New user here (and new to the company) -- the CPA entered opening Trial Balance balances into Acumatica for the cash accounts as of 1/31/2023. However, we did not “go live” with Acumatica until 10/1/2023 - still used QB. How do I adjust those opening TB balances now? No bank reconciliations have been completed to date.

Adjusting Opening Balances in Cash Accounts

Best answer by Laura03

Hello

It seems like you have two questions:

- How to import previous year GL Trial Balances for months that were skipped, and

- How to perform the first bank reconciliation statement in Acumatica.

Correct?

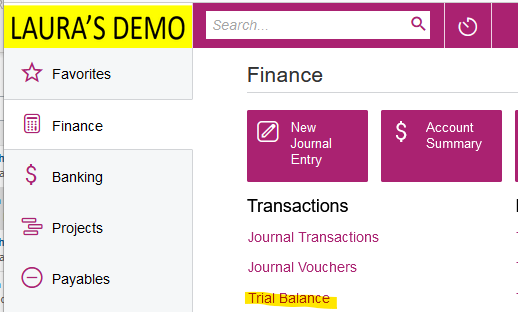

If you’d like to load GL Trial Balances for 02-2023 through 08-2023, Finance → Trial Balance screen.

When importing Trial Balances in the above screen, you’ll need an Excel sheet containing Account, Subaccount, and YTD Balance (with debits represented as positive numbers and credits represented as negative numbers so that YTD Balance column sums to $0).

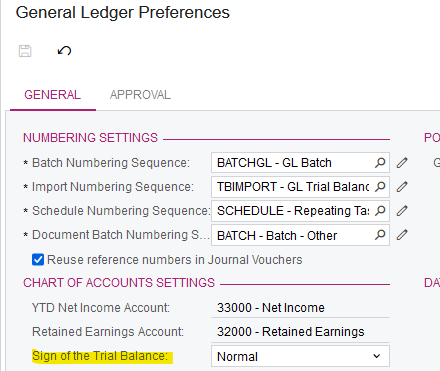

In GL Preferences, temporarily set the Sign of the Trial Balance to reversed, load your months in chronological sequence, then set the Sign of the Trial Balance back to Normal.

For what period are you planning the first bank reconciliation statement? If you are planning the first bank reconciliation statement in Acumatica for 10/31/2023, for example, it’s not a requirement to load all the older general ledger trial balances, in order to balance cash to the bank as long as 9/30/2023 Trial Balance has been loaded.

Reconciling cash instructions are attached.

Laura

Enter your E-mail address. We'll send you an e-mail with instructions to reset your password.