Hello,

We are having a scenario and I would like to know what is the best way to log them in system. Here is the scenario and what we are doing now:

Both “Costco” and “CITI bank” are vendors in our system.

We purchase some items from “Costco” using credit card. And in order to track inventory, we created a PO from Costco and received the items and generated the bill to Costco. We call bill 1 .

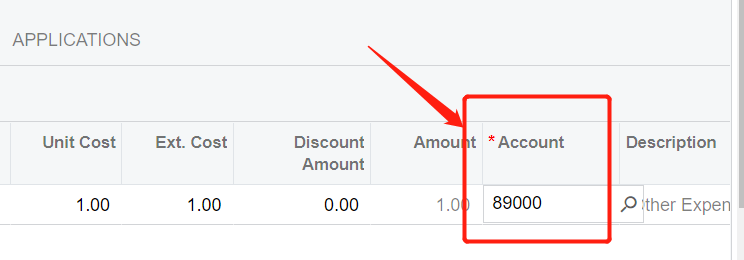

And also monthly, we get a bill from “CITI bank” including the total amount used in Costco and other amounts(means not the same with bill 1), like fuel, gas (not inventory item, so no POs). In order to log the payment, we also create a bill to “CITI Bank”. We call bill 2.

Now you see, on bill 1 and bill 2 we are actually having same item. so we don’t have to pay twice. And also we don’t have to double our liabilities.

Can anyone give me some directions to deal with this scenario in a best way.