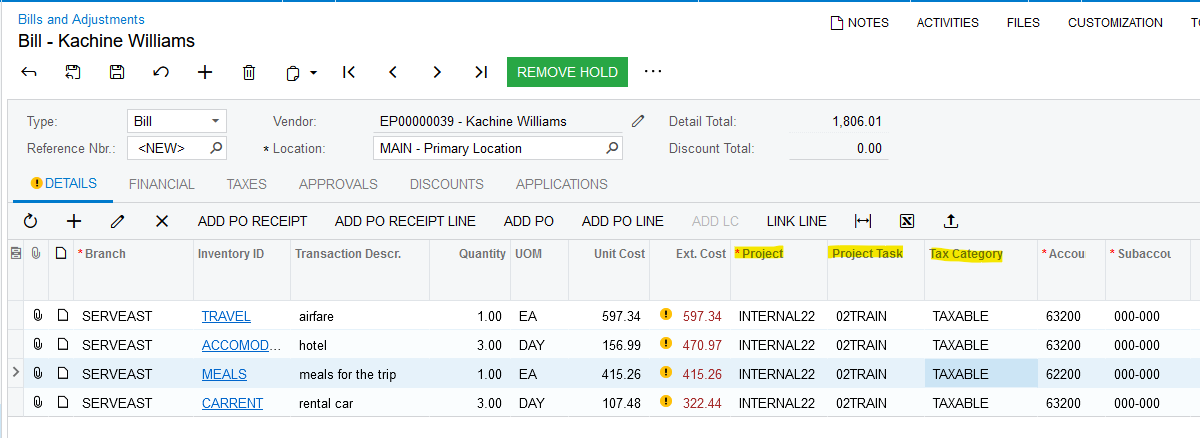

Client is using Project / Construction. Orders material and sets type to Project drop ship. Issues is the commitment shows the order with Taxes. But when receive the material it only adds the Item costs to the project and then writes the Tax portion off to an expense account. How do you get the tax to get added to the cost of the project during receipt or Bill processing?

Solved

Project Costs including Taxes

Best answer by Laura03

Hello,

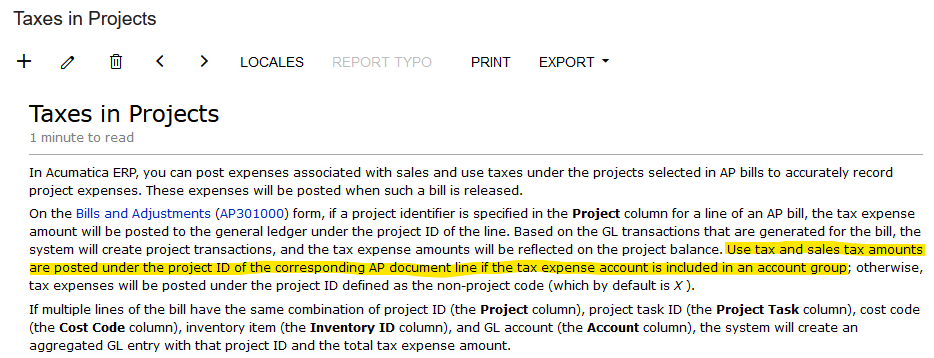

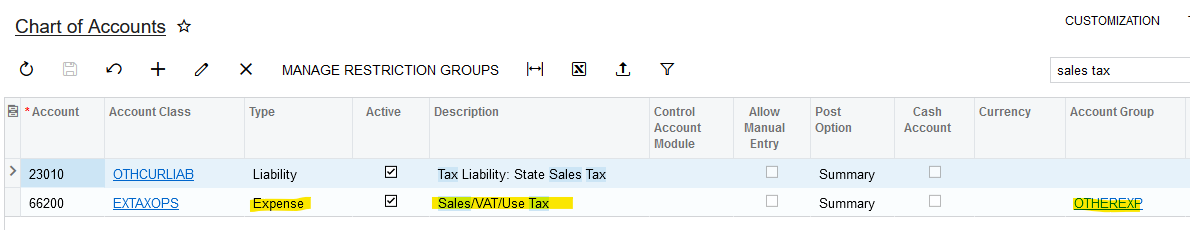

Acumatica Help indicates that the Project will be updated with sales tax if the Sales Tax Expense account has an Account Group Connected in the Chart of Accounts, and the Project ID is included on the AP Bill that is paying for the Drop-Ship PO merchandise.

Laura

Enter your E-mail address. We'll send you an e-mail with instructions to reset your password.