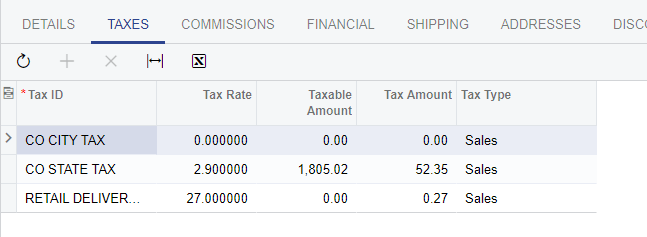

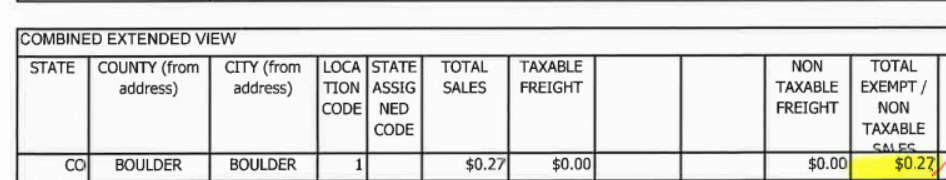

Does anyone know of a way to handle the new CO Retail Delivery Fee ($.27 beginning July 1, 2022) either with Avatax or without?

Avalara had sent out communications regarding this which stated to perform the following:

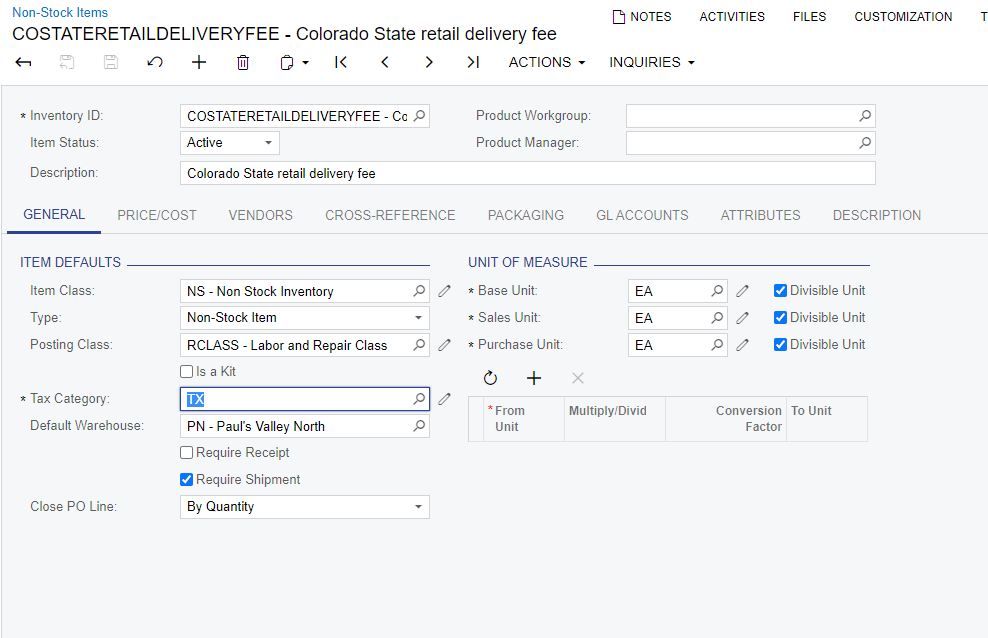

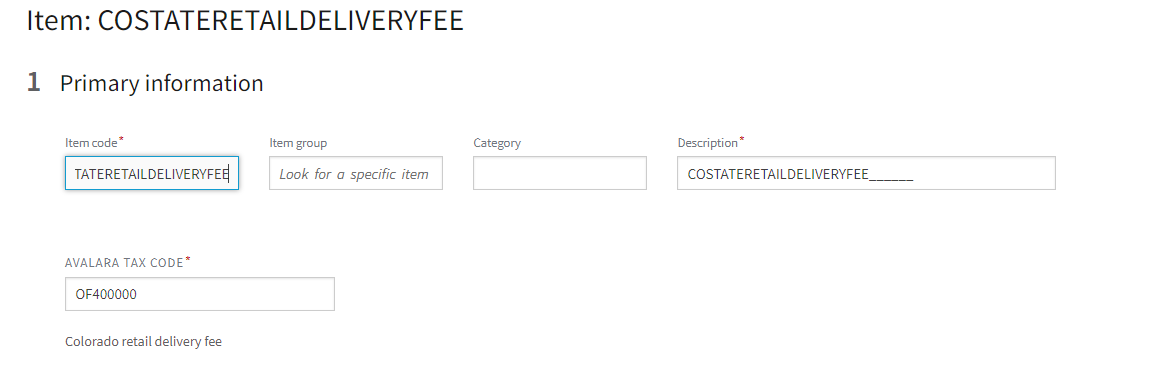

Merchants subject to this fee will need to add a $0 line item to their orders with the OF400000 tax code.

I’m unsure as to how this would be done in Acumatica. Perhaps someone from Acumatica may know if there will be something released in a new build perhaps?

Best answer by dneiheiser94

View original