Our company is changing from individual meal expenses to a Per Diem scenario. The concept is that, as an employee submits a hotel receipt to confirm an out of town stay, they can then enter a Per Diem expense for each night of stay. The Per Diem would be a set price (e.g. $10) and the employee would enter a quantity associated with the Expense Item or Per Diem (i.e. $10 x qty 3 nights = $30 total). The hotel stay is charged to a corporate account, and the Per Diem would be associated with a personal expense so that it would be reimbursed to the employee.

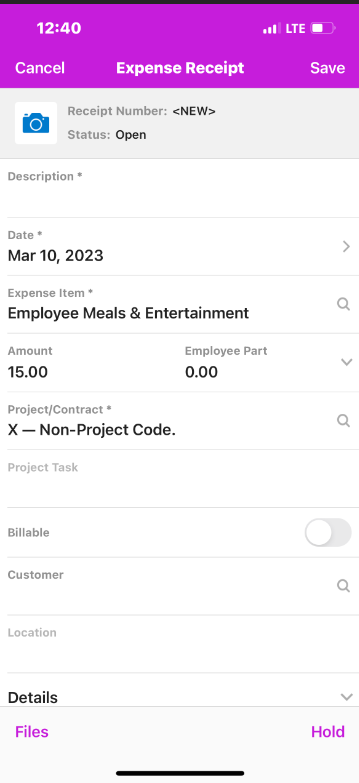

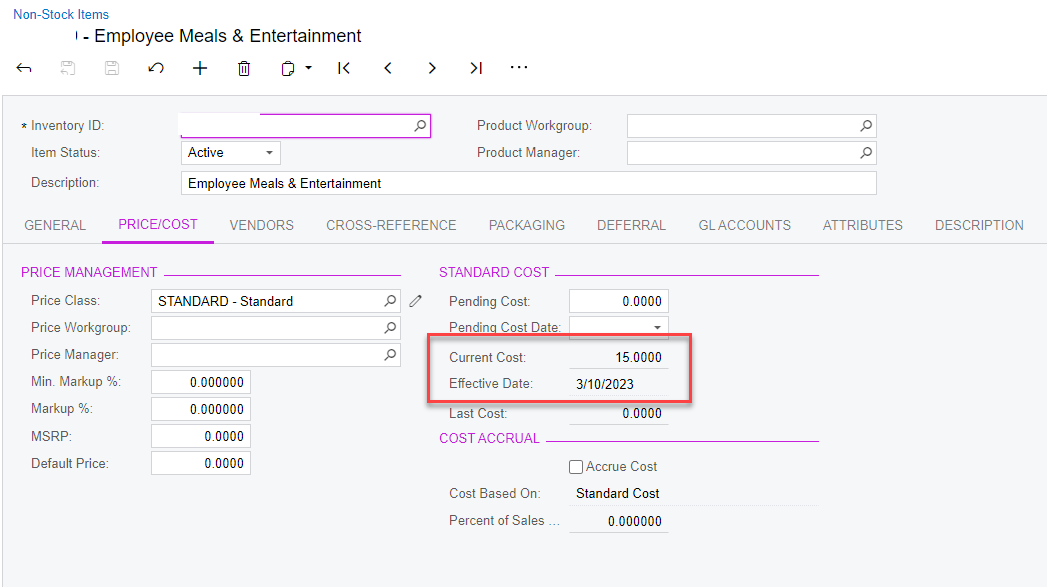

I had no issue creating the additional non-stock Expense item of Per Diem. What I attempted to do was to was set a default price for the Per Diem item in hopes it would show up in the expense receipt entry of the phone app. However it does not, it comes up with a 0 value that then needs to be entered.

Is there any way of getting this to work as we desire, or does the expense process not pull price/cost info from the NS item?

Note - We are not interested in having this go through PR as that would incur additional work and is not necessary as we are under IRS guidelines for per diem limitations. Likewise, we do not want to create additional AP processes to manually track this for employee reimbursement as we are already using the expense process and this would be the easiest mechanism for identifying, confirming eligibility, and paying per diem.