I’d like to delete a released bill, how can I manage it?

Right now I could only see the “reverse” button, and when I clicked it the system just created a debit adjustment. I want to delete both of them. Please teach me how. Thanks in advance!

I’d like to delete a released bill, how can I manage it?

Right now I could only see the “reverse” button, and when I clicked it the system just created a debit adjustment. I want to delete both of them. Please teach me how. Thanks in advance!

Best answer by vkumar

Hi

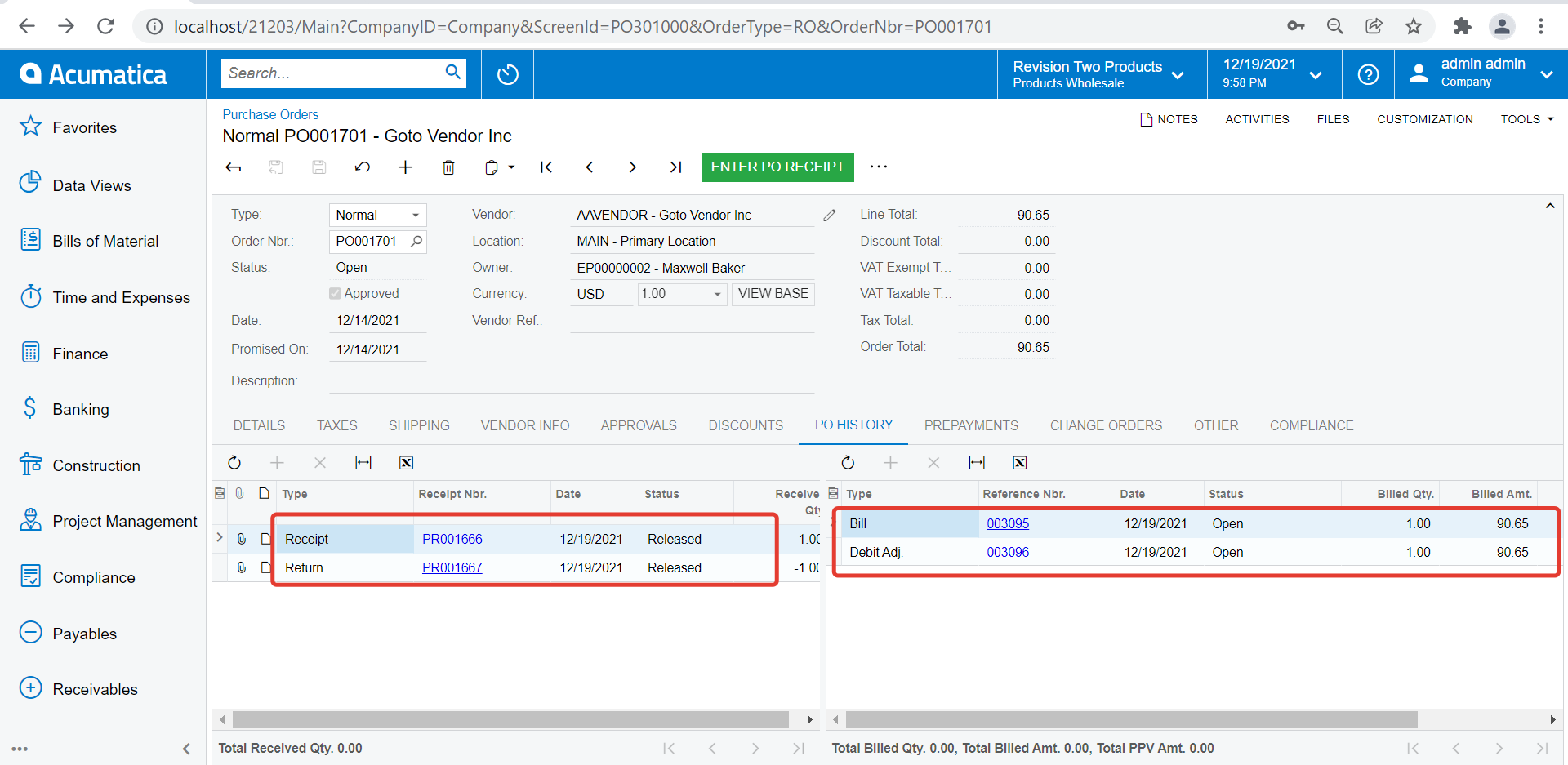

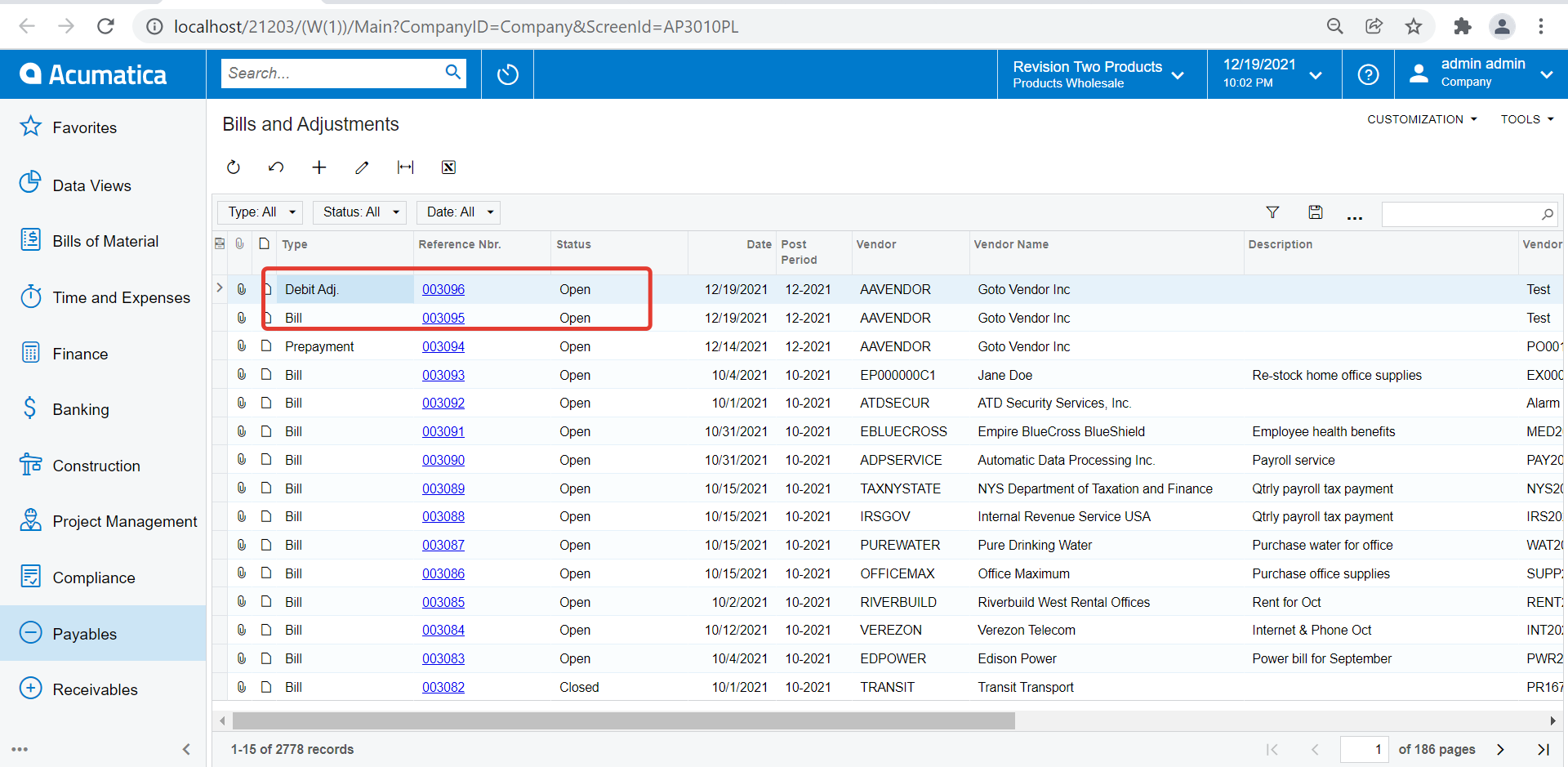

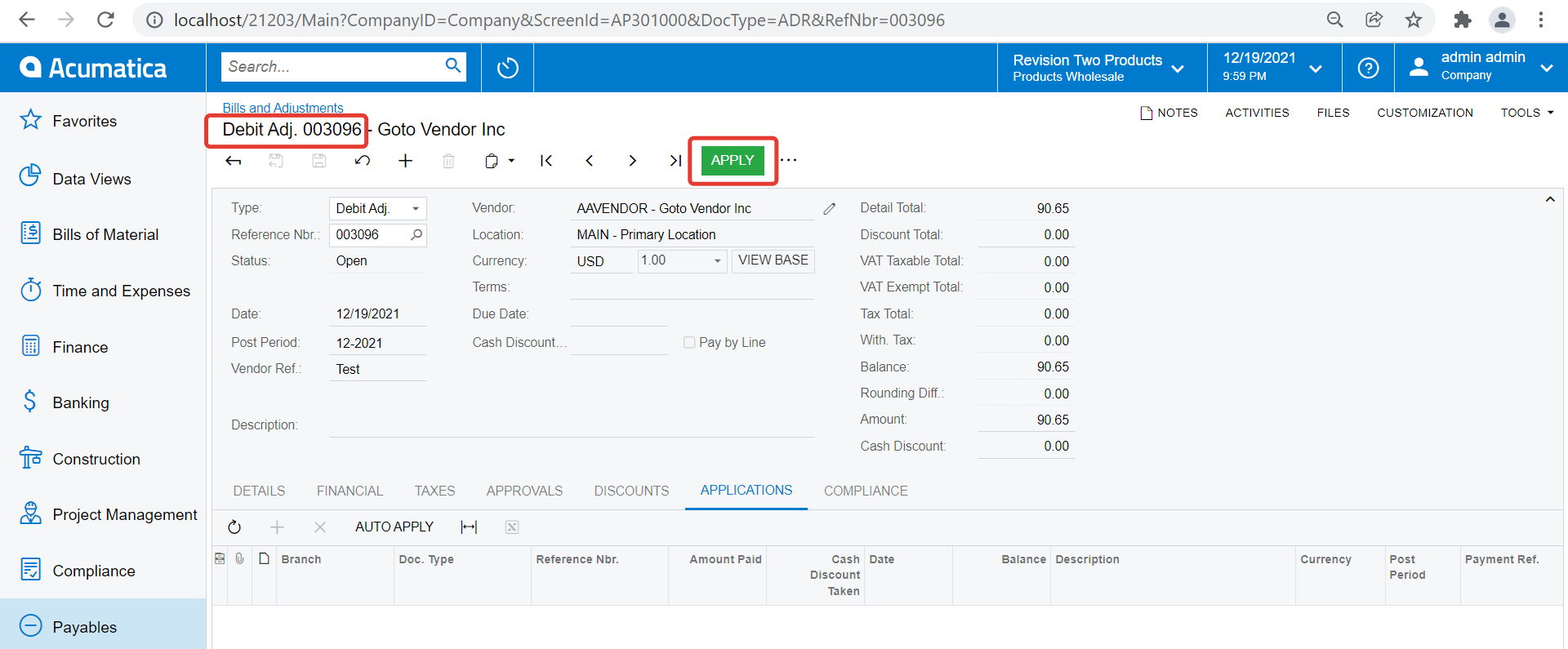

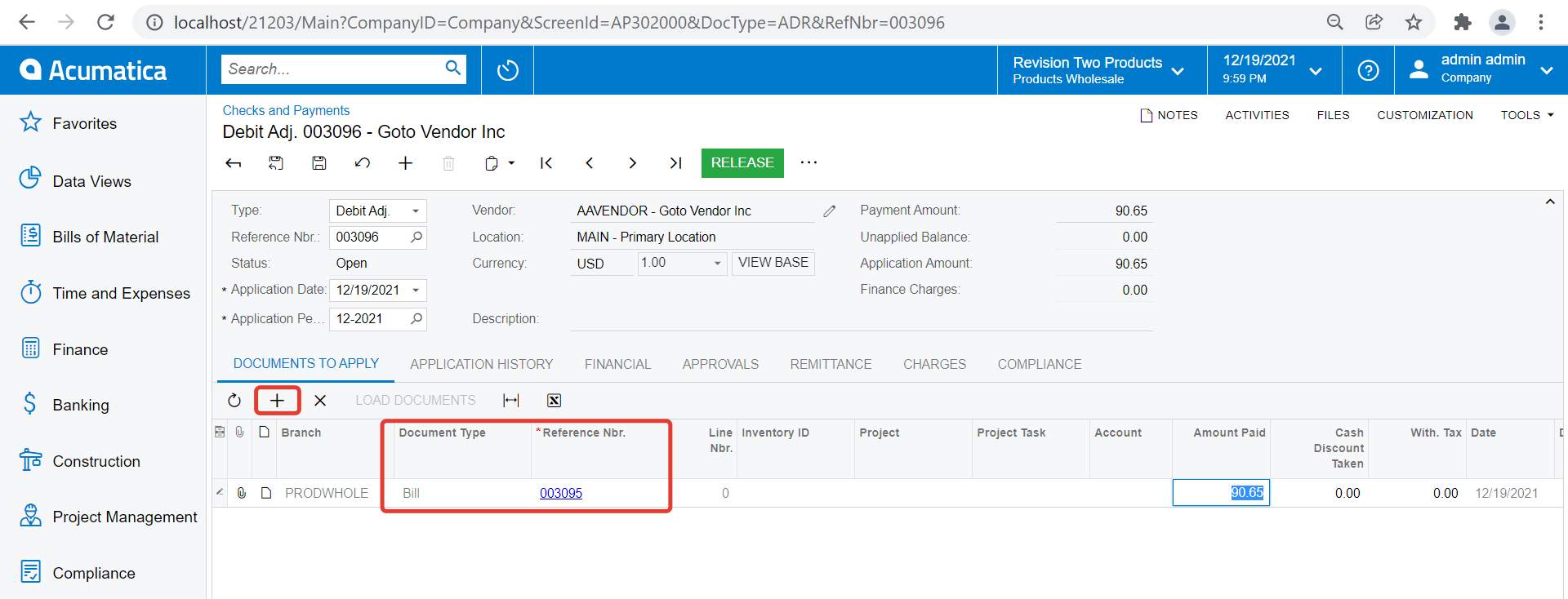

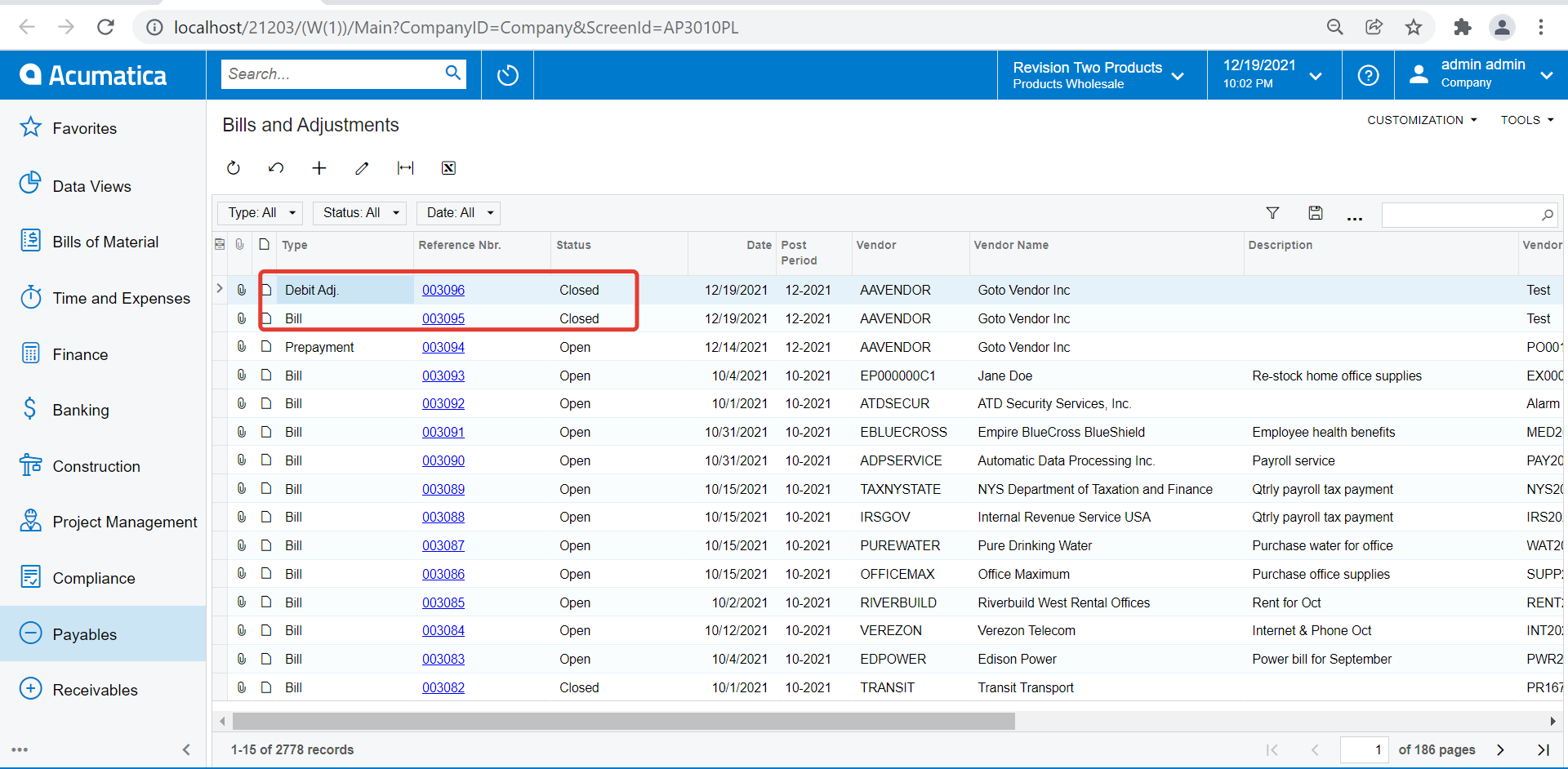

Here is an example.

PO with PO receipt, PO return, AP bill and Debit adjustment documents.

On Release of above document, note the AP bill and Debit adjustment status changes from ‘Open’ to ‘Closed’

Hope this clarifies. Let me know if you have further questions.

Regards,

Enter your E-mail address. We'll send you an e-mail with instructions to reset your password.