Hi Everyone,

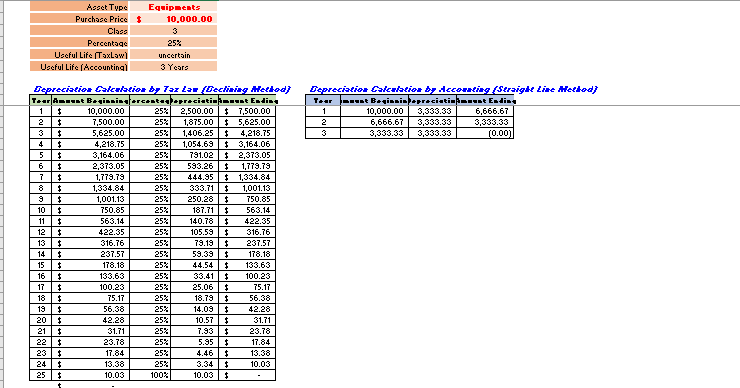

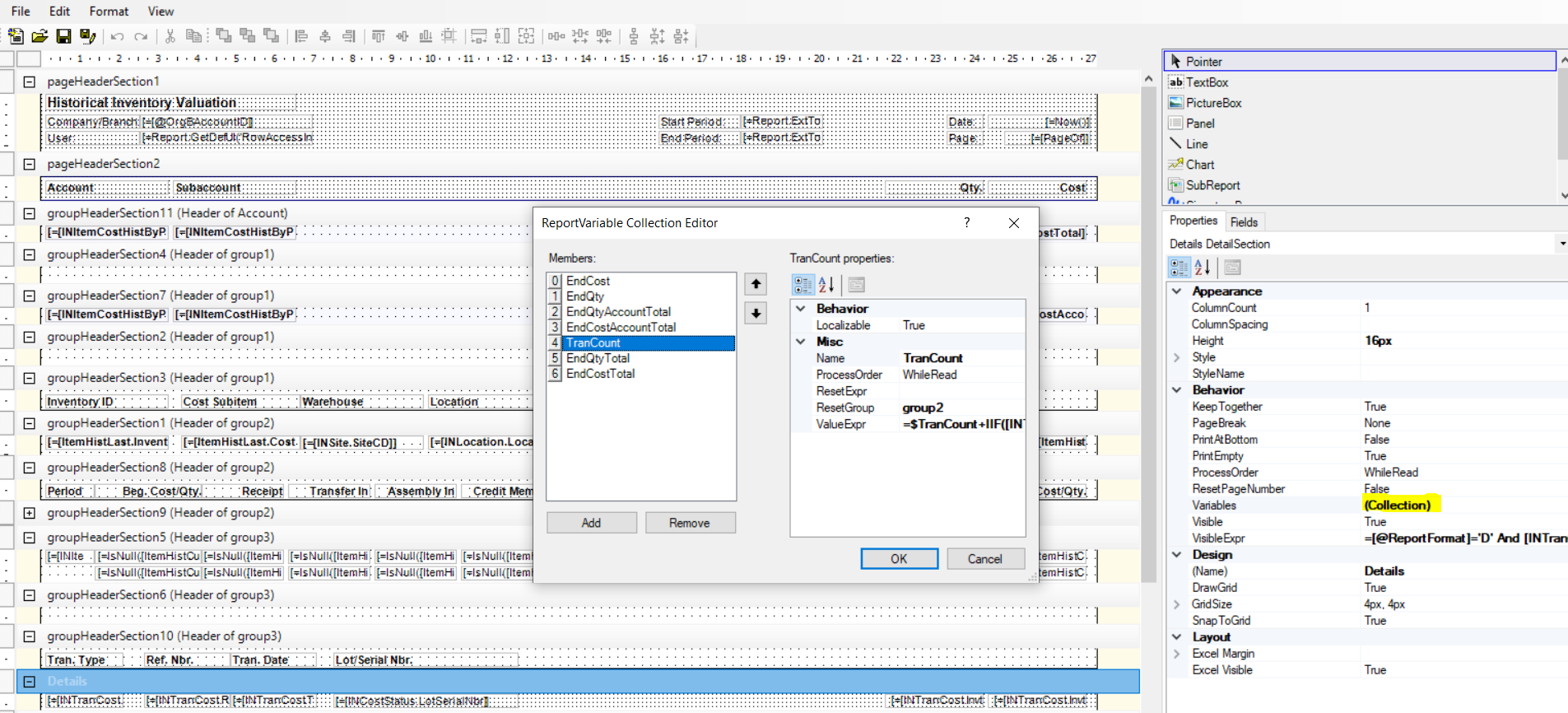

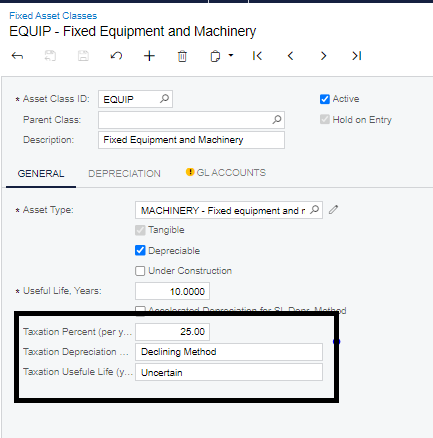

Is it possible to create this scenario in Report Designer? Upon reading some articles creating a running balance in GI is not possible. Where in the Depreciation stop if it identifies a certain value?

What reports can I adjust or revise if ever.