Hi,

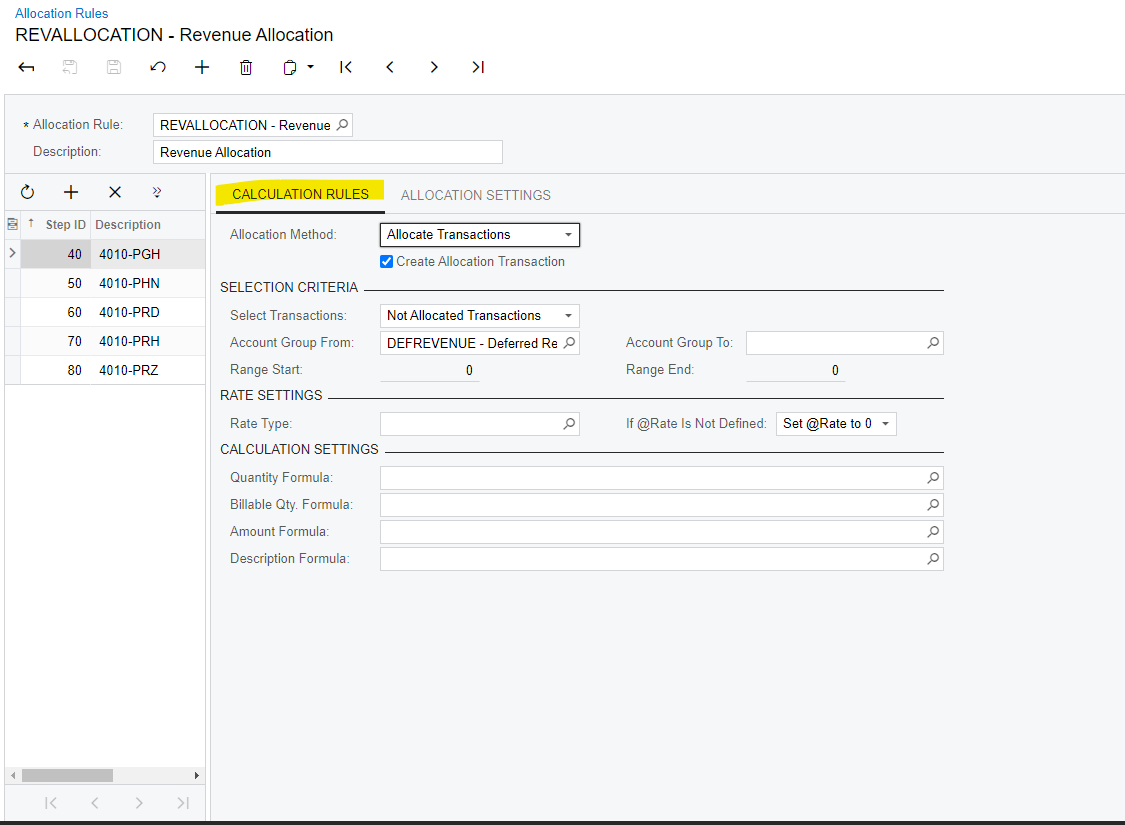

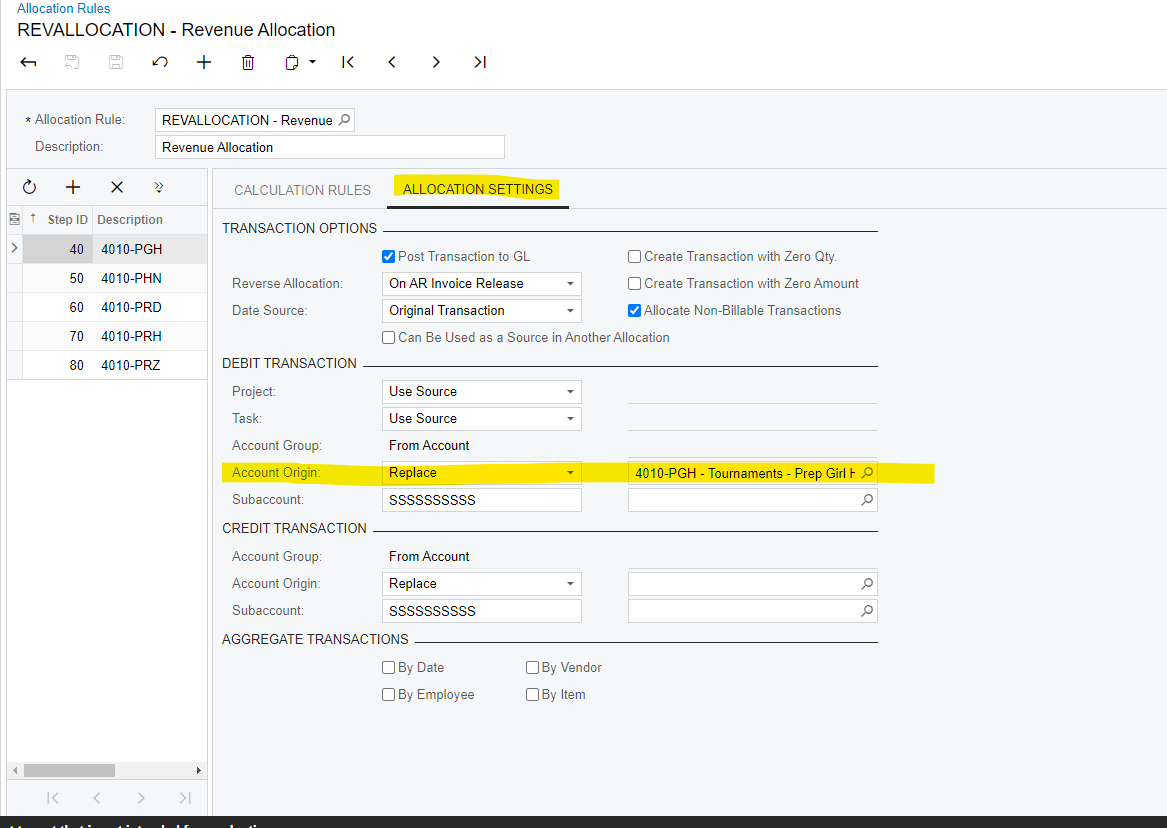

I have a client that records their revenue to a deferred revenue account right away. I was able to create an allocation rule that works. However, the client uses several revenue accounts that might be different for each project. I tried setting up all the accounts in one allocation rule. However, when I run the allocation, only one revenue account needs to be allocated but the allocation rule duplicates the allocation for the other G/L accounts and I don’t want that to happen. When the allocation is run it’s supposed to debit the deferred account and credit the revenue account setup under the Defaults section within the project. It does this but duplicates the same amount to each other revenue account.

Here is my allocation rule. The calculation rules and allocation settings are the same for each line item. The only difference is the revenue accounts. Will I have to create a separate allocation rule for each revenue account? All the revenue accounts are in the same account group and there is a account group for the deferred account. Let me know or what is the proper way to setup one allocation rule. Any help would be great.

Thanks,

Frances

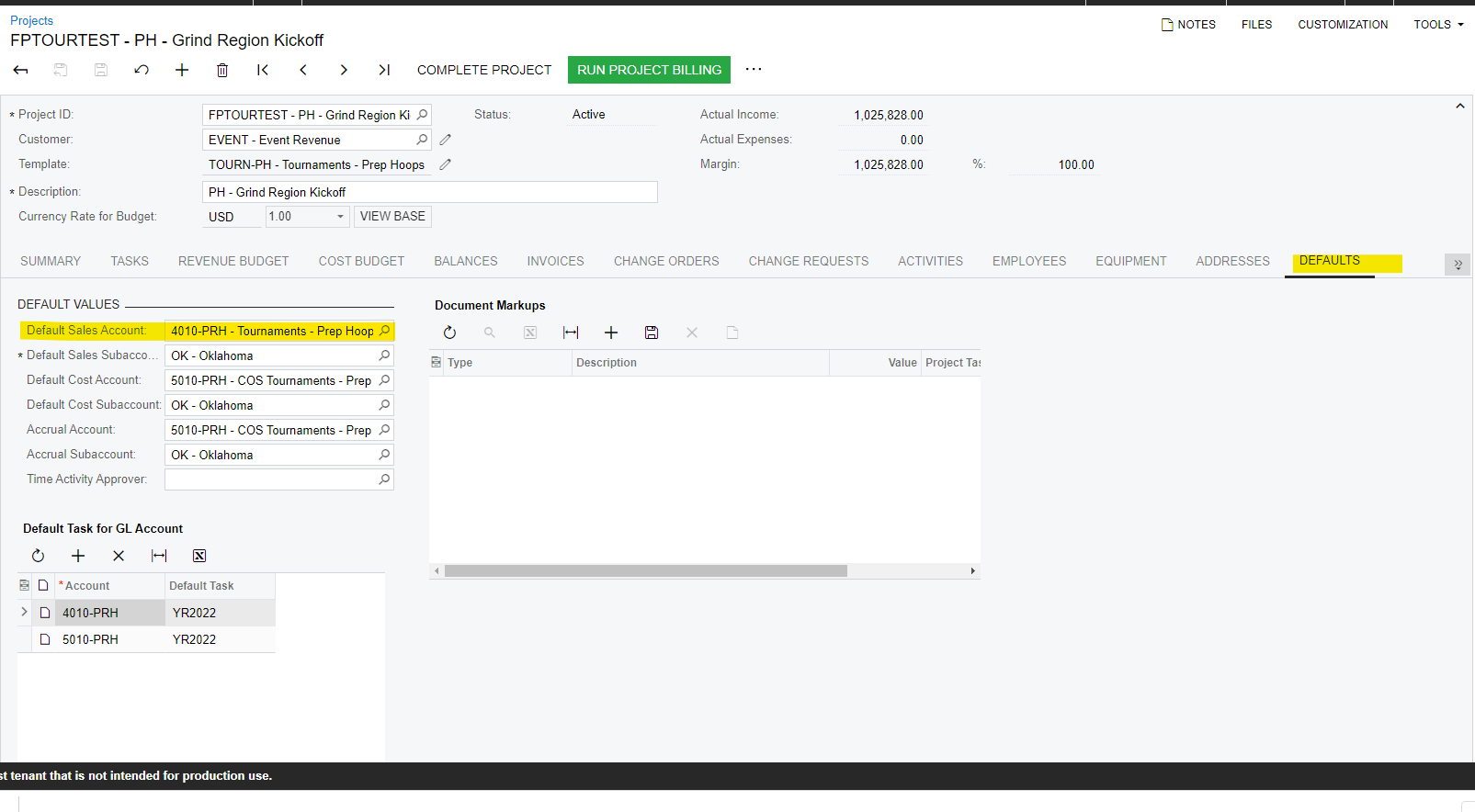

Revenue account that is for the project: