Here’s the scenario that I cannot figure out:

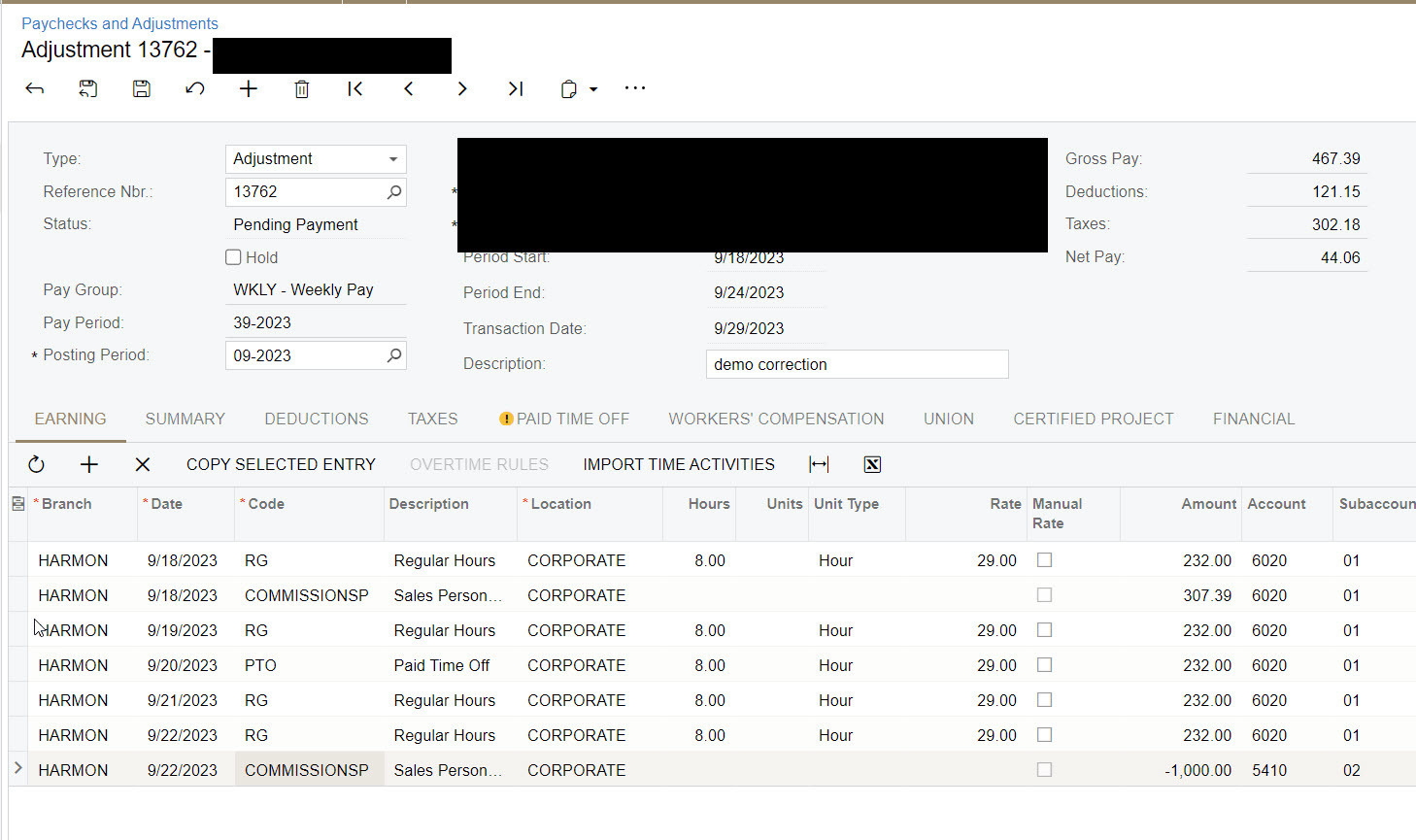

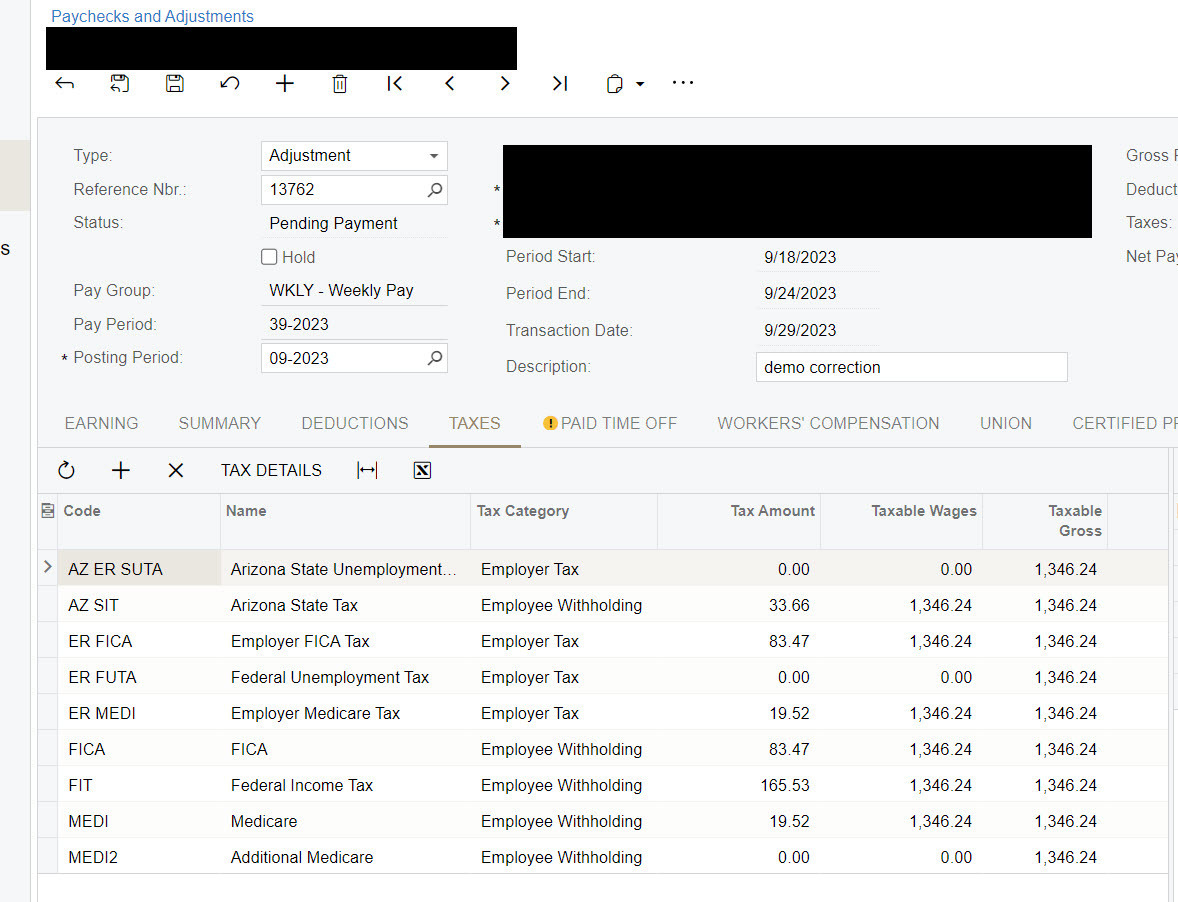

Employee 1 paid commissions of $1000 in each June, July, and Aug (total $3000 in commissions over 3 months). In Sept we realize that June was overpaid commission by $300. We can enter a negative $300 amount on the next payroll using Payroll Adjustment but cannot figure out how to get the taxes (employee and employer) back. Essentially he paid taxes on the $300 back in June and if we’re taking the $300 away from him we need to give him back the taxes paid on that $300.

There are also employer paid taxes that we need to get figured out but most importantly we need to get the employee the taxes paid back since we’re taking that $300 away.

Any suggestions are greatly appreciated!