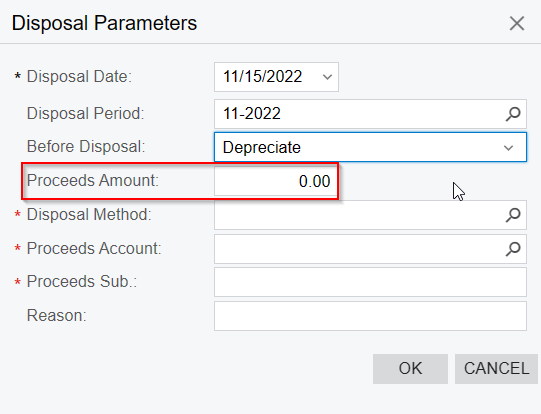

Hi Family, I would like to ask, how do I dispose of an asset of vehicle type that has been written off and the period I want to dispose in was 11-2022? The vehicle received some funds from the insurance, more than what the car is worth now.

I would like to ask what figures goes to the Proceeds amount field as the current cost of the asset has changed. Thank you in advance.

Best answer by Laura02

View original