Hello all,

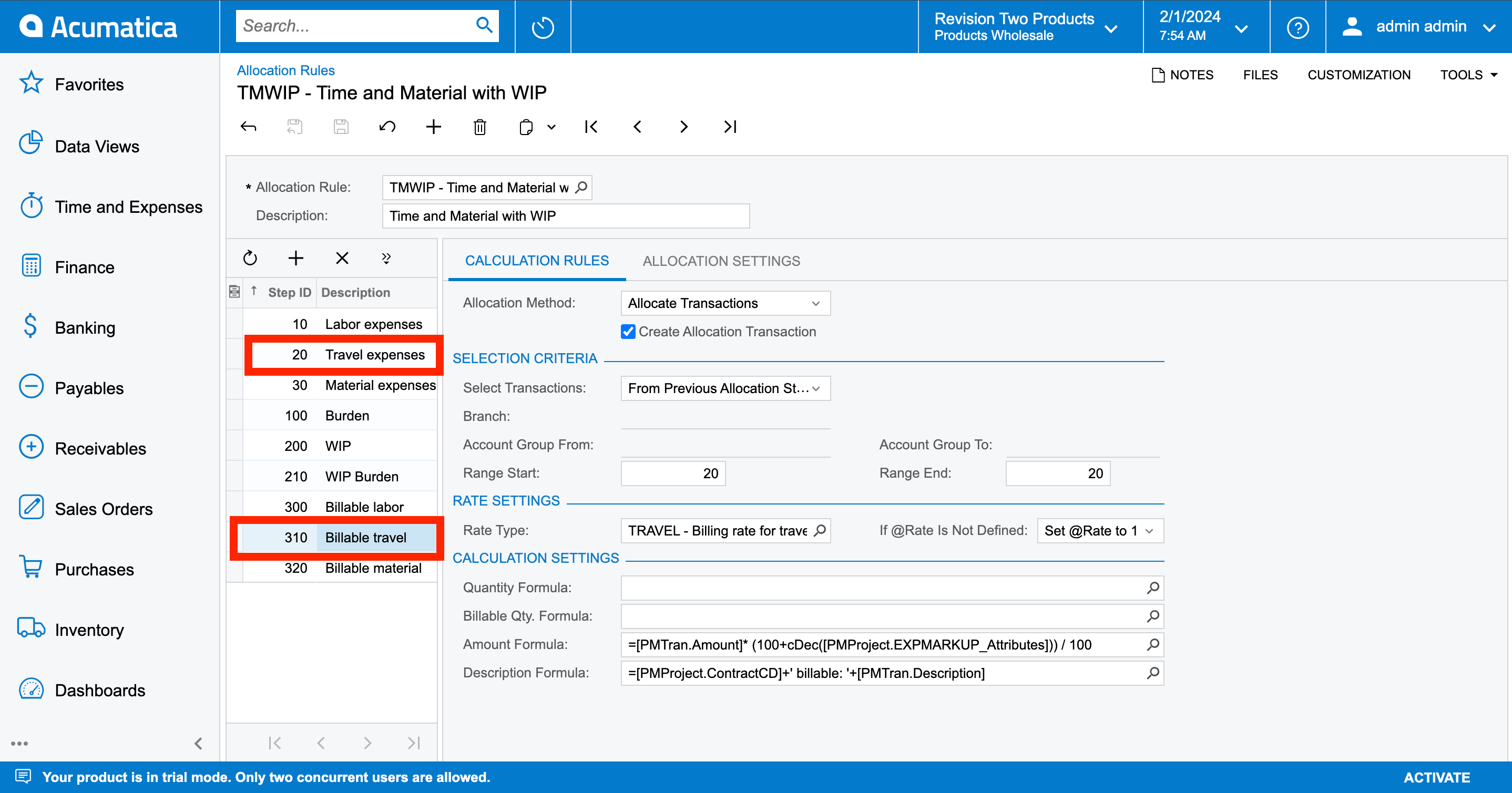

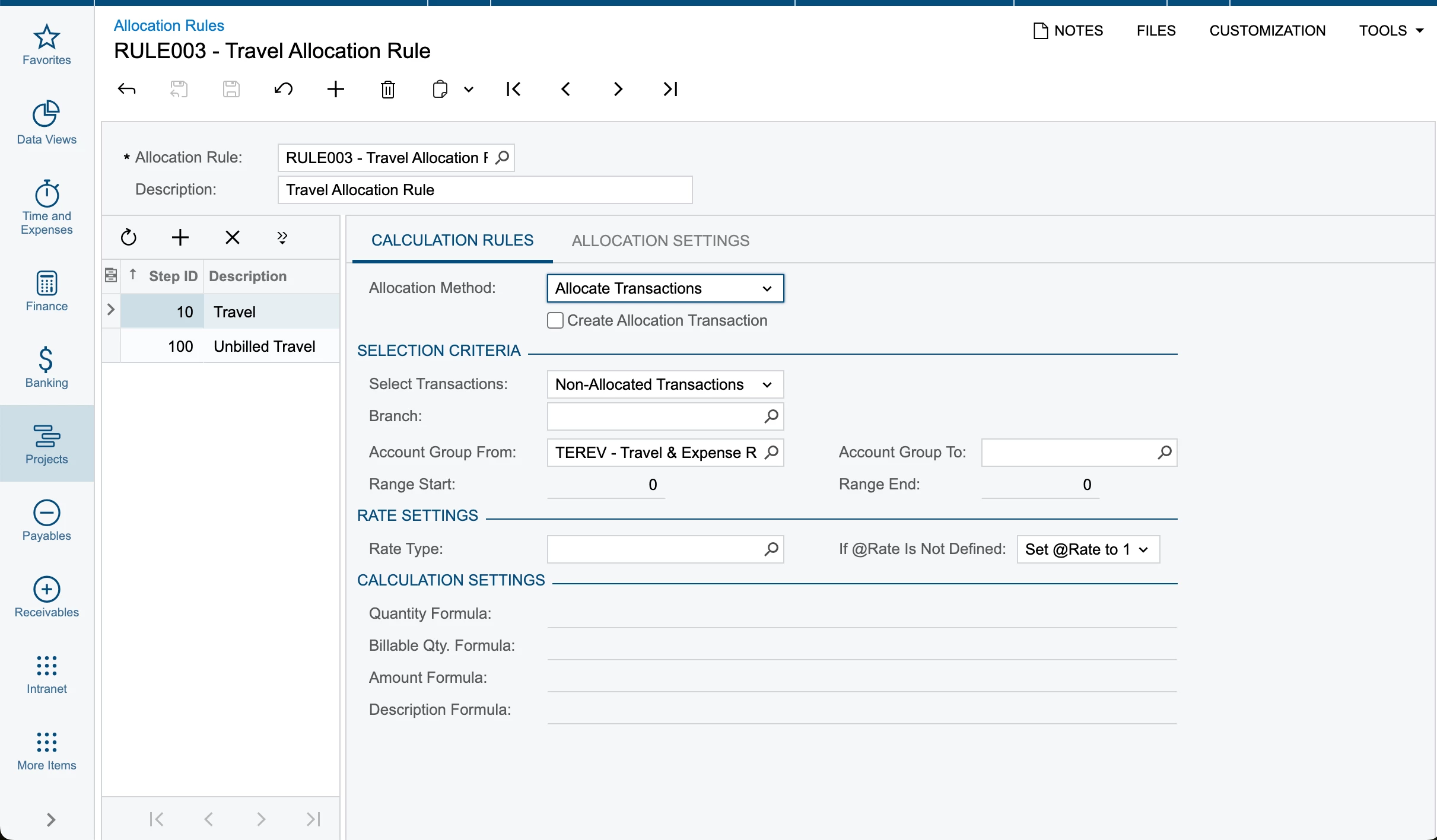

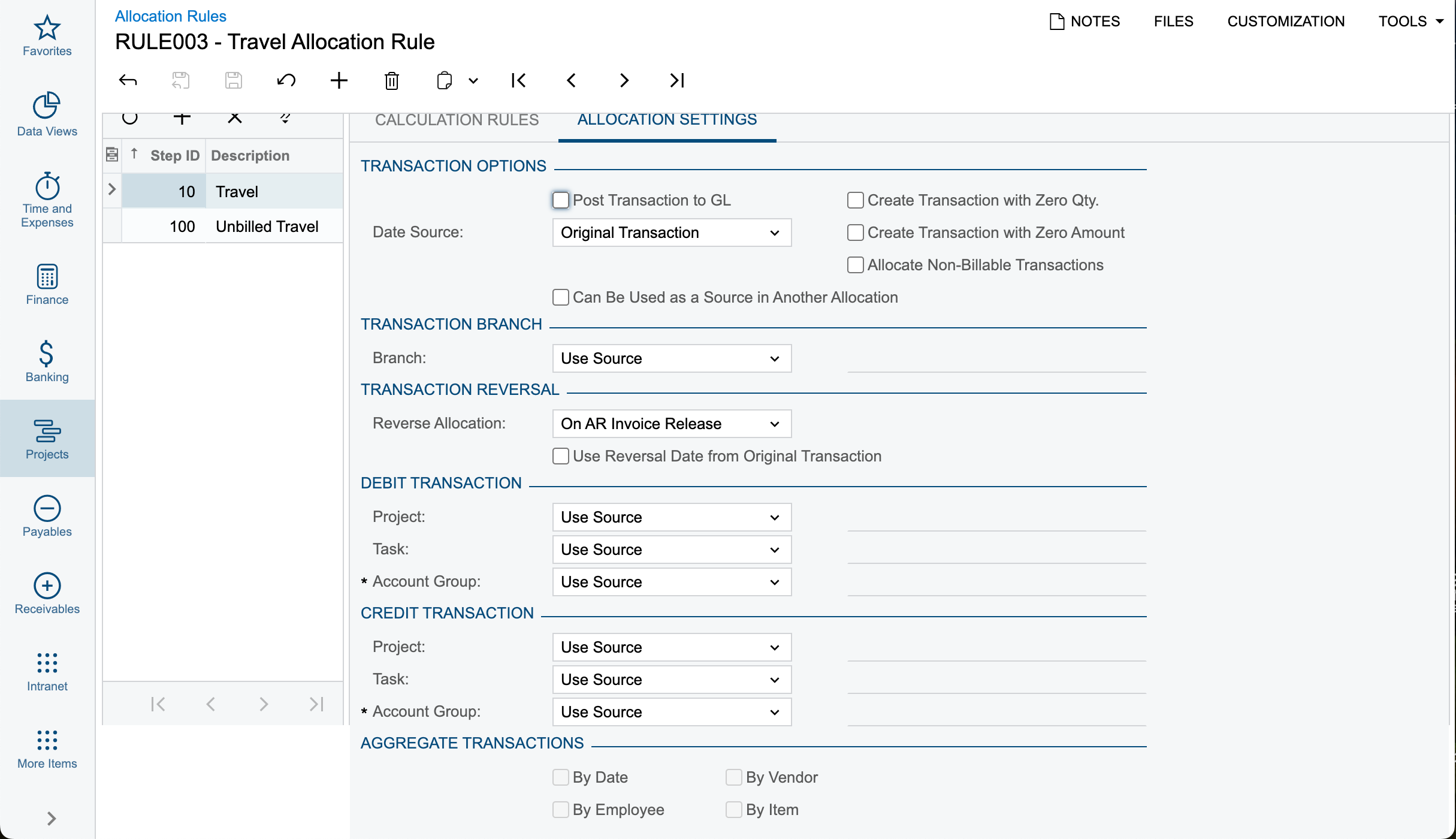

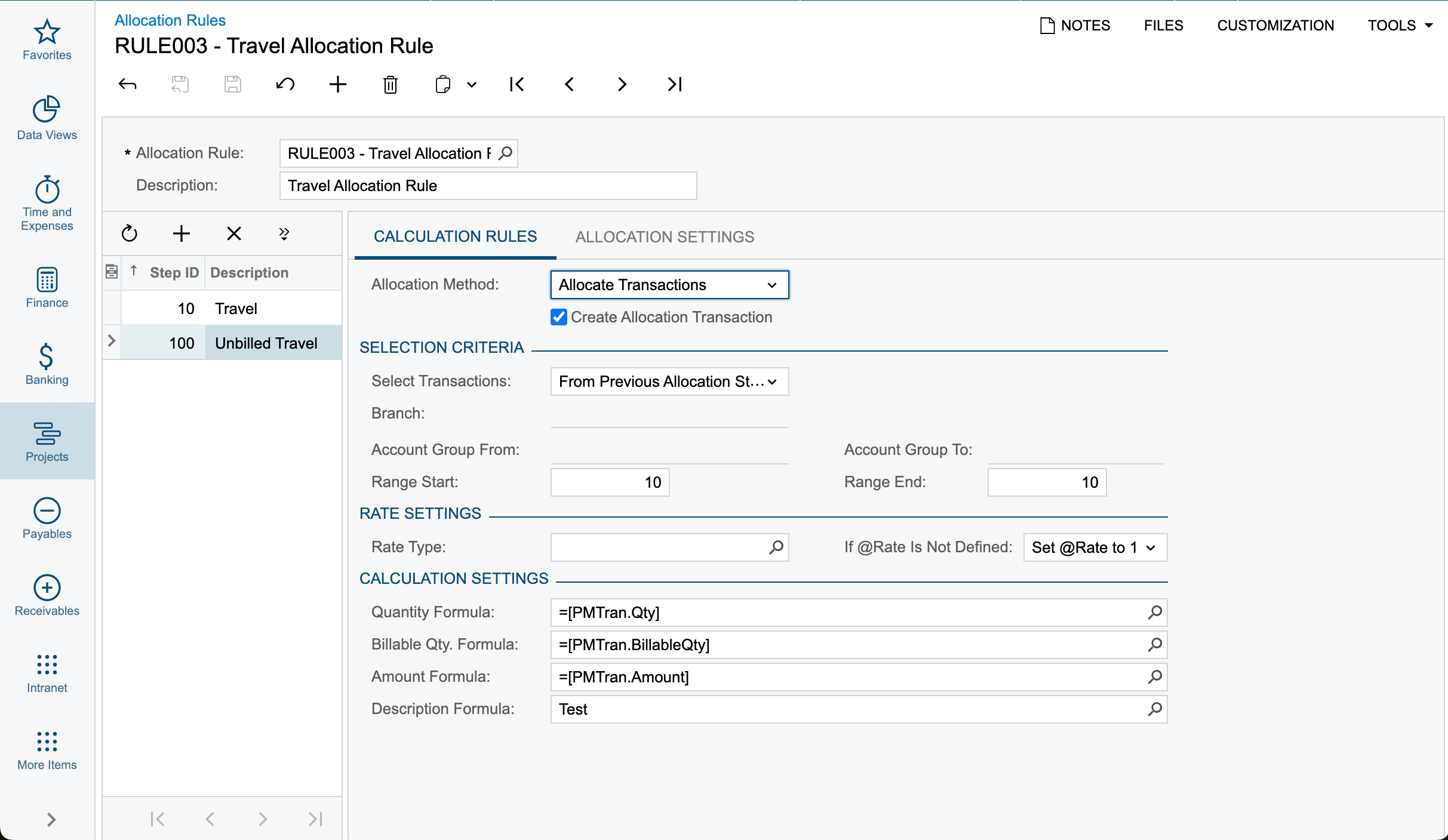

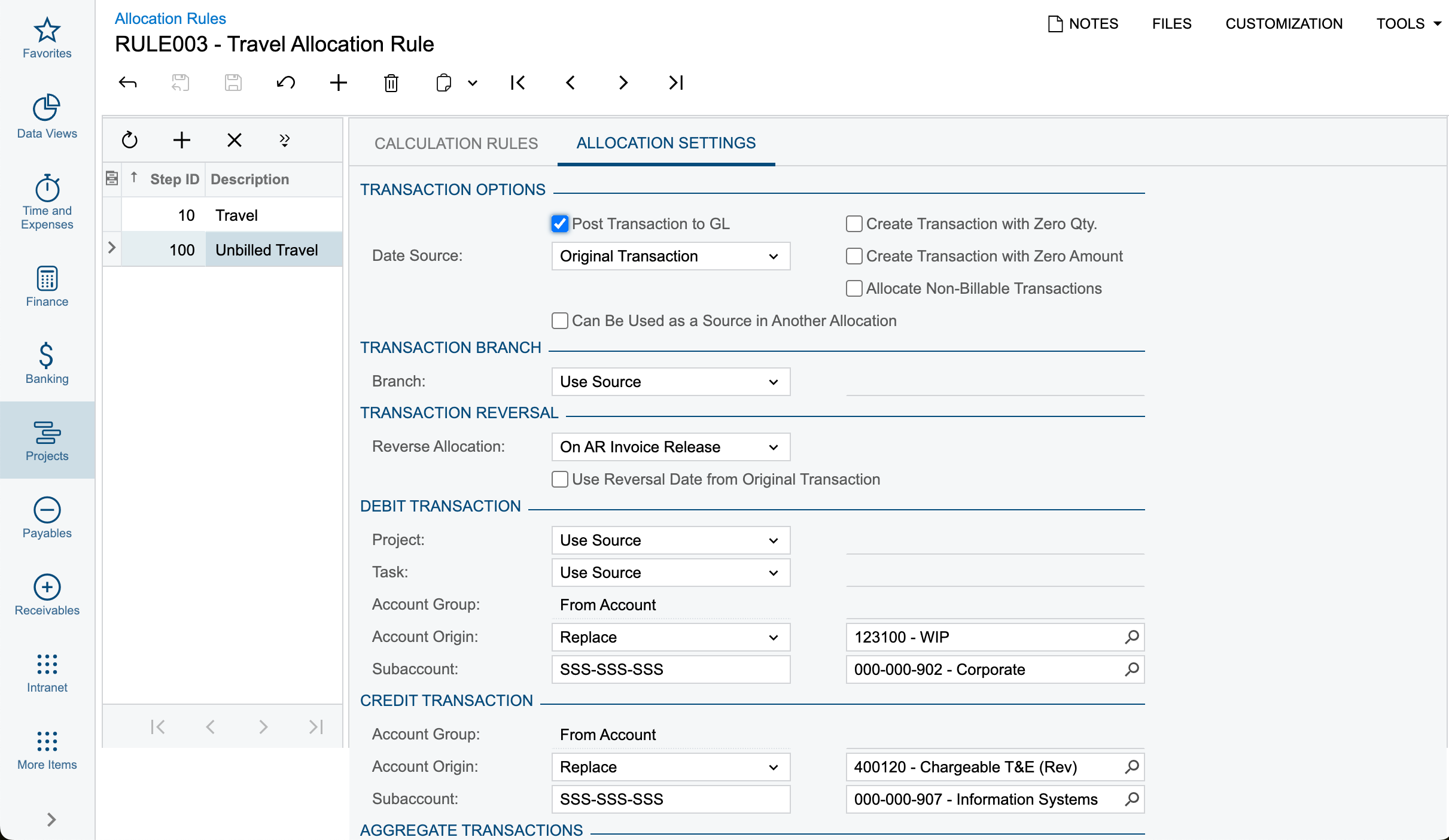

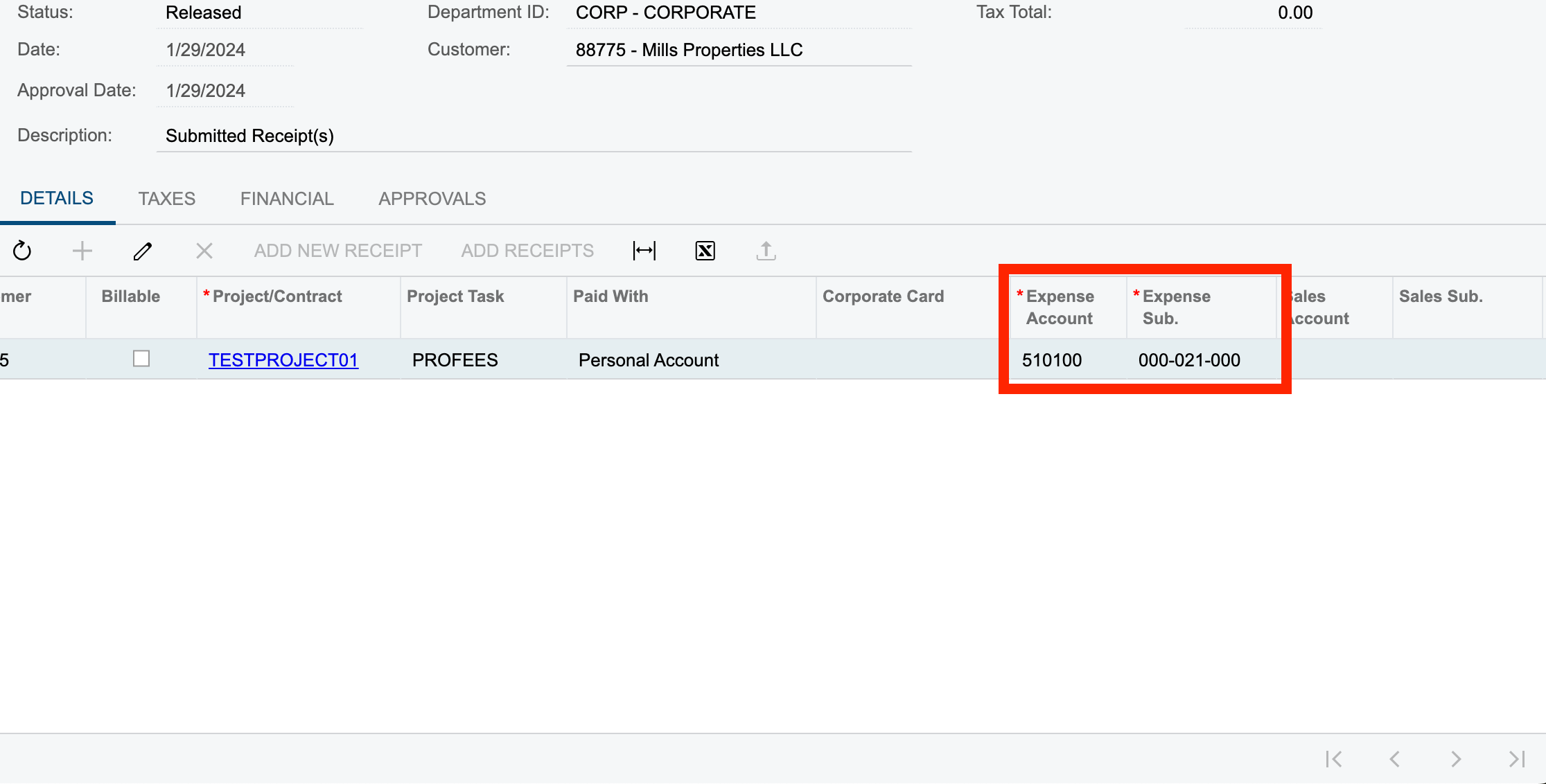

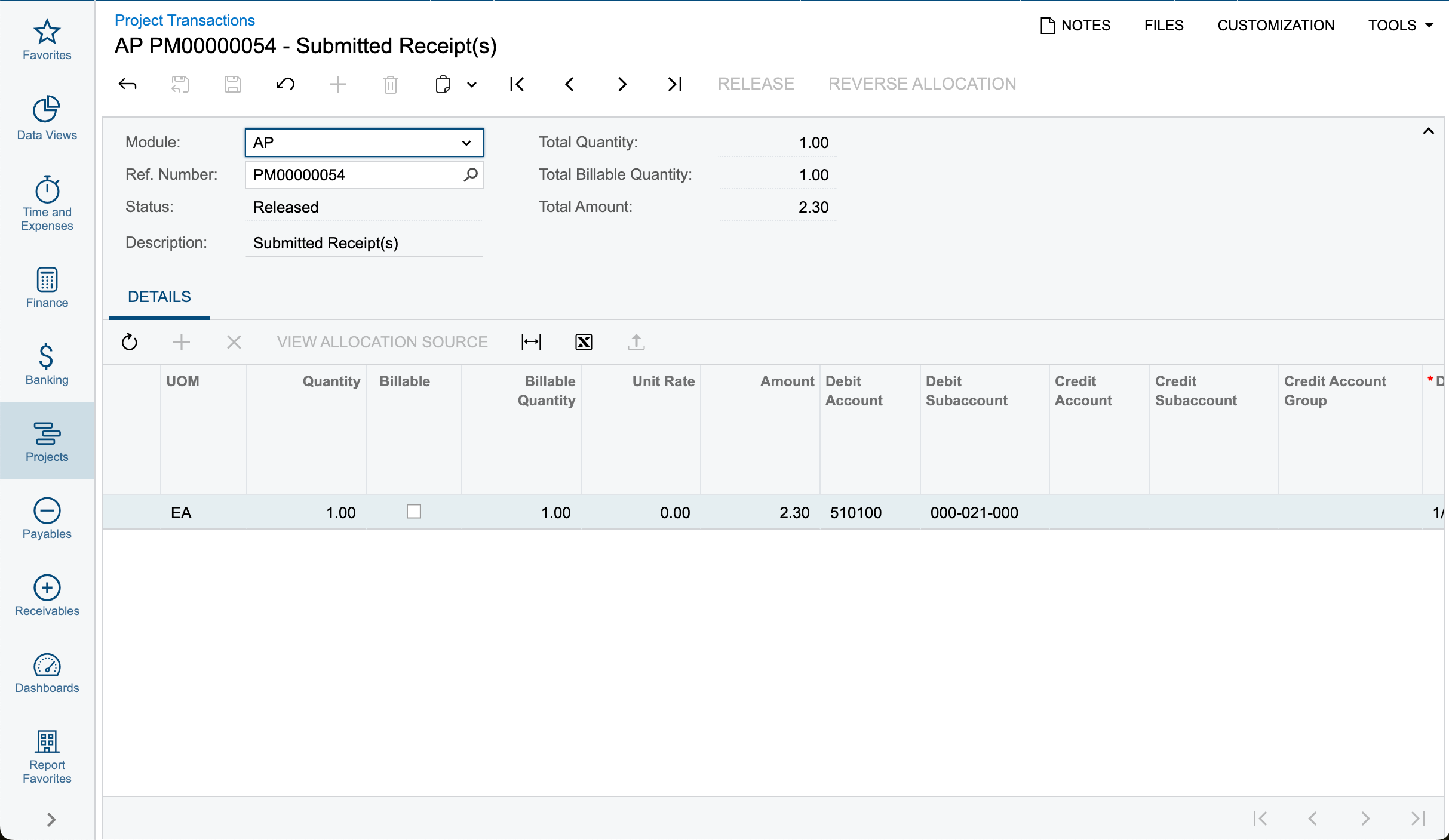

I have been trying to run an allocation rule that should generate a Project trxn of the type PM. The allocation rule is to run whenever an Expense Claim is released for the particular project. But at the moment it is directly creating a project trxn of type AP and also creating an AP Bill. What i would want is I would first like to run the allocation rule to the unbilled part/WIP and then generate an AP Bill. How to achieve this?

So here, before the Project trxn of AP is generated I would like to generate of the type PM. And it should not effect any of the Debit/Credit parts.

How can i get this done?

Thanks in advance.

Best answer by Laura02

View original