Hi,

What is the option available to roll-back/reverse depreciation for a specific fixed assets or a class of assets.

Thanks,

Dulanjana

Best answer by Laura02

View originalHi,

What is the option available to roll-back/reverse depreciation for a specific fixed assets or a class of assets.

Thanks,

Dulanjana

Best answer by Laura02

View originalHi

Thank you, But my issue is related to just reversing depreciation. Not reverse the purchase transaction. I couldn’t find a solution there.

Thanks,

Dulanjana

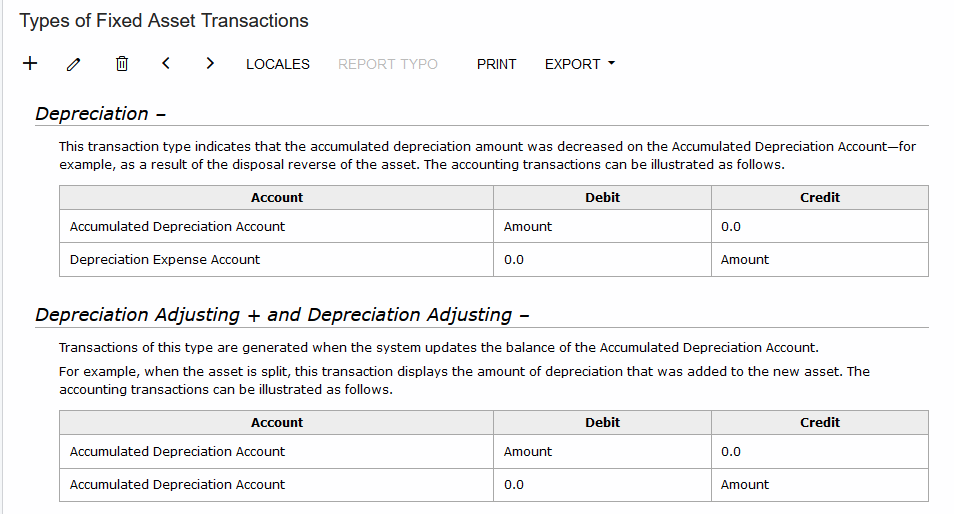

Hello, you can adjust depreciation with a Fixed Asset Transaction.

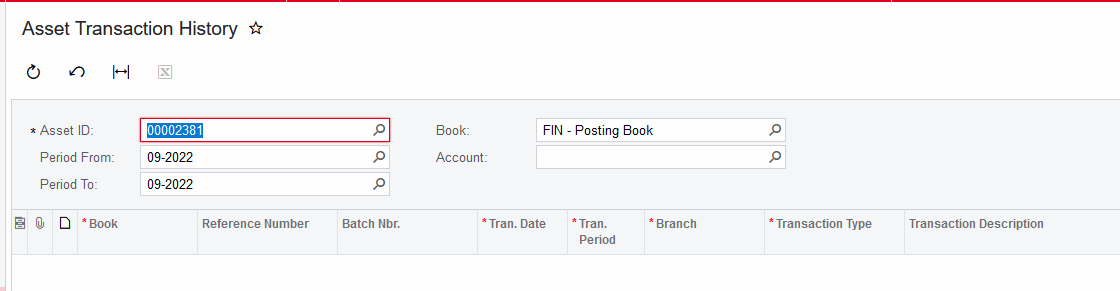

If you have a group of assets to adjust, use Asset Transaction History inquiry to isolate and export the depreciation to be reversed.

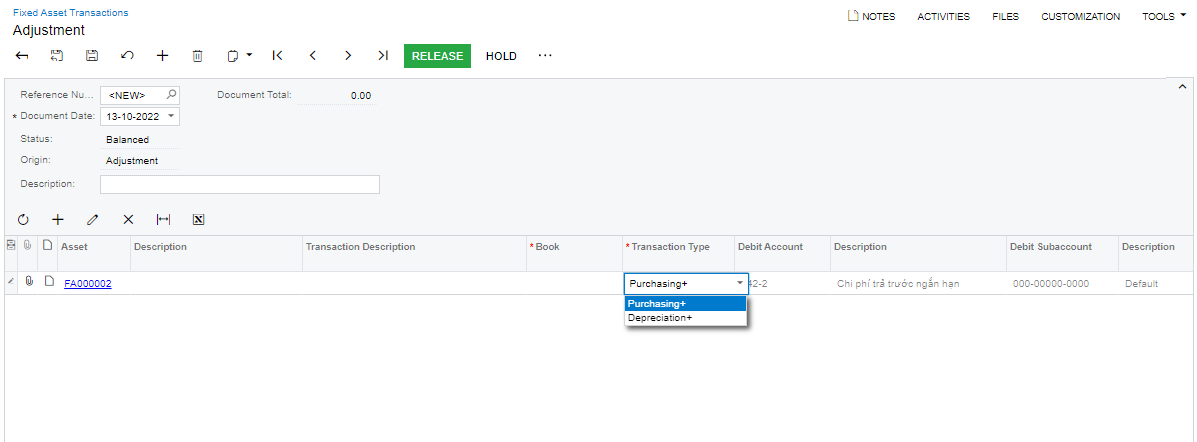

Next, import the reversing transactions using Depreciation - transaction type in Fixed Assets Transactions screen.

It is always a good idea to test your correction in your Training environment to make sure you see the desired results, then repeat the same correction in Live/Production environment.

Hi

Thank you for your support.

Thanks,

Dulanjana

Hi

I can not see the type “Depreciation -” in the Fixed Asset Transactions screen.

Do you know why? Thanks

Hello,

What are you trying to do? Reverse & correct depreciation? Try “Reverse” action from the (...) Actions menu in the Fixed Asses profile screen. This action creates a reversal of the purchase, reconciliation, and prior depreciation, so that you may correct whatever setting caused incorrect depreciation calculations: the asset life, purchase amounts, and/or depreciation methods. Then depreciate again.

Hello,

What are you trying to do? Reverse & correct depreciation? Try “Reverse” action from the (...) Actions menu in the Fixed Asses profile screen. This action creates a reversal of the purchase, reconciliation, and prior depreciation, so that you may correct whatever setting caused incorrect depreciation calculations: the asset life, purchase amounts, and/or depreciation methods. Then depreciate again.

HI

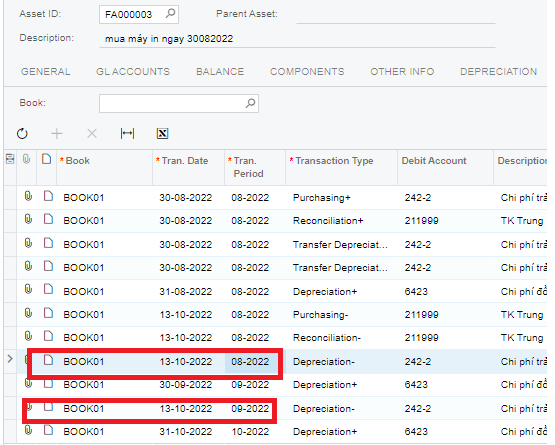

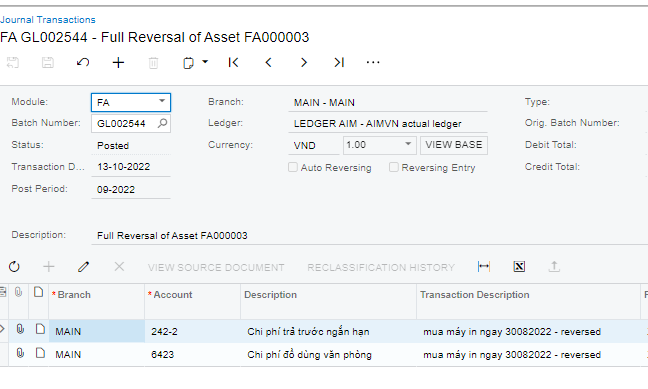

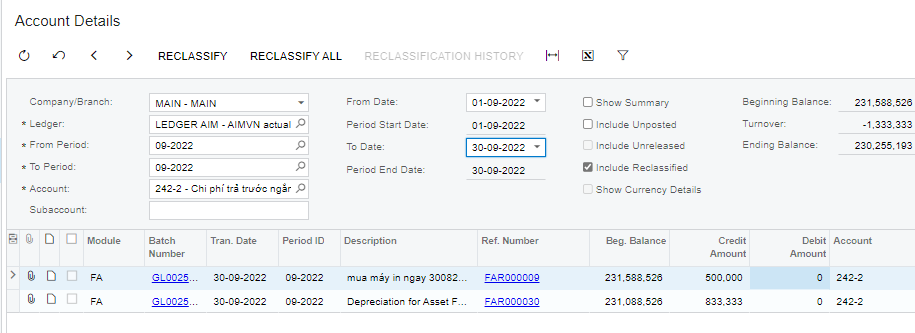

I check the batch number, it has the same problem. I wonder what will be impacted on that.

Do you have any ideas on that?

Thanks

Hello,

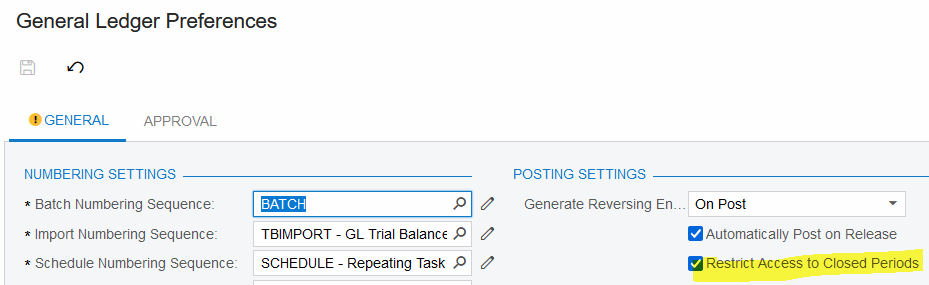

Some companies allow posting of corrections to prior periods, some do not.

If the closed periods were updated and you don’t want closed periods to be updated, you can correct in GL. Then update GL Preferences. When Restrict Access is checked ON as shown below, only people in the Financial Supervisors role can post to closed periods.

Hello,

Some companies allow posting of corrections to prior periods, some do not.

If the closed periods were updated and you don’t want closed periods to be updated, you can correct in GL. Then update GL Preferences. When Restrict Access is checked ON as shown below, only people in the Financial Supervisors role can post to closed periods.

HI

But I wonder why the system generate the reverse transaction date diff with the reverse transaction period. When I export report with the condition include tran.period & tran.date, it’s doesn’t show the reverse because it does not meet both condition.

The period of the reverse is correct & what I expect is the trans.date of the reversion should be same with the original date.

Hello,

This is a question for Acumatica. I don’t know why the original date of the depreciation that is being reversed was not used in the reversal. In my test and your experience, FA Reverse transactions used the date we created the transaction.

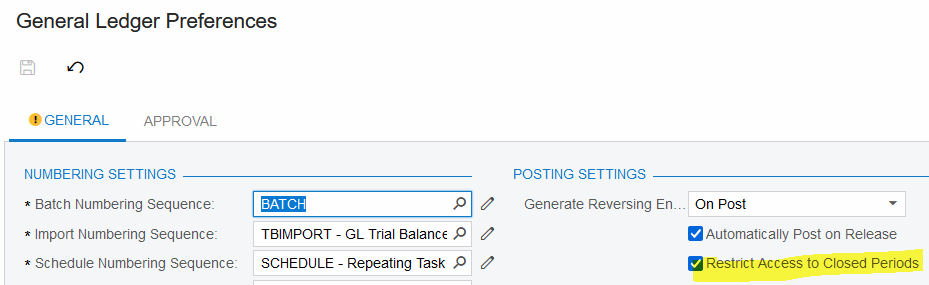

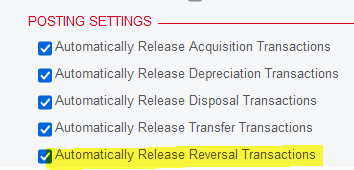

In my test company, Restrict Access to Closed Periods was checked ON in GL Preferences, and all of my reversals posted to the same day AND to the same period even though the depreciation happened over several months. There was no warning, there was no “Are you sure?” upon clicking Reverse, there was no pop-up asking our preferences on how the reversal is posted.

I don’t see choices in FA Preferences, for what date and period should be used on reversals. In my test the reversal batch released and posted itself… due to one setting in FA Preferences (below).

Maybe you can post your Ideas of how the Correction/Reversal should work, in the Ideas section of this community.

Hello,

This is a question for Acumatica. I don’t know why the original date of the depreciation that is being reversed was not used in the reversal. In my test and your experience, FA Reverse transactions used the date we created the transaction.

In my test company, Restrict Access to Closed Periods was checked ON in GL Preferences, and all of my reversals posted to the same day AND to the same period even though the depreciation happened over several months. There was no warning, there was no “Are you sure?” upon clicking Reverse, there was no pop-up asking our preferences on how the reversal is posted.

I don’t see choices in FA Preferences, for what date and period should be used on reversals. In my test the reversal batch released and posted itself… due to one setting in FA Preferences (below).

Maybe you can post your Ideas of how the Correction/Reversal should work, in the Ideas section of this community.

Thanks

Enter your E-mail address. We'll send you an e-mail with instructions to reset your password.