According to Avalara's documentation, all ERPs must have an option to disable document recording so that, when an invoice is released, it doesn't get added as a transaction in Avalara. Does anyone know how to engage this feature in Acumatica?

Background:

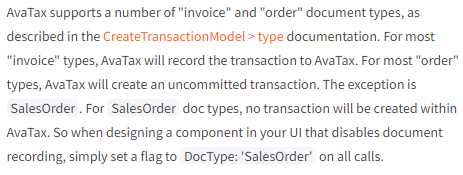

I’m importing orders from my online store which is integrated with Avalara. Some orders are paid for in the store and some are invoiced for in Acumatica, so it simplifies things to let the store record the document in Avalara. When I import the orders, I need the sales tax to match what was charged. The best solution to this I can think of is to have Avalara just do another calculation for imported orders but to not create a transaction in Avalara at the invoicing stage as that would duplicate our tax liability.

I also tried creating a tax zone that allows for tax to be added manually. There are 2 issues I’ve run into here:

- The taxes on the SO don’t carry over to the invoice.

- While I can enter the tax into the document and save, it doesn’t seem to work to update the tax amount on the SO with an import scenario.