Some more details on how to set it up:

They don’t make it clear, but it does work:

Prerequisites:

1: Configure a Tax Zone with geography for your Branch Address. This can be Zip Code or State for example.

2: Set the default Tax Zone of your Branch in the Branches Screen

3: Uncheck the Require Tax Zone box on the Customer Class

4: Setup a customer and clear the Tax Zone. Give them an address outside your Branch Geography.

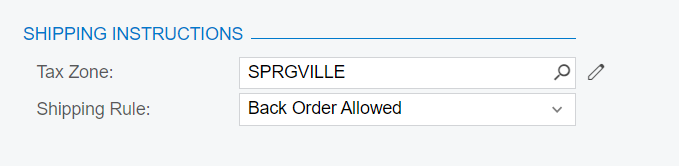

5: Set a Tax Zone with geography for the customer address you are shipping to.

6: Configure at least 2 Taxes with different tax rates.

7: Assign the 1 tax rate to each Zone.

8: Assing a Tax Category to your Taxes.

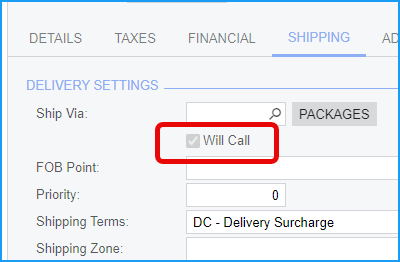

9: Set up at least one Ship Via with the Common Carrier Check Box selected.

To Test it:

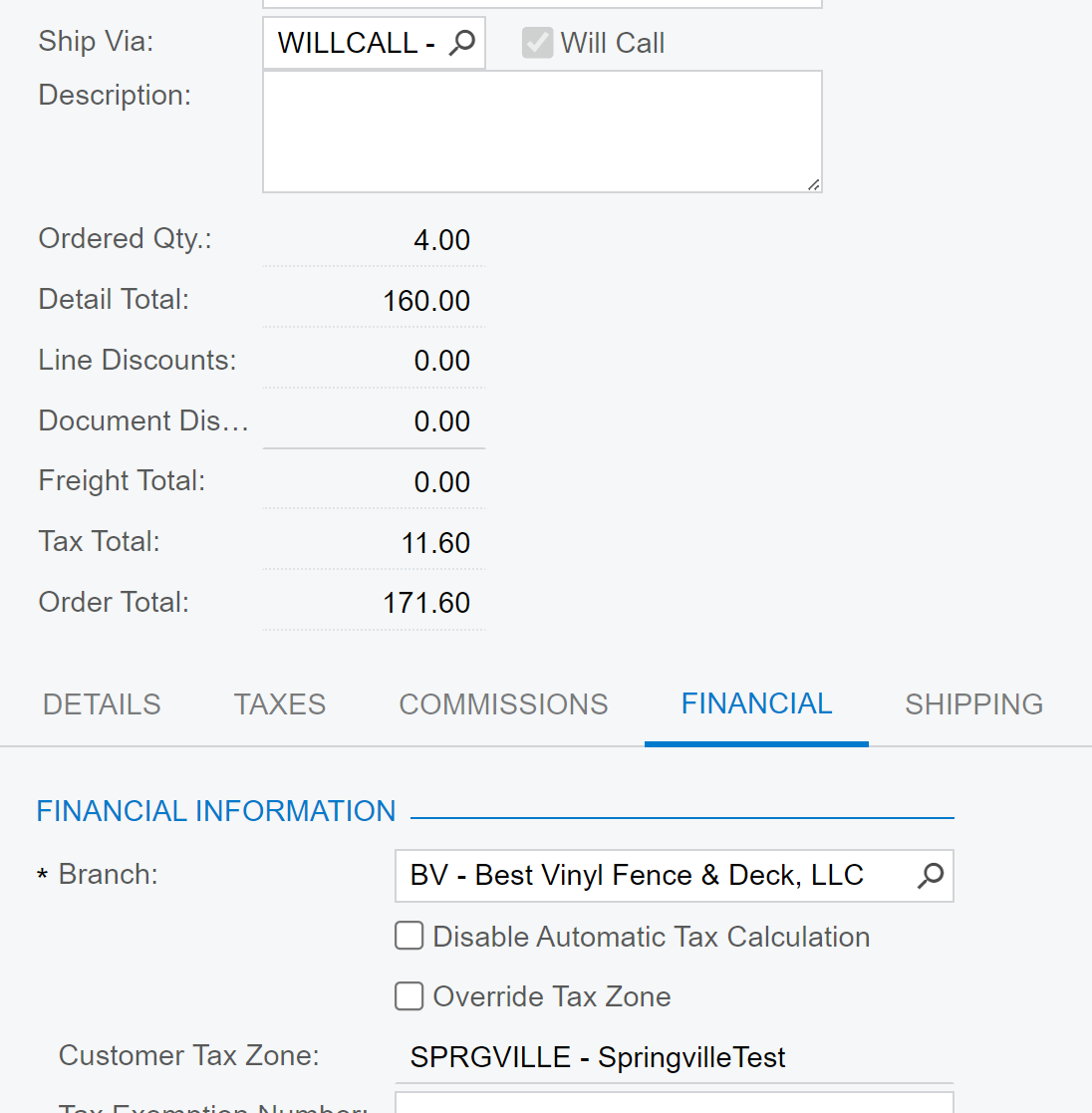

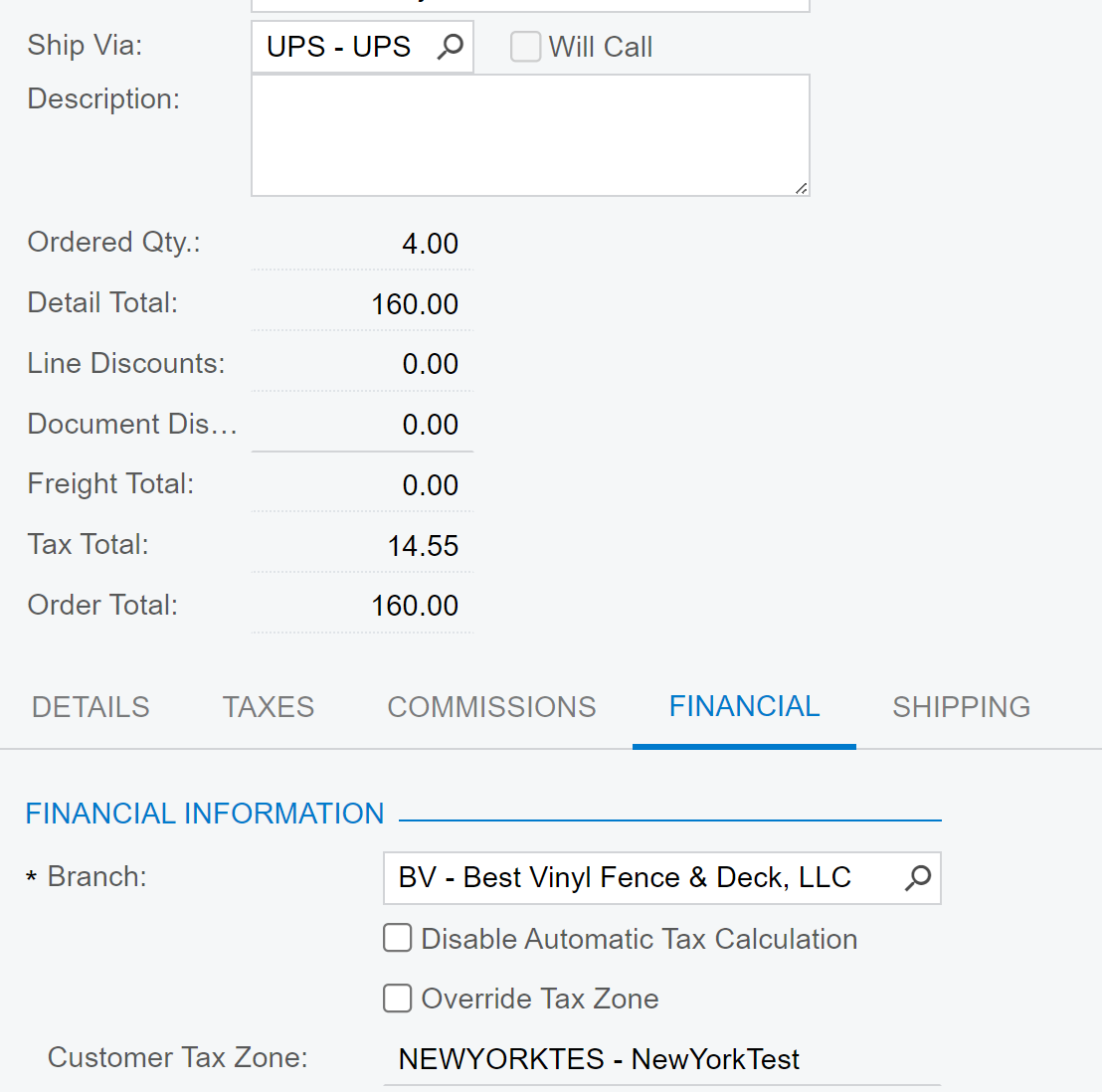

Create a Sales Order, add an item with the tax Category.

Go to the financial tab.

Set the order to use the Ship Via created above, exit that field. You should see taxes calculated under totals. Then clear the Ship Via and you will see the Tax Zone change and the taxes recalculate instantly. No need to save like with external tax providers.