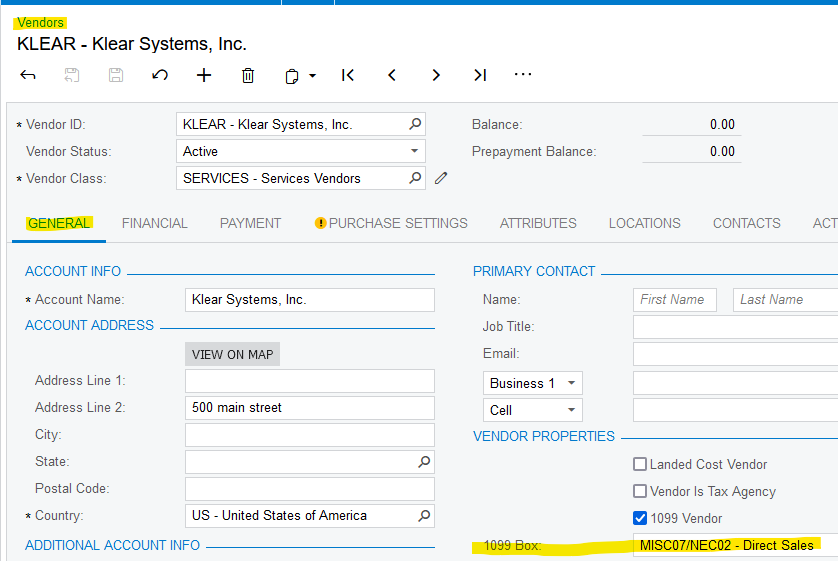

I have one more recommendation: DO return to your 1099 vendors and provide a Default Box # for each. When Default 1099 Box # is populated on all 1099 vendors, the process of correcting Bills in January is avoided.

#Laura02 - We have this setup for all the 1099 vendors, but it doesn’t seem to auto populate when invoices are created through a PO.

Thanks

Jeremy

Hi

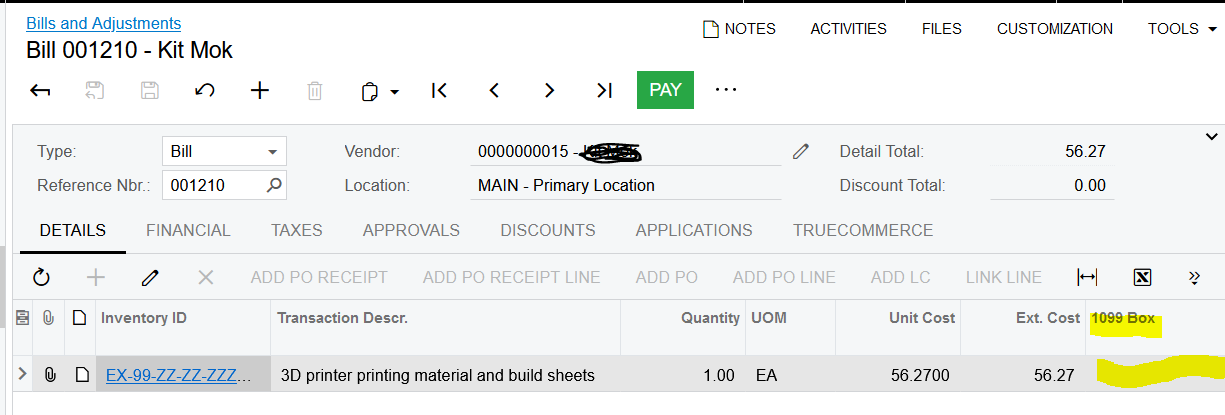

I did a quick test for you: in Sales Demo version 2022 R2, an AP Bill created directly from a PO Receipt does default the 1099 box number from the vendor:

If your 1099 box does not default from the vendor with customizations temporarily unpublished, then open a support ticket with Acumatica/your VAR.

Laura

Reply

Enter your E-mail address. We'll send you an e-mail with instructions to reset your password.