In Acumatica if no tax zone is specified for the customer location, the customer tax zone is the tax zone assigned to the selling branch.

You can override the default value.

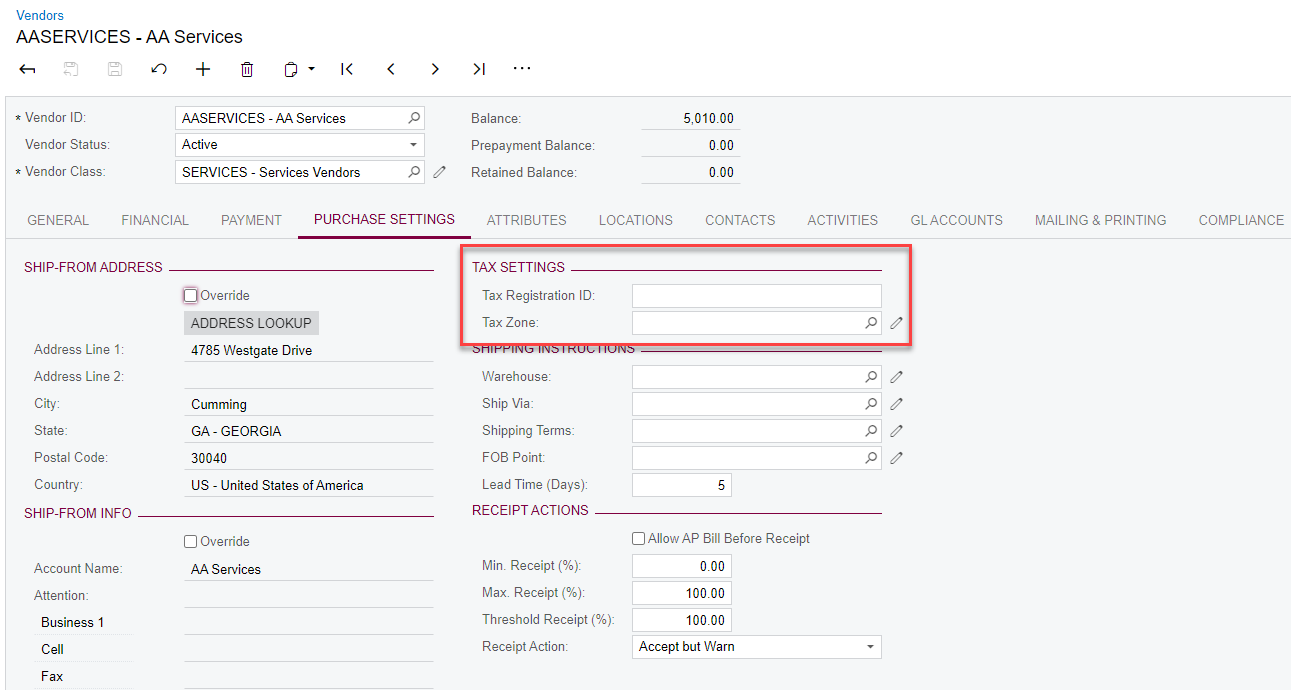

Is this same functionality available with Vendors? In my research I find that the Vendor location specify the tax Zone. The Tax Zone will be incorrect if you do not specify the Location and use a global Vendor across multiple companies.

Retha van Alphen