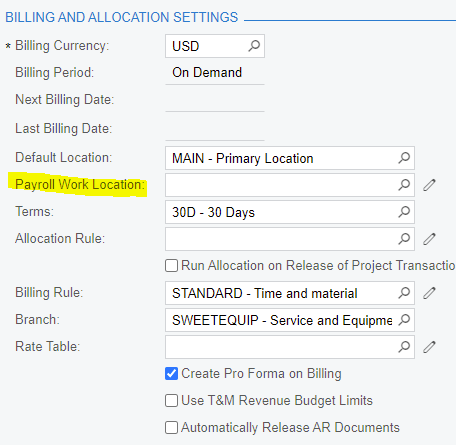

We have several projects in different states, other than our own that our technicians are working. How do we process a paycheck to withhold from the state they are performing the work for those hours, in addition to the hours working at our home base.

If an employee lives in Texas, but is working in Arkansas for a week, will the project allow for his time to be charged to the state where the withholding will need to occur (Arkansas)?

Best answer by mbertram21

View original