Does anyone know how the Landed Costs with Type - VAT Taxes work?

I want to know how to configure and how it works.

Thanks

Jesus

Does anyone know how the Landed Costs with Type - VAT Taxes work?

I want to know how to configure and how it works.

Thanks

Jesus

Best answer by ChandraM

Hi

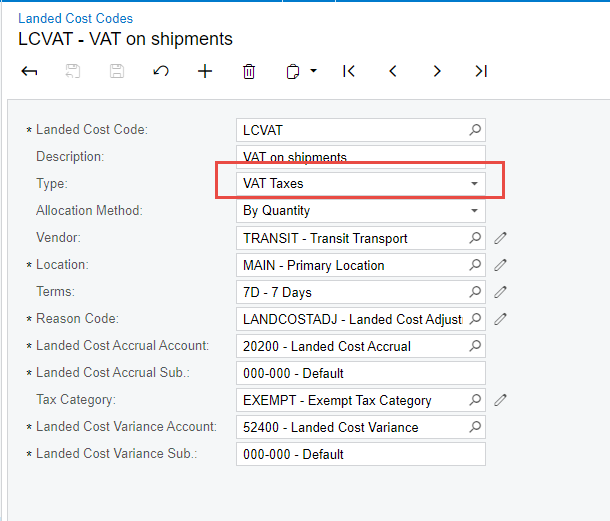

Landed Cost Code:

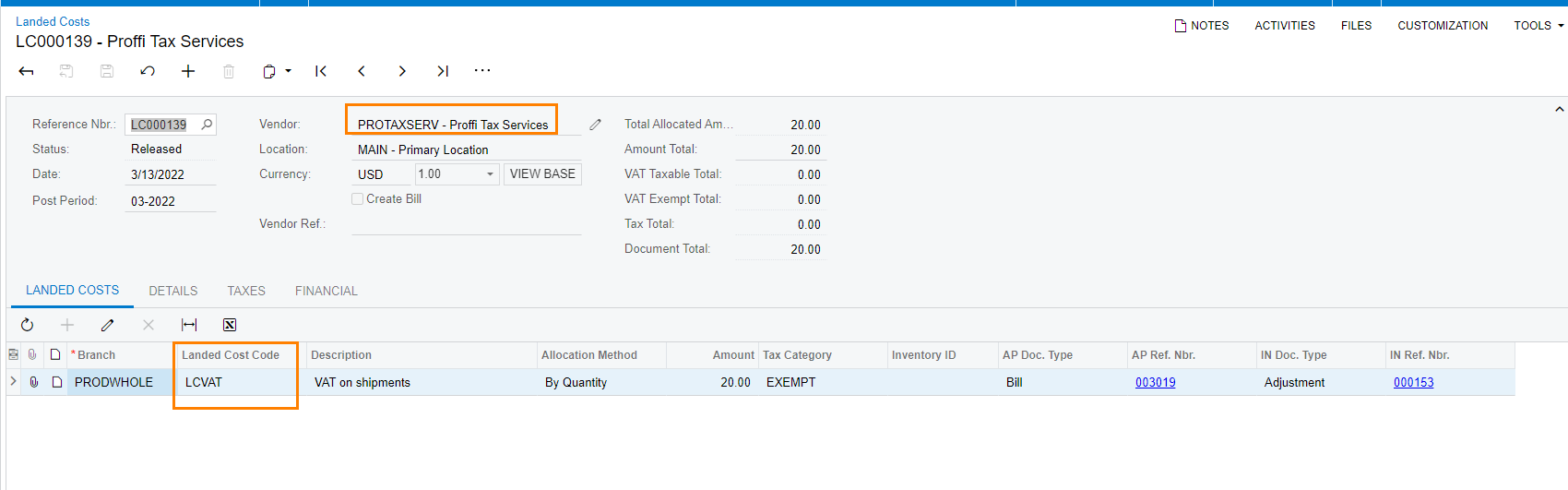

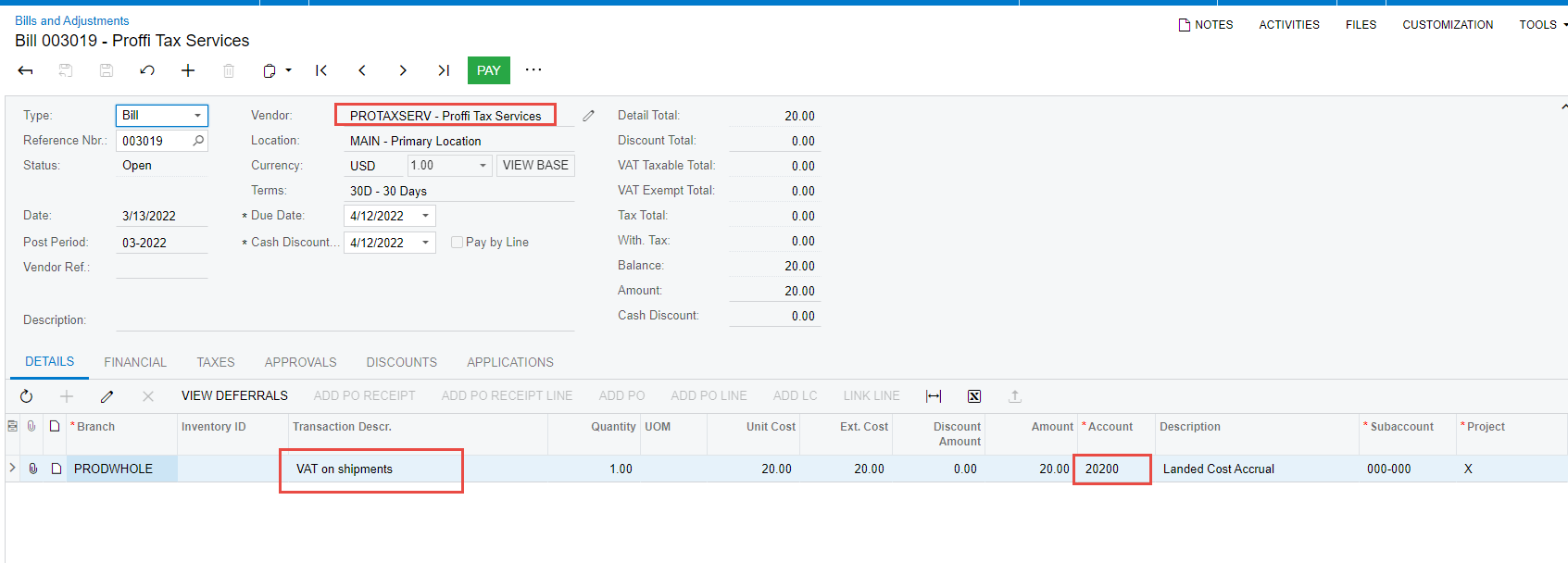

Landed Cost Entry:

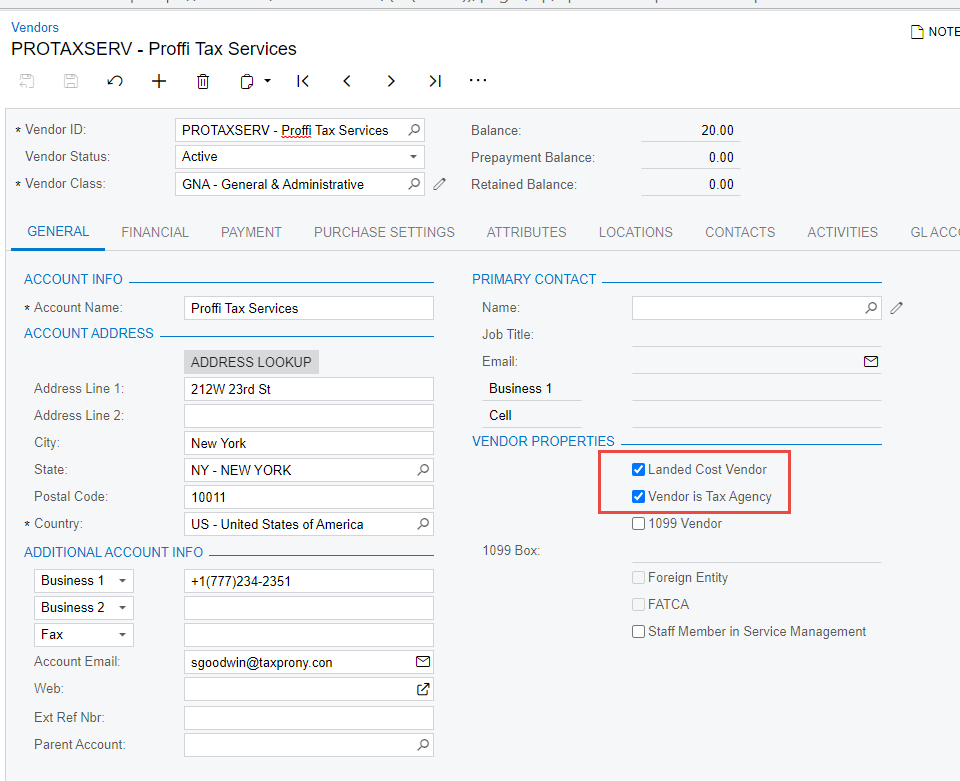

Vendor setting - LC Vendor and Tax Agency:

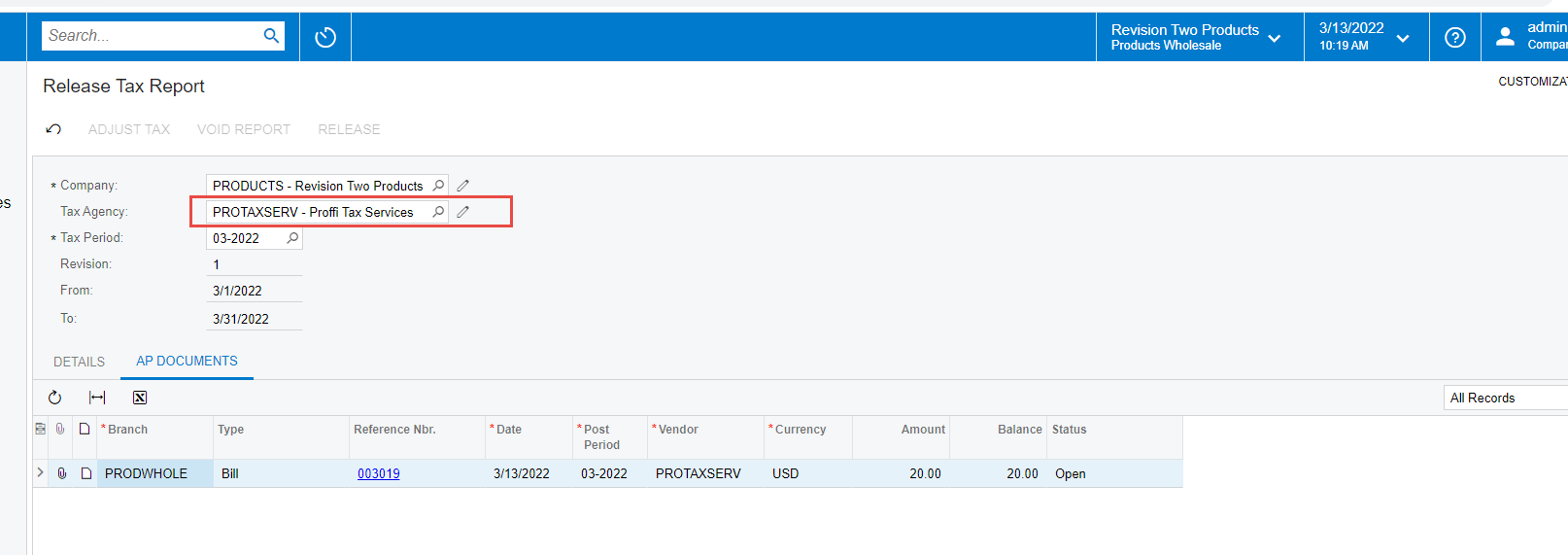

Release Tax Report

Thanks

Enter your E-mail address. We'll send you an e-mail with instructions to reset your password.