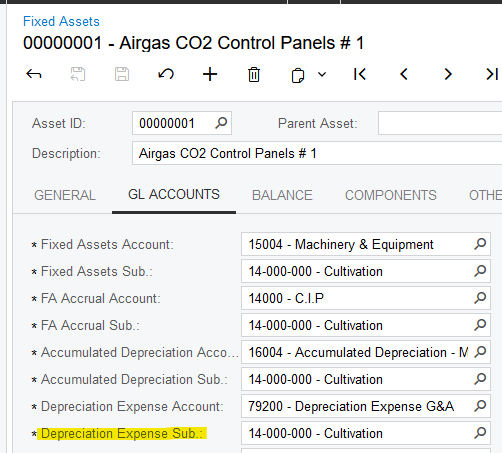

Hi, I have a customer that wants to expense depreciation to multiple subaccounts when depreciation is calculated and released. The only way I know how to do this is by creating an allocation in the financial module to allocate the expenses to the correct subaccounts.

Has anyone else know of another way to allocate the expenses to the proper subaccounts, the customer is not on board with the allocation method.

Thanks,

Coleen