Hello Everyone,

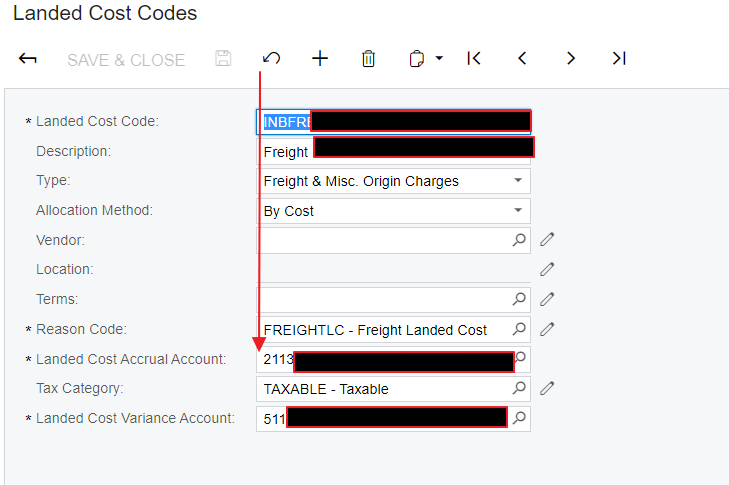

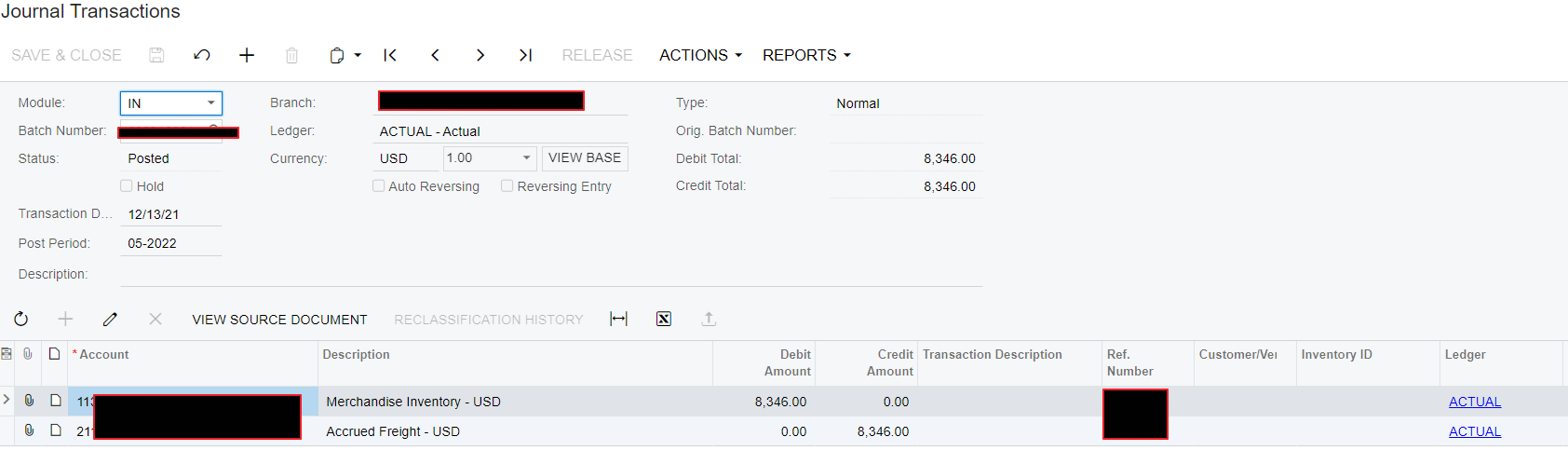

What is the best practice for receiving inventory at landed cost when the freight is charged as a separate line item by the goods vendor?

The distinction from using a Landed Cost document is that the freight is being charged by the goods vendor on the same invoice as the goods receipt, not from a separate freight vendor. The following idea has been submitted, but wanted to check if anyone had a good process for this while under review.

Thank you!

Luke

Best answer by Ellie

View original