Hi,

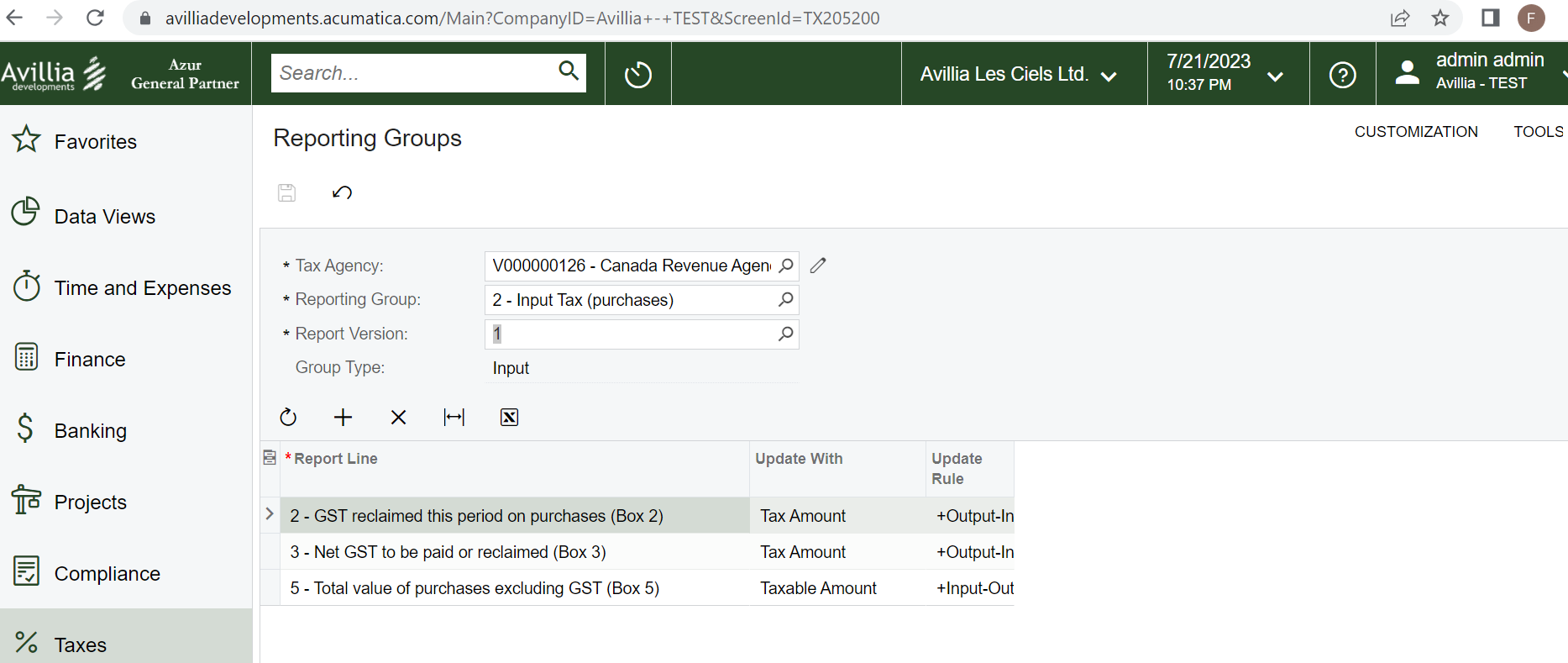

I have a client who needs to report GST in Canada on the Sales and Purchases side. However, they have multiple AP or AR line items under one invoice that could include GST and Non-GST items. I am having issues how to reflect both GST and Non-GST amounts on the Tax Details or Tax Summary reports under % Taxes in Acumatica. Here is an example of the Reporting Group I have setup on the Purchases (AP) side.

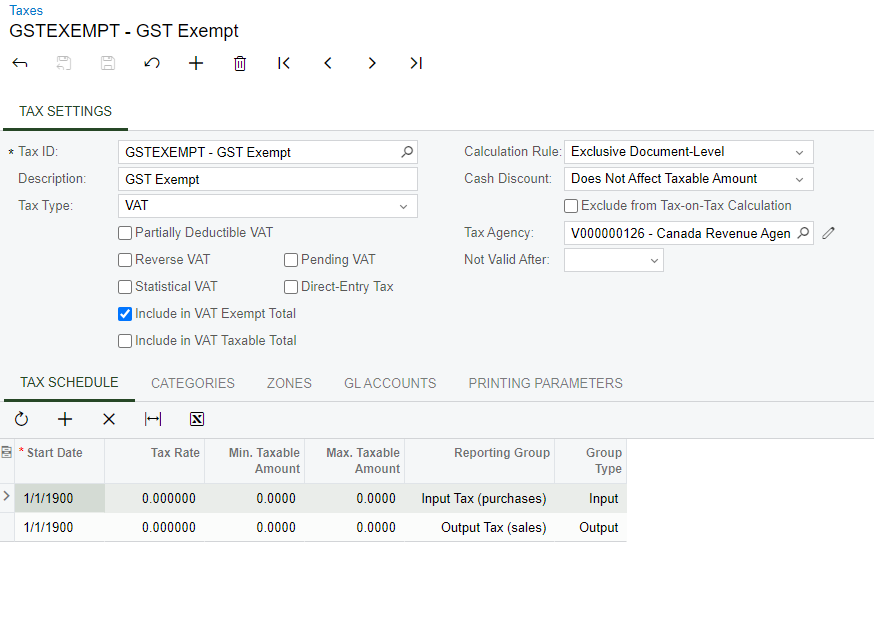

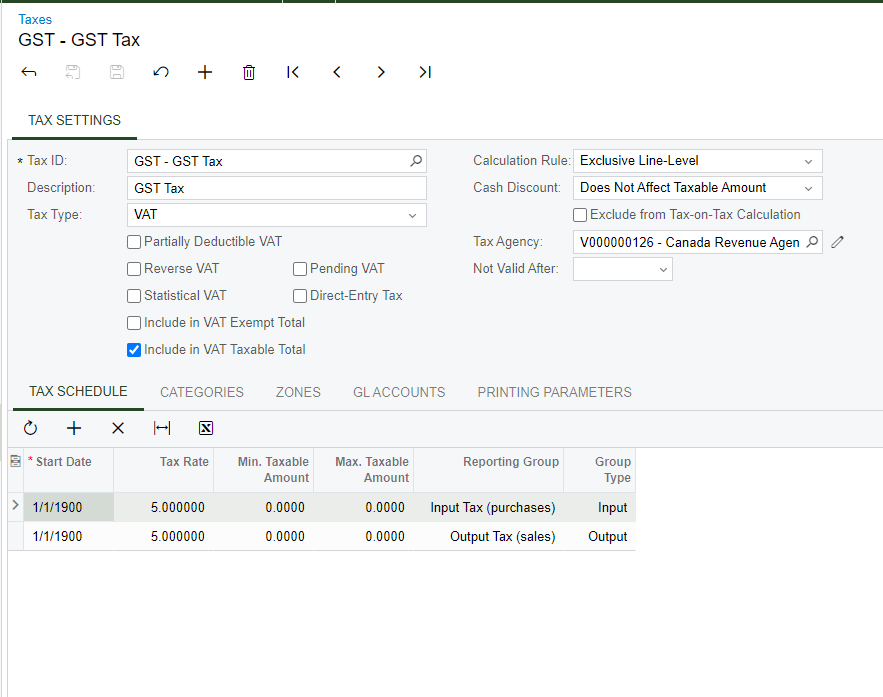

I have also created two separate tax zones for GST and GST Exempt here are print screen of those:

What am I doing wrong? Any help would be great.

Thanks,

Frances

Best answer by naeem

View original