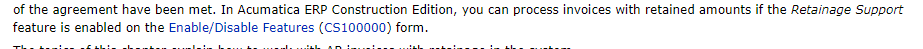

We have setup tax and it is calculating correctly in the purchase order and the bill.

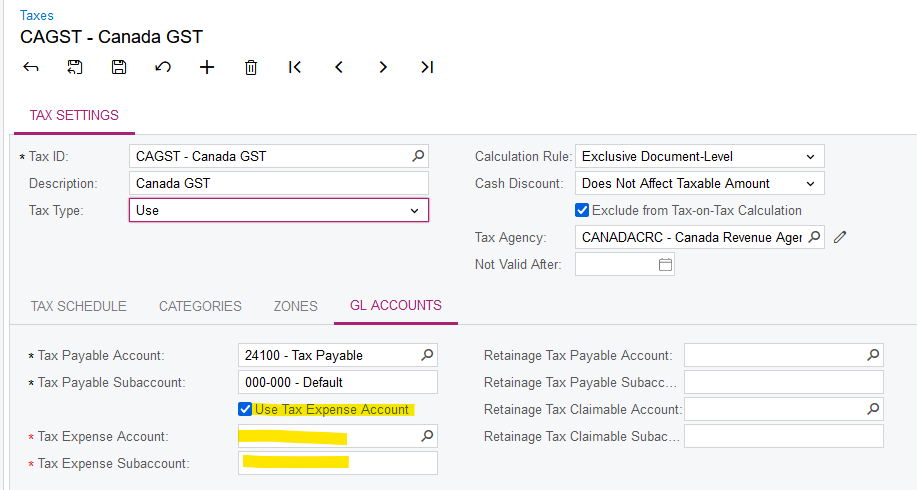

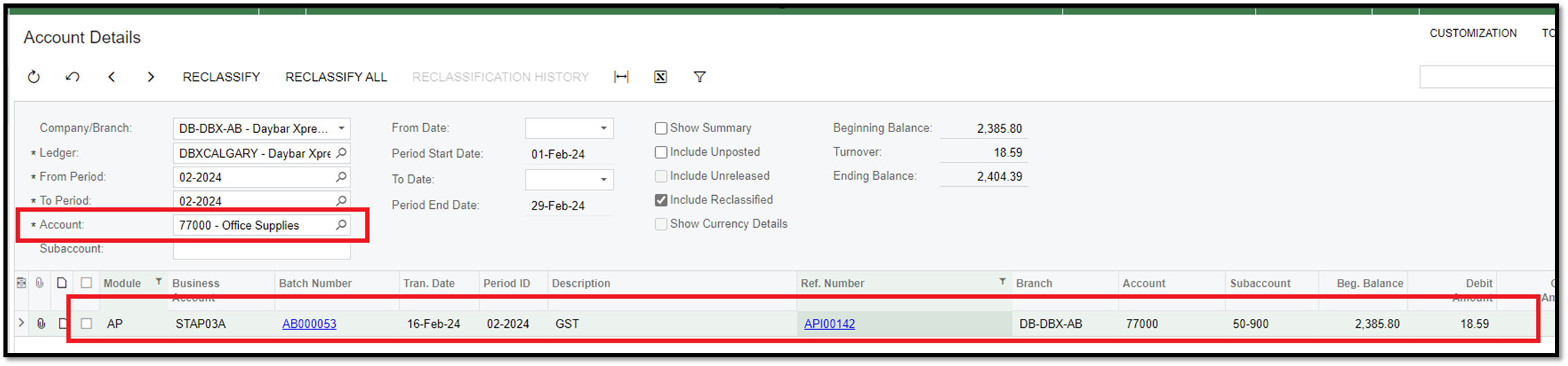

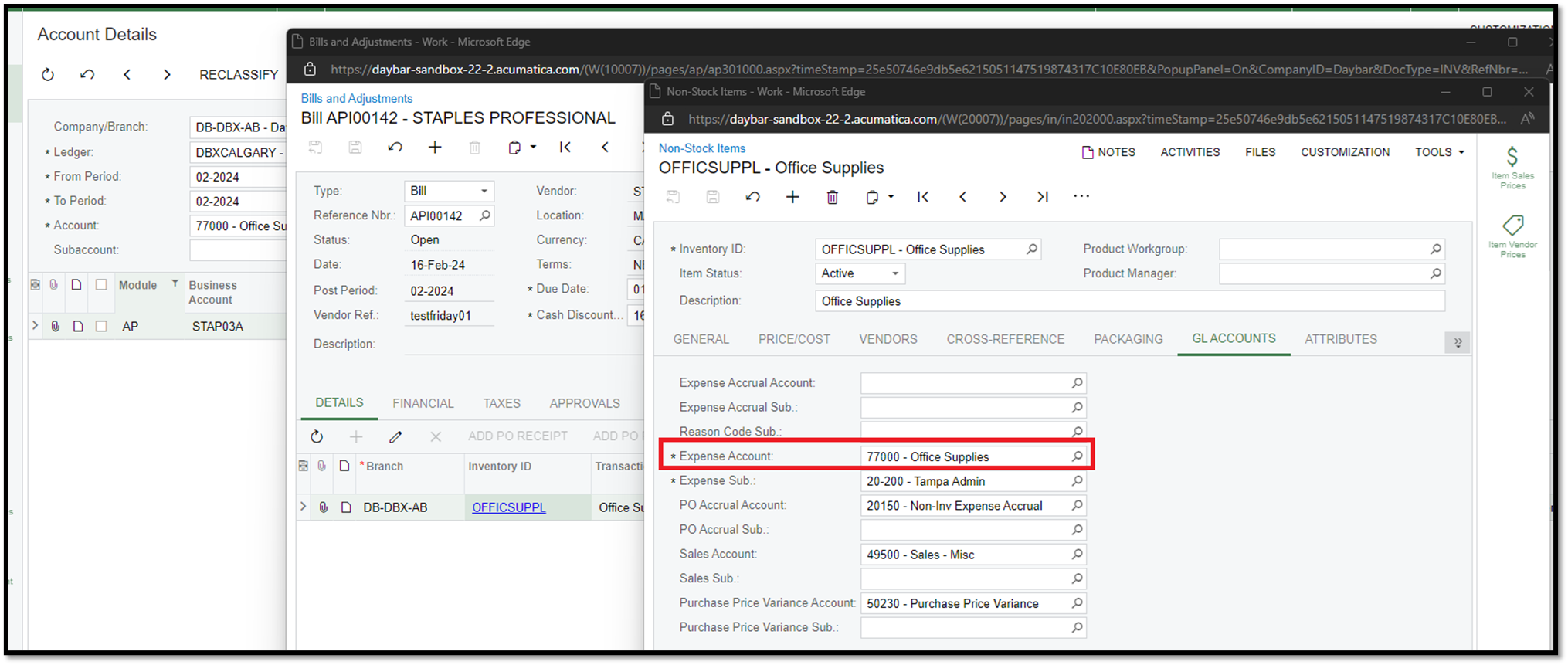

However, rather than going to the 23000 account, the tax is going to the inventory expense account

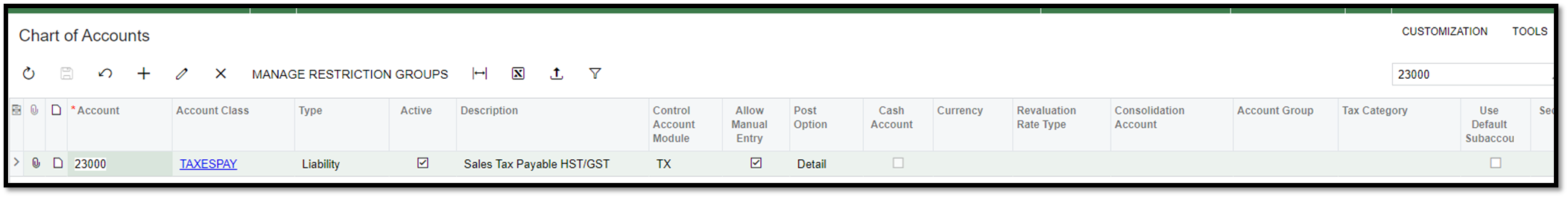

The account 23000 is designated for taxes.

We are unsure whether we missed any setup since this is working fine in AR, but not in AP where the tax entry is not being entered.