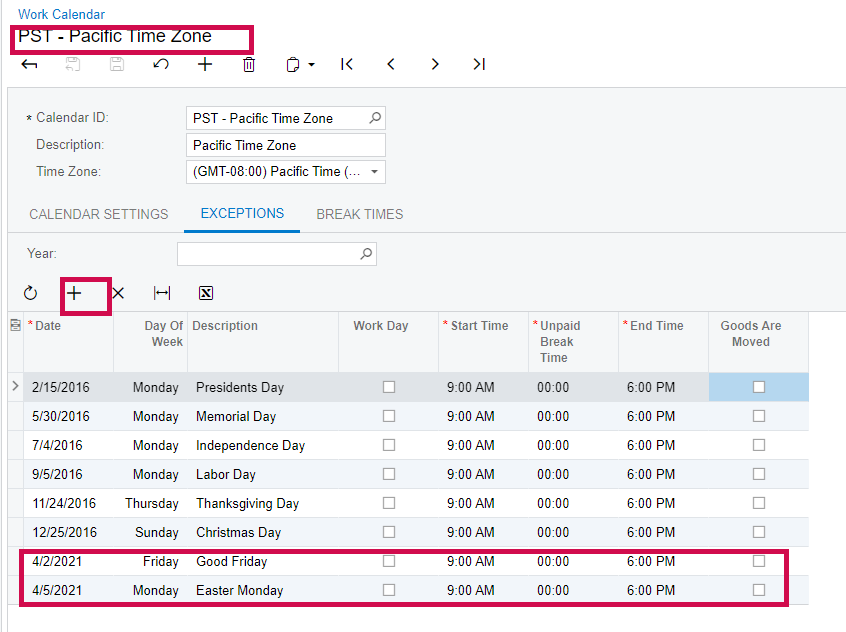

What is the best practice to pay employees for a holiday that was not setup in the work calendar Exceptions? At the time of setup, the customer missed informing us that Easter is a paid holiday. It wasn’t setup therefore we now need to get this holiday paid to the employees. We are thinking about using Paychecks and Adjustments entry with check type = Special. Can you confirm best practice?

Also, since Easter holiday and some others float around to different dates, is it understood that we should adjust the Work Calendar Exceptions list at the beginning of a new year for the upcoming years’ proper holiday dates?

Thank you much!

Amy

Best answer by Denise Johnson

View original