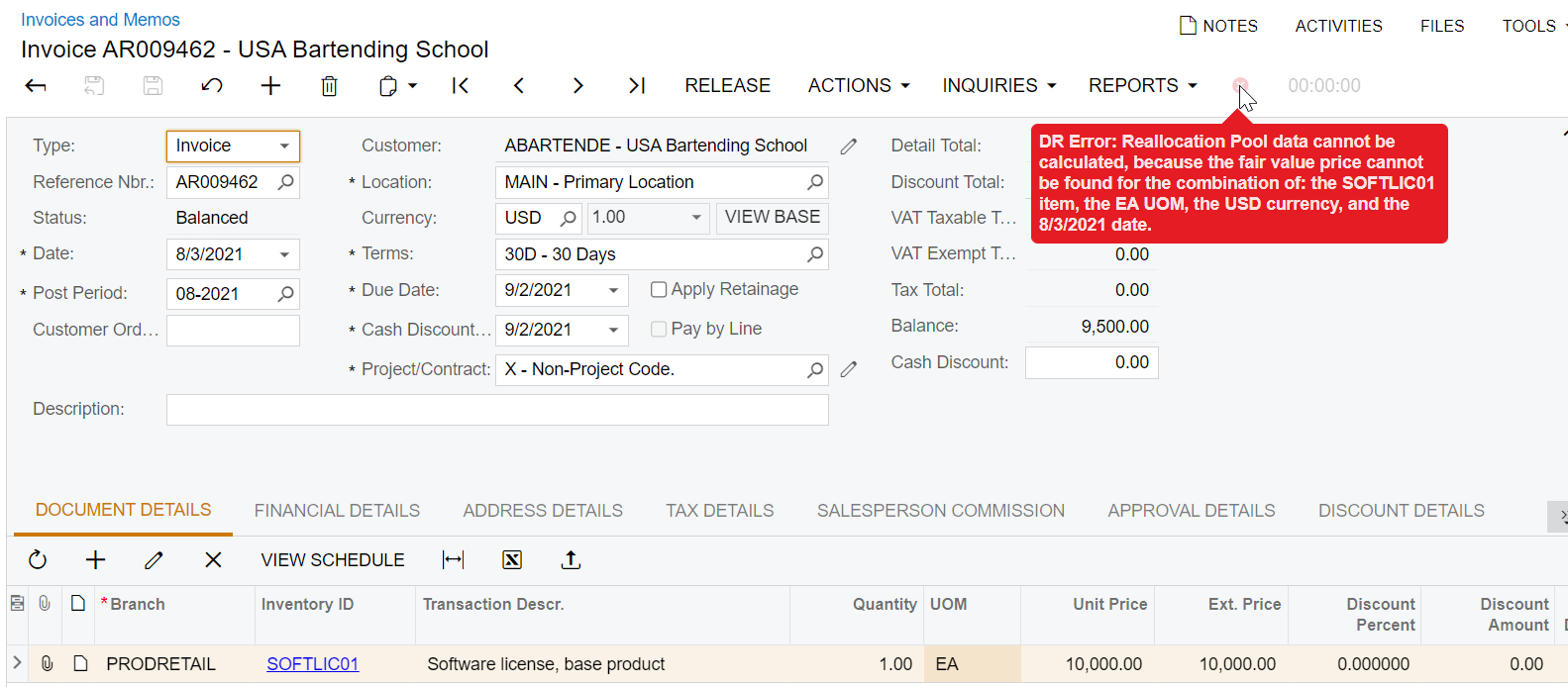

The User need to create deferred revenue functionality in Receivable.

Ex. Sales order line Amount ---10000 (Configuration Changes)

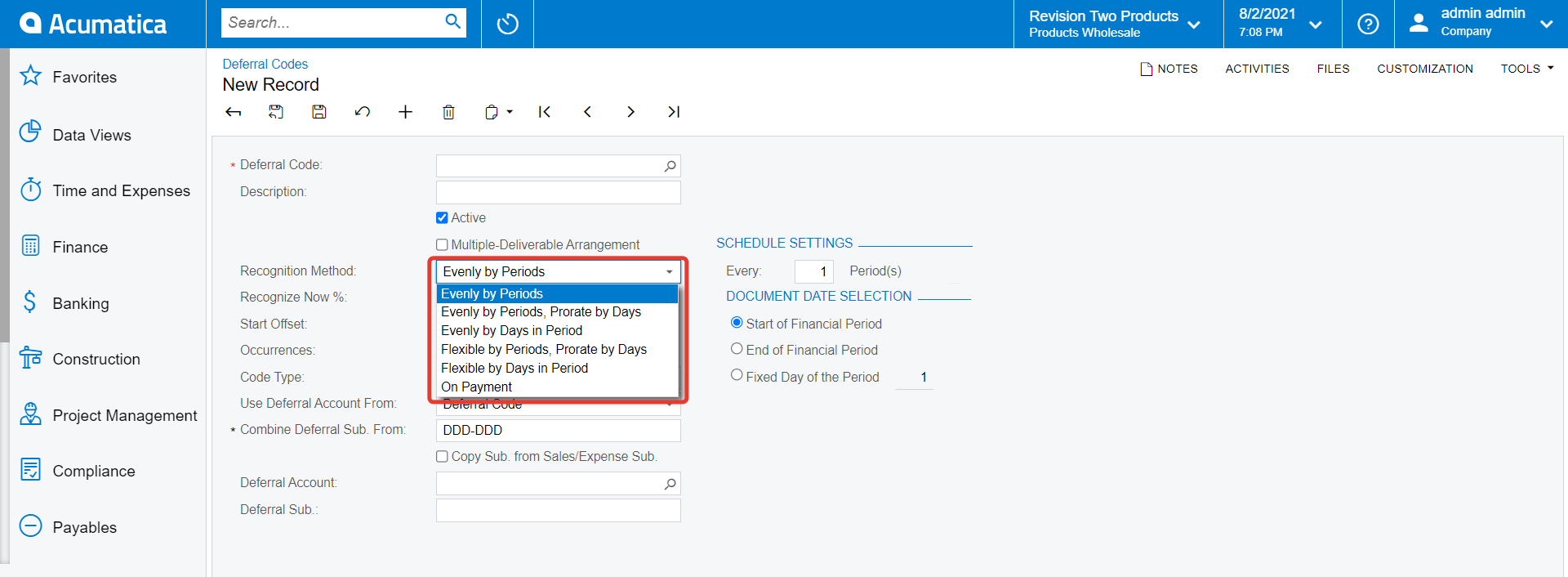

Once Shipping process and complete value should be transacted to Deferred Revenue Account.

When complete the Configuration process in steps by step, user is creating invoices.

Once created the invoice system should recognize the Exact Revenue.

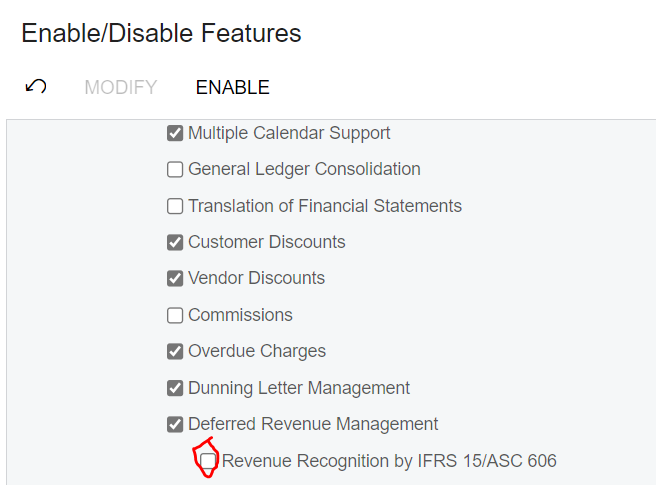

Therefore, we need to know what are the configuration steps.

Regards

Nethupul